PNC Bank 2008 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

26 P

ARENT

C

OMPANY

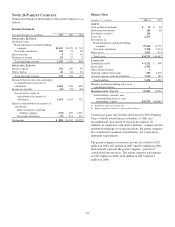

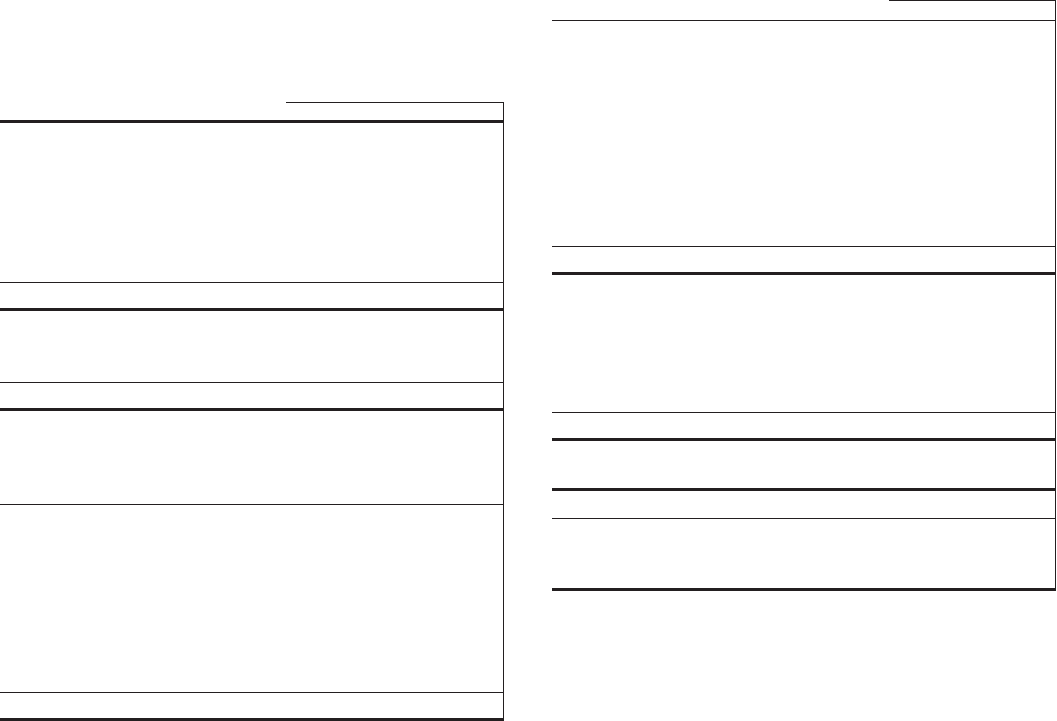

Summarized financial information of the parent company is as

follows:

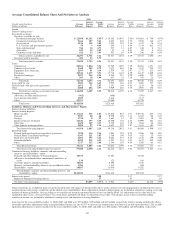

Income Statement

Year ended December 31 - in millions 2008 2007 2006

O

PERATING

R

EVENUE

Dividends from:

Bank subsidiaries and bank holding

company $1,012 $1,078 $ 710

Non-bank subsidiaries 168 74 69

Interest income 415 16

Noninterest income 18 23 9

Total operating revenue 1,202 1,190 804

O

PERATING

E

XPENSE

Interest expense 152 160 93

Other expense 46 84 46

Total operating expense 198 244 139

Income before income taxes and equity

in undistributed net income of

subsidiaries 1,004 946 665

Income tax benefits (50) (78) (60)

Income before equity in

undistributed net income of

subsidiaries 1,054 1,024 725

Equity in undistributed net income of

subsidiaries:

Bank subsidiaries and bank

holding company (125) 229 1,653

Non-bank subsidiaries (47) 214 217

Net income $ 882 $1,467 $2,595

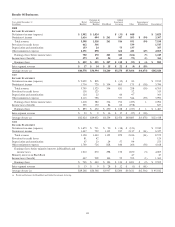

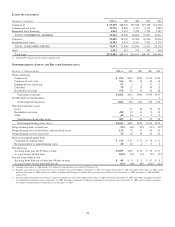

Balance Sheet

December 31 - in millions 2008 (a) 2007

A

SSETS

Cash and due from banks $15$20

Short-term investments 140 58

Investment securities 164

Loans (b) 2,275

Investments in:

Bank subsidiaries and bank holding

company 27,960 15,776

Non-bank subsidiaries 2,378 2,214

Other assets 1,821 614

Total assets $34,753 $18,682

L

IABILITIES

Subordinated debt $ 4,122 $ 968

Senior debt 2,707

Other borrowed funds 2

Nonbank affiliate borrowings 945 2,478

Accrued expenses and other liabilities 1,554 382

Total liabilities 9,330 3,828

Minority and noncontrolling interests in

consolidated entities 1

S

HAREHOLDERS

’E

QUITY

25,422 14,854

Total liabilities, minority and

noncontrolling interests, and

shareholders’ equity $34,753 $18,682

(a) Includes the impact of National City.

(b) Balance represents National City loans with subsidiaries.

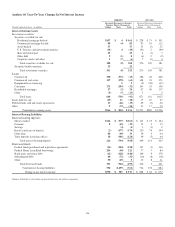

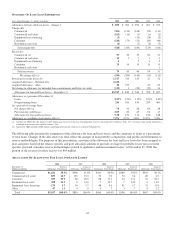

Commercial paper and all other debt issued by PNC Funding

Corp, a wholly owned finance subsidiary, is fully and

unconditionally guaranteed by the parent company. In

addition, in connection with certain affiliates’ commercial and

residential mortgage servicing operations, the parent company

has committed to maintain such affiliates’ net worth above

minimum requirements.

The parent company received net income tax refunds of $92

million in 2008, $65 million in 2007 and $35 million in 2006.

Such refunds represent the parent company’s portion of

consolidated income taxes. The parent company paid interest

of $147 million in 2008, $146 million in 2007 and $113

million in 2006.

150