PNC Bank 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

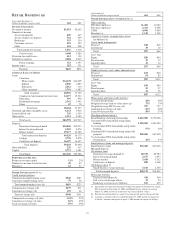

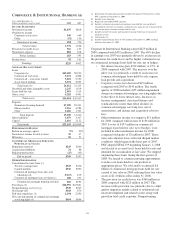

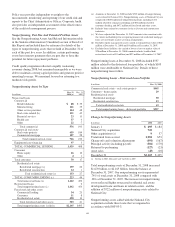

C

ORPORATE

&I

NSTITUTIONAL

B

ANKING

(a)

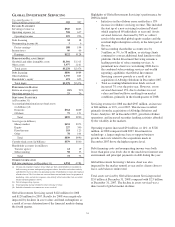

Year ended December 31

Dollars in millions except as noted 2008 2007

I

NCOME

S

TATEMENT

Net interest income $1,037 $818

Noninterest income

Corporate service fees 545 564

Other (51) 156

Noninterest income 494 720

Total revenue 1,531 1,538

Provision for credit losses 366 125

Noninterest expense 882 818

Pretax earnings 283 595

Income taxes 58 163

Earnings $225 $432

A

VERAGE

B

ALANCE

S

HEET

Loans

Corporate (b) $12,485 $9,930

Commercial real estate 5,631 4,408

Commercial – real estate related 3,022 2,390

Asset-based lending 5,274 4,595

Total loans (b) 26,412 21,323

Goodwill and other intangible assets 2,247 1,919

Loans held for sale 2,053 1,319

Other assets 6,282 4,491

Total assets $36,994 $29,052

Deposits

Noninterest-bearing demand $7,598 $7,301

Money market 5,216 4,784

Other 2,286 1,325

Total deposits 15,100 13,410

Other liabilities 5,479 3,347

Capital 2,616 2,152

Total funds $23,195 $18,909

P

ERFORMANCE

R

ATIOS

Return on average capital 9% 20%

Noninterest income to total revenue 32 47

Efficiency 58 53

C

OMMERCIAL

M

ORTGAGE

S

ERVICING

P

ORTFOLIO

(in billions)

Beginning of period $243 $200

Acquisitions/additions 31 88

Repayments/transfers (25) (45)

End of period $249 $243

O

THER

I

NFORMATION

Consolidated revenue from (c):

Treasury management $545 $476

Capital markets $336 $290

Commercial mortgage loan sales and

valuations (d) $(115) $19

Commercial mortgage loan servicing (e) 180 233

Commercial mortgage banking activities $65 $252

Total loans (f) $28,996 $23,861

Nonperforming assets (f) (g) $749 $243

Net charge-offs $168 $70

Full-time employees (f) 2,294 2,290

Net carrying amount of commercial mortgage

servicing rights (f) $654 $694

(a) Information for all periods presented excludes the impact of National City, which

PNC acquired on December 31, 2008.

(b) Includes lease financing.

(c) Represents consolidated PNC amounts.

(d) Includes valuations on commercial mortgage loans held for sale and related

commitments, derivative valuations, origination fees, gains on sale of loans held for

sale and net interest income on loans held for sale.

(e) Includes net interest income and noninterest income from loan servicing and

ancillary services.

(f) At December 31.

(g) Includes nonperforming loans of $747 million at December 31, 2008 and $222

million at December 31, 2007.

Corporate & Institutional Banking earned $225 million in

2008 compared with $432 million in 2007. The 48% decline

in earnings over 2007 was primarily driven by an increase in

the provision for credit losses and by higher valuation losses

on commercial mortgage loans held for sale, net of hedges.

• Net interest income grew $219 million, or 27%, in

2008 compared with 2007. The increase over the

prior year was primarily a result of an increase in

commercial mortgage loans held for sale, organic

loan growth and acquisitions.

• Corporate service fees decreased $19 million

compared with 2007 to $545 million. The fourth

quarter of 2008 included a $35 million impairment

charge on commercial mortgage servicing rights due

to the effect of lower interest rates. Increases in

treasury management, structured finance and

syndication fees more than offset declines in

commercial mortgage servicing fees, net of

amortization, and merger and acquisition advisory

fees.

• Other noninterest income was negative $51 million

for 2008 compared with income of $156 million in

2007. Losses of $197 million on commercial

mortgage loans held for sale, net of hedges, were

included in other noninterest income for 2008

compared with gains of $3 million in 2007. These

non-cash valuation losses reflected illiquid market

conditions which began in the latter part of 2007.

• PNC adopted SFAS 159 beginning January 1, 2008

and elected to account for its loans held for sale and

intended for securitization at fair value. We stopped

originating these loans during the first quarter of

2008. We intend to continue pursuing opportunities

to reduce our loans held for sale position at

appropriate prices. We sold and/or securitized $.6

billion of commercial mortgage loans held for sale

carried at fair value in 2008 reducing these fair value

assets to $1.4 billion at December 31, 2008.

• The provision for credit losses was $366 million in

2008 compared with $125 million in 2007. The

increase in the provision was primarily due to credit

quality migration mainly related to residential real

estate development and related sectors along with

growth in total credit exposure. Nonperforming

50