PNC Bank 2008 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

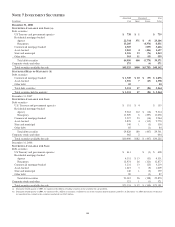

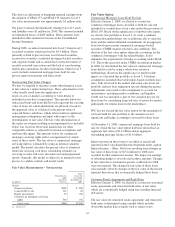

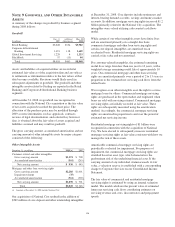

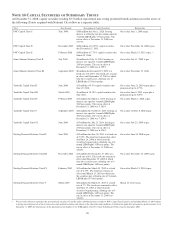

Changes in the commercial mortgage servicing rights were as

follows:

Commercial Mortgage Servicing Rights

In millions 2008 2007

Balance at January 1 $694 $471

Additions (a) 300 310

Amortization expense (95) (87)

Balance at December 31 899 694

Impairment charge (35)

Net carrying amount at December 31 $864 $694

(a) Includes $210 million in 2008 as part of the National City acquisition.

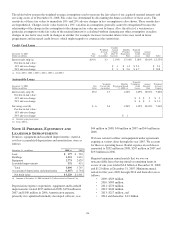

Servicing revenue from both commercial and residential

mortgage servicing assets and liabilities generated

contractually specified servicing fees, net interest income

from servicing portfolio deposit balances, and ancillary fees

totaling $171 million in 2008, $192 million in 2007 and $139

million in 2006. We also generate servicing revenue from

fee-based activities provided to others.

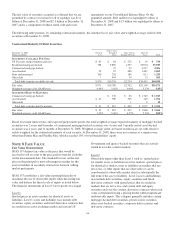

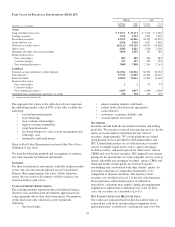

Amortization expense on intangible assets for 2008, 2007 and

2006 was $228 million, $173 million and $99 million,

respectively. The 2008 amortization expense includes a $35

million impairment charge for certain mortgage servicing

rights due to the effect of lower interest rates. Amortization

expense on existing intangible assets for 2009 through 2013 is

estimated to be as follows:

• 2009: $297 million,

• 2010: $232 million,

• 2011: $227 million,

• 2012: $206 million, and

• 2013: $180 million.

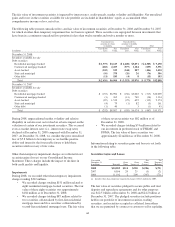

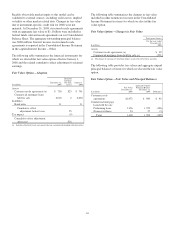

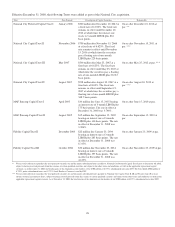

The changes in the carrying amount of goodwill and net other

intangible assets during 2008 follows:

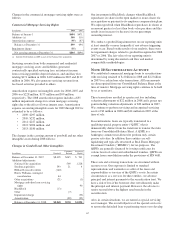

Changes in Goodwill and Other Intangibles

In millions Goodwill

Customer-

Related

Servicing

Rights

Balance at December 31, 2007 $8,405 $445 $ 701

Additions/adjustments:

National City acquisition 569 1,228

Sterling acquisition 593 21 4

Hilliard Lyons divestiture (140)

Harris Williams contingent

consideration 44

Other acquisitions (21) (3)

Mortgage and other loan servicing

rights 90

BlackRock (13)

Other (7)

Impairment charge (35)

Amortization (98) (95)

Balance at December 31, 2008 $8,868 $930 $1,890

Our investment in BlackRock changes when BlackRock

repurchases its shares in the open market or issues shares for

an acquisition or pursuant to its employee compensation plans.

We adjust goodwill when BlackRock repurchases its shares at

an amount greater (or less) than book value per share and this

results in an increase (or decrease) in our percentage

ownership interest.

We conduct a goodwill impairment test on our reporting units

at least annually or more frequently if any adverse triggering

events occur. Based on the results of our analysis, there were

no impairment charges related to goodwill recognized in 2008,

2007 or 2006. The fair value of our reporting units is

determined by using discounted cash flow and market

comparability methodologies.

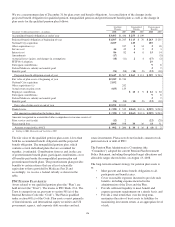

N

OTE

10 S

ECURITIZATION

A

CTIVITY

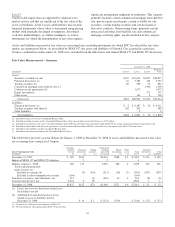

We contributed commercial mortgage loans to securitizations

with servicing retained of $.4 billion in 2008 and $2.2 billion

in 2007 for cash in loan sales transactions. All loan amounts

are derecognized from our Consolidated Balance Sheet at the

time of transfer. Mortgage servicing rights continue to be held

by us as transferor.

These transactions resulted in a pretax net loss including

valuation adjustments of $22 million in 2008 and a pretax net

gain including valuation adjustments of $20 million in 2007.

We continue to perform servicing and recognized servicing

assets of $3 million in 2008 and $14 million in 2007 at the

time of sale.

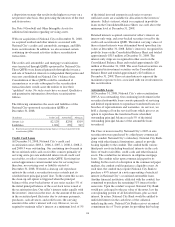

In securitizations, loans are typically transferred to a

qualifying special purpose entity (“QSPE”) that is

demonstrably distinct from the transferor to transfer the risks

from our Consolidated Balance Sheet. A QSPE is a

bankruptcy-remote trust allowed to perform only certain

passive activities. In addition, these entities are self-

liquidating and typically structured as Real Estate Mortgage

Investment Conduits (“REMICs”) for tax purposes. The

QSPEs are generally financed by issuing certificates for

various levels of senior and subordinated tranches. QSPEs are

exempt from consolidation under the provisions of FIN 46R.

These sale and servicing transactions are structured without

recourse to us. Our exposure is limited to standard

representations and warranties as seller of the loans and

responsibilities as servicer of the QSPE’s assets. In certain

circumstances as a servicer for these entities, we advance

principal and interest payments to the securitization trust. We

have a risk of loss if the borrower does not ultimately make

the principal and interest payment. However, the advance is

senior secured above the highest rated tranche in the

securitization.

Also, in certain situations, we are named as special servicing

asset manager. The overall objective of the special servicer is

to restore the defaulted loan to performing status or to develop

117