PNC Bank 2008 Annual Report Download - page 169

Download and view the complete annual report

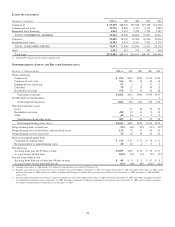

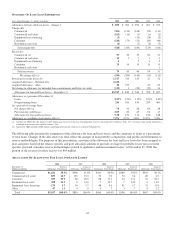

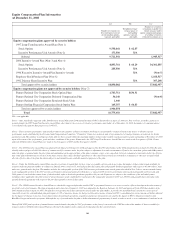

Please find page 169 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 6 – The Employee Stock Purchase Plan became effective in February 1997. The purchase price for shares sold under the plan represents 95% of the fair market value on the last day

of each six-month offering period. The number under column (c) for the plan reflects the number of shares remaining unsold under the 1997 plan after completion of sales for the last

six-month offering period pursuant to that plan ending December 31, 2008. The 1997 plan was replaced by an amended and restated plan of the same name effective for offering periods

beginning on or after January 1, 2009. The 2009 plan will be presented to the PNC shareholders for approval at the 2009 annual meeting.

Note 7 – The plans in this section of the table reflect awards under pre-acquisition plans of National City Corporation and Sterling Financial Corporation, respectively. National City was

merged into PNC on December 31, 2008 and Sterling was merged into PNC on April 4, 2008. Pursuant to the respective merger agreements for these acquisitions, common shares of

National City or Sterling, as the case may be, issuable upon the exercise or settlement of various equity awards granted under the National City or Sterling plans were converted into

corresponding awards covering PNC common stock. Additional information regarding these plans is included in Note 16 Stock-Based Compensation Plans in the Notes To Consolidated

Financial Statements in Item 8 of this Report.

Note 8 – The National City Corporation 2004 Deferred Compensation Plan provided eligible employees the opportunity to defer the receipt of cash compensation which would have

otherwise been received as salary, as variable pay, or as an incentive award and provided participants with nonelective deferred compensation. The plan was frozen as to new deferral

elections and nonelective deferred compensation in December 2008. Deferred compensation already in the plan at that time, or contributed to the plan pursuant to previous deferral

elections, is credited with gains or losses based upon investment options made available from time to time, and, as such, there is no weighted-average exercise price. The plan does not

limit the number of shares that may be issued for the plan.

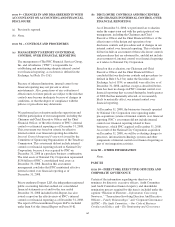

ITEM

13 – CERTAIN RELATIONSHIPS AND RELATED

TRANSACTIONS, AND DIRECTOR INDEPENDENCE

The information required by this item is included under the

captions “Transactions with Related Persons, Indemnification,

and Advancement of Costs” and “Corporate Governance At

PNC – Director Independence” in our Proxy Statement to be

filed for the 2009 annual meeting of shareholders and is

incorporated herein by reference.

ITEM

14 – PRINCIPAL ACCOUNTING FEES AND

SERVICES

The information required by this item is included under the

caption “Item 3 – Ratification of the Audit Committee’s

Selection of PricewaterhouseCoopers LLP as the Independent

Registered Public Accounting Firm for 2009” in our Proxy

Statement to be filed for the 2009 annual meeting of

shareholders and is incorporated herein by reference.

PART IV

ITEM

15 – EXHIBITS, FINANCIAL STATEMENT

SCHEDULES

FINANCIAL STATEMENTS, FINANCIAL

STATEMENT SCHEDULES

Our consolidated financial statements required in response to

this Item are incorporated by reference from Item 8 of this

Report.

Audited consolidated financial statements of BlackRock, Inc.

(“BlackRock”) as of December 31, 2008 and 2007 and for

each of the three years ended December 31, 2008, are

incorporated herein by reference to Item 15 (a) (1) of

BlackRock’s 2008 Annual Report on Form 10-K

(Commission File Number 001-33099).

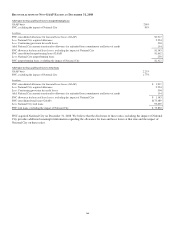

The report of our former independent registered public

accounting firm follows:

REPORT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

To the Board of Directors and Shareholders of

The PNC Financial Services Group, Inc.

Pittsburgh, Pennsylvania

We have audited the accompanying consolidated statements of

income, shareholders’ equity, and cash flows of The PNC

Financial Services Group, Inc. and subsidiaries (the

“Company”) for the year ended December 31, 2006. These

financial statements are the responsibility of the Company’s

management. Our responsibility is to express an opinion on

these financial statements based on our audit.

We conducted our audit in accordance with the standards of

the Public Company Accounting Oversight Board (United

States). Those standards require that we plan and perform the

audit to obtain reasonable assurance about whether the

financial statements are free of material misstatement. An

audit includes examining, on a test basis, evidence supporting

the amounts and disclosures in the financial statements. An

audit also includes assessing the accounting principles used

and significant estimates made by management, as well as

evaluating the overall financial statement presentation. We

believe that our audits provide a reasonable basis for our

opinion.

In our opinion, such consolidated financial statements present

fairly, in all material respects, the results of operations and

cash flows of The PNC Financial Services Group, Inc. and

subsidiaries for the year ended December 31, 2006, in

conformity with accounting principles generally accepted in

the United States of America.

As discussed in Note 1 to the consolidated financial

statements, the Company adopted Statement of Financial

Accounting Standard No. 158, “Employers’ Accounting for

Defined Benefit Pension and Other Postretirement Plans – an

amendment of FASB Statements No. 87, 88, 106, and 132(R)”

as of December 31, 2006.

165