PNC Bank 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In addition to dividends from PNC Bank, N.A., other sources

of parent company liquidity include cash and short-term

investments, as well as dividends and loan repayments from

other subsidiaries and dividends or distributions from equity

investments. As of December 31, 2008, the parent company

had approximately $4.2 billion in funds available from its cash

and short-term investments.

We can also generate liquidity for the parent company and

PNC’s non-bank subsidiaries through the issuance of

securities in public or private markets.

In December 2008, PNC Funding Corp issued the following

securities totaling $2.9 billion under the FDIC’s Temporary

Liquidity Guarantee Program-Debt Guarantee Program:

• $2 billion of fixed rate senior notes due June 2012.

These notes pay interest semiannually at a fixed rate

of 2.3%.

• $500 million of fixed rate senior notes due June

2011. These notes pay interest semiannually at a

fixed rate of 1.875%.

• $400 million of floating rate senior notes due June

2011. Interest will be reset quarterly to 3-month

LIBOR plus 28 basis points and interest will be paid

quarterly.

Each of these series of senior notes is guaranteed by the parent

company and by the FDIC and is backed by the full faith and

credit of the United States through June 30, 2012.

See the Executive Summary section of this Financial Review

and Note 19 Shareholders’ Equity in the Notes To

Consolidated Financial Statements in Item 8 of this Report for

information regarding PNC’s December 31, 2008 issuance of

$7.6 billion of preferred stock and related common stock

warrant to the US Treasury under the TARP Capital Purchase

Program.

PNC Funding Corp has the ability to offer up to $3.0 billion of

commercial paper to provide the parent company with

additional liquidity. As of December 31, 2008, $99 million of

commercial paper was outstanding under this program.

We have effective shelf registration statements which enable

us to issue additional debt and equity securities, including

certain hybrid capital instruments. As of December 31, 2008,

there were $1.4 billion of parent company contractual

obligations, including commercial paper, with maturities of

less than one year.

We also provide tables showing contractual obligations and

various other commitments representing required and

potential cash outflows as of December 31, 2008 under the

heading “Commitments” below.

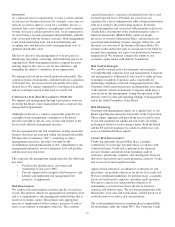

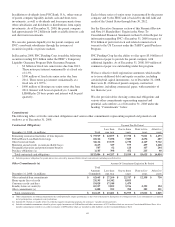

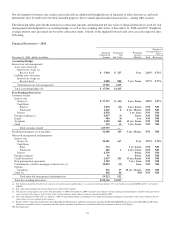

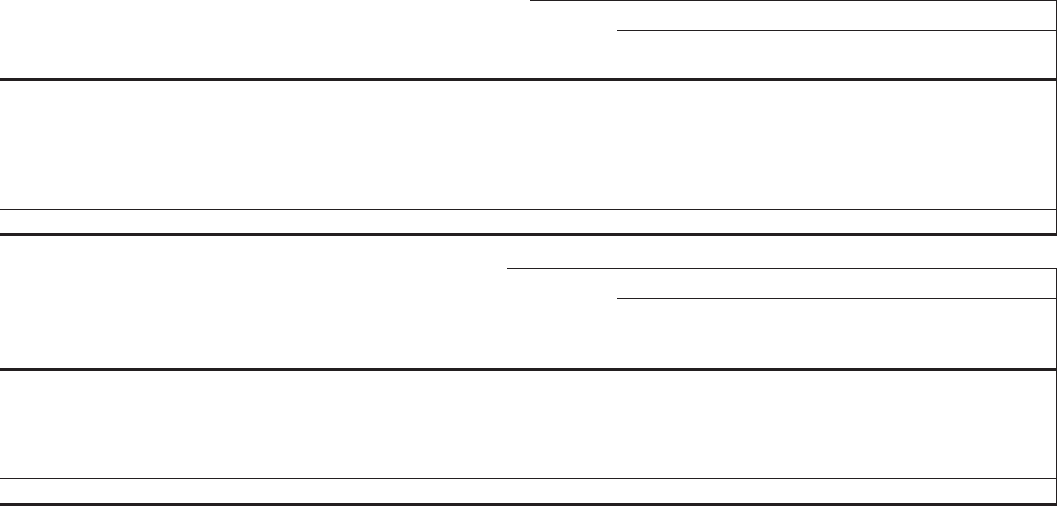

Commitments

The following tables set forth contractual obligations and various other commitments representing required and potential cash

outflows as of December 31, 2008.

Contractual Obligations Payment Due By Period

December 31, 2008 - in millions Total

Less than

one year

One to three

years

Four to five

years

After five

years

Remaining contractual maturities of time deposits $ 75,919 $ 44,877 $ 17,758 $ 9,011 $ 4,273

Federal Home Loan Bank borrowings 18,126 5,058 7,887 4,694 487

Other borrowed funds 34,114 13,533 6,730 4,129 9,722

Minimum annual rentals on noncancellable leases 2,615 329 579 459 1,248

Nonqualified pension and postretirement benefits 567 62 124 117 264

Purchase obligations (a) 1,145 398 472 215 60

Total contractual cash obligations $132,486 $ 64,257 $ 33,550 $ 18,625 $ 16,054

(a) Includes purchase obligations for goods and services covered by noncancellable contracts and contracts including cancellation fees.

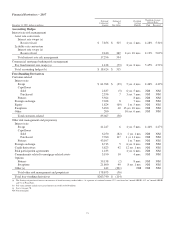

Other Commitments (a) Amount Of Commitment Expiration By Period

December 31, 2008 - in millions

Total

Amounts

Committed

Less than

one year

One to three

years

Four to five

years

After five

years

Other unfunded loan commitments $ 62,665 $ 27,260 $ 22,317 $ 12,358 $ 730

Home equity lines of credit 23,195 14,342 8,853

Consumer credit card lines 19,028 17,549 1,479

Standby letters of credit (b) 10,317 3,855 3,916 2,352 194

Other commitments (c) 1,408 595 390 302 121

Total commitments $ 116,613 $ 63,601 $ 36,955 $ 15,012 $ 1,045

(a) Other commitments are funding commitments that could potentially require performance in the event of demands by third parties or contingent events. Loan commitments are reported

net of participations, assignments and syndications.

(b) Includes $5.1 billion of standby letters of credit that support remarketing programs for customers’ variable rate demand notes.

(c) Includes unfunded commitments related to private equity investments of $540 million and other investments of $178 million which are not on our Consolidated Balance Sheet. Also

includes commitments related to tax credit investments of $690 million which are included in other liabilities on the Consolidated Balance Sheet.

65