PNC Bank 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FSP clarifies that certain convertible debt instruments should

be separately accounted for as liability and equity

components. This guidance will be effective beginning with

our first quarter 2009 Form 10-Q. We do not expect the

adoption of this guidance to have a material effect on our

results of operations or financial position.

In June 2008, the FASB issued FSP EITF 03-6-1,

“Determining Whether Instruments Granted in Share-Based

Payment Transactions Are Participating Securities.” This FSP

clarifies that unvested share-based payment awards that

contain nonforfeitable rights to dividends or dividend

equivalents are considered participating securities and should

be included in the calculation of basic earnings per share using

the two-class method prescribed by SFAS 128, “Earnings Per

Share.” This guidance will be effective for disclosure

beginning with our first quarter 2009 Form 10-Q with

retrospective application required. We do not expect the

adoption of this guidance to have a material effect on our

earnings per share disclosures.

In September 2008, the FASB issued FSP FAS 133-1 and FIN

45-4, “Disclosures about Credit Derivatives and Certain

Guarantees: An Amendment of FASB Statement No. 133 and

FASB Interpretation No. 45; and Clarification of the Effective

Date of FASB Statement No. 161.” This FSP amends FASB

Statement No. 133, “Accounting for Derivative Instruments

and Hedging Activities,” to require disclosures by sellers of

credit derivatives, including credit derivatives embedded in a

hybrid instrument. This FSP also amends FASB Interpretation

No. 45, “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees

of Indebtedness of Others,” to require additional disclosure

about the payment/performance risk of a guarantee. This

guidance was effective December 31, 2008 for PNC. See Note

25 Commitments and Guarantees for additional information.

In September 2008, the FASB issued an Exposure Draft,

“Proposed Statement, Amendments to FASB Interpretation

No. 46(R).” This proposed Statement would amend FIN 46R

and require ongoing assessments to determine: 1) whether an

entity is a variable interest entity and, 2) whether an enterprise

is the primary beneficiary of a variable interest entity. The

primary beneficiary determination generally would be based

on a qualitative analysis based on who has power over the

activities of the entity and the rights to receive benefits or

absorb losses. Enhanced disclosures would also be required.

This proposed guidance would be effective for PNC beginning

January 1, 2010. The guidance as proposed could require us to

consolidate certain VIEs or securitization trusts if we are

deemed the primary beneficiary.

In September 2008, the FASB issued an Exposure Draft,

“Proposed Statement, Accounting for Transfers of Financial

Assets – an amendment of FASB Statement No. 140.” This

proposed Statement, a revision of a 2005 FASB Exposure

Draft, would remove (1) the concept of a qualifying SPE from

FASB Statement No. 140, “Accounting for Transfers and

Servicing of Financial Assets and Extinguishments of

Liabilities,” and (2) the exceptions from applying FIN 46R to

qualifying SPEs. This proposed Statement would also revise

and clarify the derecognition requirements for transfers of

financial assets, establish conditions for transfer of a portion

of a financial asset, and requiring the initial measurement of

beneficial interests that are received as proceeds in connection

with transfers of financial assets at fair value. This proposed

guidance would be effective for PNC beginning January 1,

2010.

In October 2008, the FASB issued FSP FAS 157-3,

“Determining the Fair Value of a Financial Asset When the

Market for That Asset Is Not Active.” This FSP clarifies the

application of FASB Statement No. 157, “Fair Value

Measurements,” in a market that is not active and provides an

example to illustrate key considerations in determining the fair

value of a financial asset when the market for that financial

asset is not active. This guidance was considered in

determining the fair value of financial assets beginning

September 30, 2008.

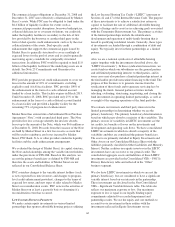

In December 2008, the FASB issued FSP FAS 140-4 and FIN

46(R)-8, “Disclosures by Public Entities (Enterprises) about

Transfers of Financial Assets and Interests in Variable Interest

Entities.” This FSP amends FASB Statement No. 140,

“Accounting for Transfers and Servicing of Financial Assets

and Extinguishments of Liabilities,” and will require

additional disclosures about transfers of financial assets. It

also amends FASB Interpretation No. 46 (revised December

2003), “Consolidation of Variable Interest Entities,” and

requires additional disclosures about involvement with

variable interest entities. This guidance was effective

December 31, 2008 for PNC. See Note 3 Variable Interest

Entities for additional information.

In December 2008, the FASB issued FSP FAS 132(R)-1,

“Employers’ Disclosures about Postretirement Benefit Plan

Assets.” This FSP amends FASB Statement No. 132 (revised

2003), “Employers’ Disclosures about Pensions and Other

Postretirement Benefits,” to provide guidance on an

employer’s disclosures about plan assets of a defined benefit

pension or other postretirement plan. This guidance will be

effective December 31, 2009 for PNC.

In January 2009, the FASB issued FSP EITF 99-20-1,

“Amendments to the Impairment Guidance of EITF Issue

No. 99-20.” This FSP amends the impairment guidance in

EITF Issue No. 99-20, “Recognition of Interest income and

Impairment on Purchased Beneficial Interests and Beneficial

Interest That Continue to Be Held by a Transferor in

Securitized Financial Assets.” The FSP also retains and

emphasizes the objective of an other-than-temporary

impairment assessment and the related disclosure

requirements in FASB Statement No. 115, “Accounting for

Certain Investments in Debt and Equity Securities,” and other

96