PNC Bank 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.equity method totaled $1.7 billion while investments

accounted for under the cost method totaled $648 million at

December 31, 2008. These investments totaled $1.0 billion at

December 31, 2007, all of which were accounted for under the

equity method.

Visa

At December 31, 2008, our remaining investment in Visa

Class B common shares totaled approximately 23.2 million

shares, including 19.7 million shares acquired in connection

with our National City acquisition. The Visa B shares owned

by National City were recorded by PNC at fair value

(including a liquidity discount) as part of our acquisition. The

PNC-owned Visa B shares are recorded at zero book value.

Considering the expected reduction in the IPO conversion

ratio due to settled litigation reported by Visa, these shares

would convert to approximately 14.6 million of the publicly

traded Visa Class A common shares. Based on the

December 31, 2008 closing price of $52.45 for the Visa

shares, our remaining investment had an unrecognized pretax

value of approximately $312 million at that date. The Visa

Class B common shares we own generally will not be

transferable until they can be converted into shares of the

publicly traded class of stock, which cannot happen until the

later of three years after the IPO or settlement of all of the

specified litigation. As stated above, it is expected that Visa

will continue to adjust the conversion ratio of Visa Class B to

Class A shares in connection with settlements in excess of any

amounts then in escrow for that purpose and will also reduce

the conversion ratio to the extent that it adds any funds to the

escrow in the future. Note 25 Commitments and Guarantees in

our Notes To Consolidated Financial Statements included in

Item 8 of this Report has further information on our Visa

indemnification obligation.

Private Equity

The private equity portfolio is comprised of equity and

mezzanine investments that vary by industry, stage and type

of investment. Private equity investments are reported at fair

value. Changes in the values of private equity investments are

reflected in our results of operations. Due to the nature of the

investments, the valuations incorporate assumptions as to

future performance, financial condition, liquidity, availability

of capital, and market conditions, among other factors, to

determine the estimated fair value of the investments. Market

conditions and actual performance of the investments could

differ from these assumptions. Accordingly, lower valuations

may occur that could adversely impact earnings in future

periods. Also, the valuations may not represent amounts that

will ultimately be realized from these investments. See Note 1

Accounting Policies in Item 8 for additional information.

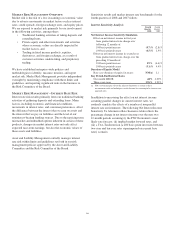

At December 31, 2008, private equity investments carried at

estimated fair value totaled $1.2 billion compared with $561

million at December 31, 2007. As of December 31, 2008,

$620 million was invested directly in a variety of companies

and $566 million was invested indirectly through various

private equity funds. Included in direct investments are

investment activities of two private equity funds that are

consolidated for financial reporting purposes. The minority

and noncontrolling interests of these funds totaled $142

million as of December 31, 2008. Our unfunded commitments

related to private equity totaled $540 million at December 31,

2008 compared with $270 million at December 31, 2007.

Other Investments

We also make investments in affiliated and non-affiliated

funds with both traditional and alternative investment

strategies. The economic values could be driven by either the

fixed-income market or the equity markets, or both. At

December 31, 2008, other investments totaled $853 million

compared with $384 million at December 31, 2007. We

recognized losses related to these investments of $156 million

during 2008 including $76 million in the fourth quarter. Given

the nature of these investments and if current market

conditions affecting their valuation were to continue or

worsen, we could incur future losses.

Our unfunded commitments related to other investments

totaled $178 million at December 31, 2008 compared with $79

million at December 31, 2007.

I

MPACT OF

I

NFLATION

Our assets and liabilities are primarily monetary in nature.

Accordingly, future changes in prices do not affect the

obligations to pay or receive fixed and determinable amounts

of money. During periods of inflation, monetary assets lose

value in terms of purchasing power and monetary liabilities

have corresponding purchasing power gains. The concept of

purchasing power, however, is not an adequate indicator of the

effect of inflation on banks because it does not take into

account changes in interest rates, which are an important

determinant of our earnings.

F

INANCIAL

D

ERIVATIVES

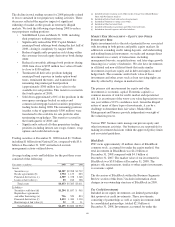

We use a variety of financial derivatives as part of the overall

asset and liability risk management process to help manage

interest rate, market and credit risk inherent in our business

activities. Substantially all such instruments are used to

manage risk related to changes in interest rates. Interest rate

and total return swaps, interest rate caps and floors and futures

contracts are the primary instruments we use for interest rate

risk management.

Financial derivatives involve, to varying degrees, interest rate,

market and credit risk. For interest rate swaps and total return

swaps, options and futures contracts, only periodic cash

payments and, with respect to options, premiums are

exchanged. Therefore, cash requirements and exposure to

credit risk are significantly less than the notional amount on

these instruments. Further information on our financial

derivatives is presented in Note 1 Accounting Policies and

Note 17 Financial Derivatives in the Notes To Consolidated

Financial Statements in Item 8 of this Report.

69