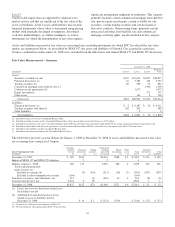

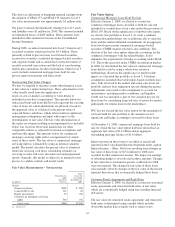

PNC Bank 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The fair value of investment securities is impacted by interest rates, credit spreads, market volatility and illiquidity. Net unrealized

gains and losses in the securities available for sale portfolio are included in shareholders’ equity as accumulated other

comprehensive income or loss, net of tax.

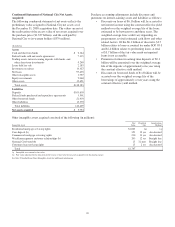

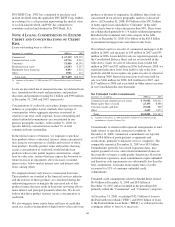

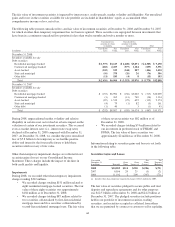

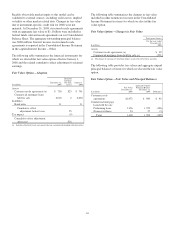

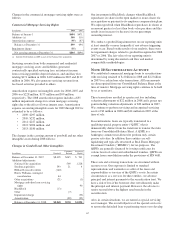

The following table presents unrealized loss and fair value of investment securities at December 31, 2008 and December 31, 2007

for which an other-than-temporary impairment has not been recognized. These securities are segregated between investments that

have been in a continuous unrealized loss position for less than twelve months and twelve months or more.

Unrealized loss

position less than

12 months

Unrealized loss

position 12 months

or more Total

In millions

Unrealized

Loss

Fair

Value

Unrealized

Loss

Fair

Value

Unrealized

Loss

Fair

Value

December 31, 2008

Securities available for sale

Debt securities

Residential mortgage-backed $(1,775) $3,619 ($ 2,608) $3,871 ($ 4,383) $ 7,490

Commercial mortgage-backed (482) 2,207 (377) 1,184 (859) 3,391

Asset-backed (102) 523 (344) 887 (446) 1,410

State and municipal (56) 370 (20) 26 (76) 396

Other debt (11) 185 (4) 8 (15) 193

Total $(2,426) $6,904 $ (3,353) $5,976 $ (5,779) $12,880

December 31, 2007

Securities available for sale

Debt securities

Residential mortgage-backed $ (157) $6,994 $ (156) $5,065 $ (313) $12,059

Commercial mortgage-backed (3) 365 (13) 769 (16) 1,134

Asset-backed (87) 1,519 (25) 655 (112) 2,174

State and municipal (4) 79 (1) 82 (5) 161

Other debt (1) 40 3 (1) 43

Total $ (252) $8,997 $ (195) $6,574 $ (447) $15,571

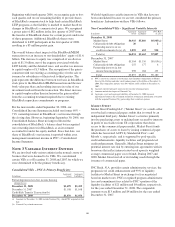

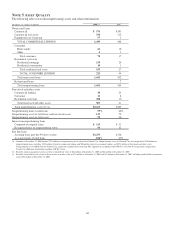

During 2008, unprecedented market volatility and relative

illiquidity in certain asset sectors had an adverse impact on the

valuation of certain of our investment securities. This occurred

even as market interest rates (i.e., interest rate swap rates)

declined at December 31, 2008 compared with December 31,

2007. At December 31, 2008, we consider the gross unrealized

loss of $5.8 billion to be temporary as we had the positive

ability and intent for the foreseeable future to hold these

securities until recovery of fair value.

Other-than-temporary impairment charges are reflected in net

securities gains (losses) on our Consolidated Income

Statement. These charges include the impact of declines in

both credit quality and liquidity.

Impairments

During 2008, we recorded other-than-temporary impairment

charges totaling $312 million.

• We recorded charges totaling $151 million related to

eight residential mortgage-backed securities. The fair

value of these eight securities was approximately

$184 million as of December 31, 2008.

• We recorded charges totaling $87 million related to

two securities collateralized by first-lien residential

mortgage loans and five securities collateralized by

second-lien residential mortgage loans. The fair value

of these seven securities was $82 million as of

December 31, 2008.

• We recorded charges totaling $74 million related to

our investment in preferred stock of FHLMC and

FNMA. The fair value of these securities was

approximately $2 million as of December 31, 2008.

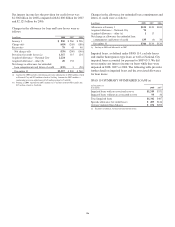

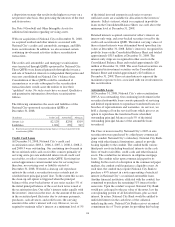

Information relating to securities gains and losses is set forth

in the following table.

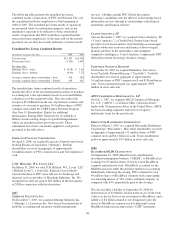

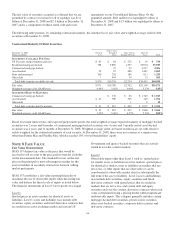

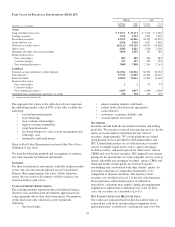

Securities Gains and Losses

Year ended

December 31

In millions Proceeds

Gross

Gains

Gross

Losses (a)

Net

Gains

(Losses)

Tax

Expense

(Benefit)

2008 $10,283 $114 $320 $(206) $(72)

2007 6,056 20 25 (5) (2)

2006 11,102 2 209 (207) (72)

(a) Includes other-than-temporary impairment charges of $312 million for 2008.

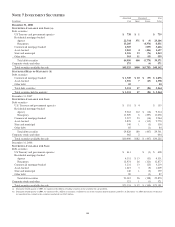

The fair value of securities pledged to secure public and trust

deposits and repurchase agreements and for other purposes

was $22.5 billion at December 31, 2008 and $24.2 billion at

December 31, 2007. The pledged securities include positions

held in our portfolio of investment securities, trading

securities, and securities accepted as collateral from others

that we are permitted by contract or custom to sell or repledge.

109