PNC Bank 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our ability to mitigate the adverse consequences of such

occurrences is in part dependent on the quality of our resiliency

planning, including our ability to anticipate the nature of any

such event that occurs. The adverse impact of natural disasters

or terrorist activities or international hostilities also could be

increased to the extent that there is a lack of preparedness on the

part of national or regional emergency responders or on the part

of other organizations and businesses that we deal with,

particularly those that we depend upon.

ITEM

1

B

–

UNRESOLVED STAFF COMMENTS

There are no SEC staff comments regarding PNC’s periodic or

current reports under the Exchange Act that are pending

resolution.

ITEM

2–

PROPERTIES

Our executive and administrative offices are located at One

PNC Plaza, Pittsburgh, Pennsylvania. The thirty-story

structure is owned by PNC Bank, N. A. We occupy the entire

building. In addition, PNC Bank, N.A. owns a thirty-four story

structure adjacent to One PNC Plaza, known as Two PNC

Plaza, that houses additional office space.

We own or lease numerous other premises for use in

conducting business activities, including operations centers,

offices, and branch and other facilities. We consider the

facilities owned or occupied under lease by our subsidiaries to

be adequate. We include here by reference the additional

information regarding our properties in Note 11 Premises,

Equipment and Leasehold Improvements in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

ITEM

3–

LEGAL PROCEEDINGS

See the information set forth in Note 24 Legal Proceedings

included in the Notes to Consolidated Financial Statements in

Item 8 of this Report, which is incorporated here by reference.

National City has agreed to pay a penalty of $200,000

imposed under section 6707 A(b)(2) of the Internal Revenue

Code for failure to include certain reportable transaction

information in its 2004 federal income tax return related to a

listed transaction. We expect to pay the penalty in 2009.

ITEM

4–

SUBMISSION OF MATTERS TO A VOTE OF

SECURITY HOLDERS

A special meeting of shareholders of The PNC Financial

Services Group, Inc. was held on December 23, 2008 for the

purpose of considering and acting upon the following matters:

(1) a proposal to approve the issuance of shares of PNC

common stock as contemplated by the Agreement and Plan of

Merger, dated as of October 24, 2008, by and between The

PNC Financial Services Group, Inc. and National City

Corporation, as such agreement may be amended from time to

time; and (2) a proposal to approve the adjournment of the

special meeting, if necessary or appropriate, to solicit

additional proxies, in the event that there were not sufficient

votes at the time of the special meeting to approve the

proposal described under (1) above.

Based on a total of approximately 348.5 million eligible votes,

approximately 266 million votes, or 76% of the total, were

cast. The votes cast included votes for or against either

proposal, as well as abstentions.

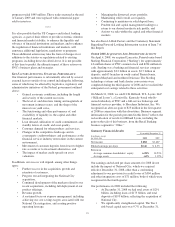

The proposal to approve the issuance of shares of PNC

common stock in connection with PNC’s acquisition of

National City was ratified and the aggregate votes cast for or

against and the abstentions were as follows:

Aggregate Votes

For Against Abstain

262,287,739 3,057,391 634,073

The proposal to approve the adjournment of the special

meeting, if necessary, was ratified and the aggregate votes cast

for or against and the abstentions were as follows (there were

also 1,550 non-votes):

Aggregate Votes

For Against Abstain

240,665,800 24,585,286 726,567

With respect to all of the preceding matters, holders of our

common and voting preferred stock voted together as a single

class. The following table sets forth, as of the November 14,

2008 record date, the number of shares of each class or series

of stock that were issued and outstanding and entitled to vote,

the voting power per share, and the aggregate voting power of

each class or series:

Title of Class or Series

Voting Rights

Per Share

Number of

Shares Entitled

to Vote

Aggregate

Voting Power

Common Stock 1 347,960,466 347,960,466

$1.80 Cumulative

Convertible

Preferred Stock –

Series A 8 6,540 52,320

$1.80 Cumulative

Convertible

Preferred Stock –

Series B 8 1,137 9,096

$1.60 Cumulative

Convertible

Preferred Stock –

Series C 4/2.4 119,126 198,543

$1.80 Cumulative

Convertible

Preferred Stock –

Series D 4/2.4 170,761 284,602

Total possible votes 348,505,027*

* Represents greatest number of votes possible. Actual aggregate voting power was less

since each holder of voting preferred stock was entitled to a number of votes equal to

the number of full shares of common stock into which such holder’s preferred stock

was convertible.

17