PNC Bank 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

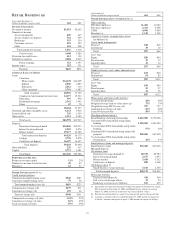

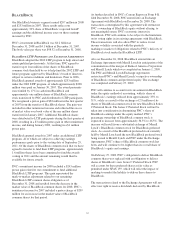

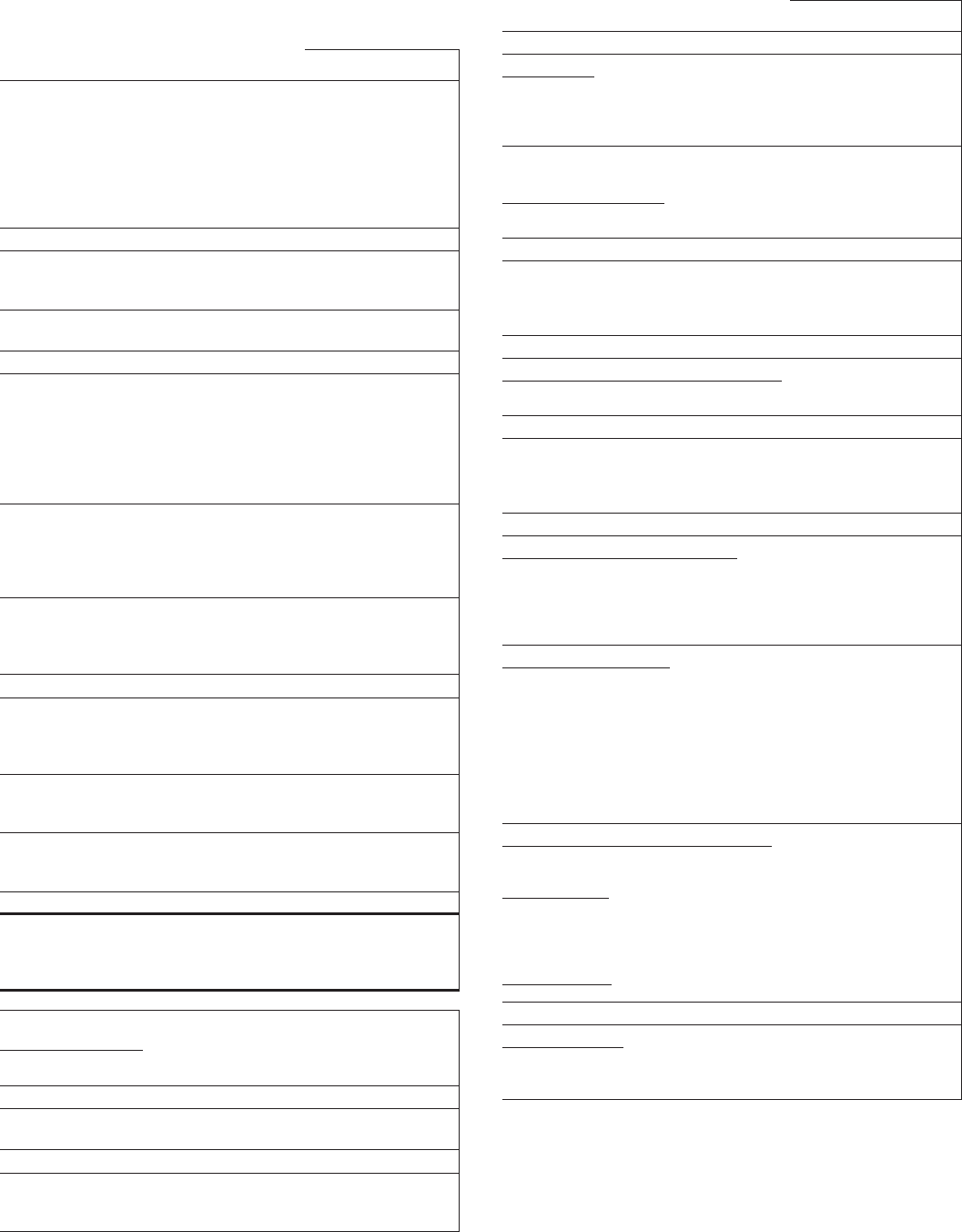

R

ETAIL

B

ANKING

(a)

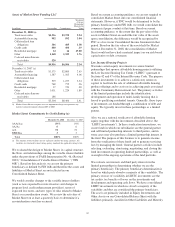

Year ended December 31

Dollars in millions except as noted 2008 2007

I

NCOME

S

TATEMENT

Net interest income $1,992 $2,062

Noninterest income

Asset management 420 445

Service charges on deposits 362 339

Brokerage 153 134

Consumer services 419 392

Other 262 208

Total noninterest income 1,616 1,518

Total revenue 3,608 3,580

Provision for credit losses 612 138

Noninterest expense 2,284 2,045

Pretax earnings 712 1,397

Income taxes 283 521

Earnings $429 $876

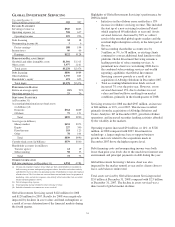

A

VERAGE

B

ALANCE

S

HEET

Loans

Consumer

Home equity $14,678 $14,209

Indirect 2,050 1,897

Education 2,012 110

Other consumer 1,761 1,487

Total consumer 20,501 17,703

Commercial and commercial real estate 14,677 12,534

Floor plan 997 978

Residential mortgage 2,362 1,992

Other 67 70

Total loans 38,604 33,277

Goodwill and other intangible assets 6,132 4,920

Loans held for sale 329 1,564

Other assets 1,513 2,182

Total assets $46,578 $41,943

Deposits

Noninterest-bearing demand $10,860 $10,513

Interest-bearing demand 9,583 8,876

Money market 19,677 16,786

Total transaction deposits 40,120 36,175

Savings 2,701 2,678

Certificates of deposit 16,397 16,637

Total deposits 59,218 55,490

Other liabilities 329 417

Capital 3,773 3,481

Total funds $63,320 $59,388

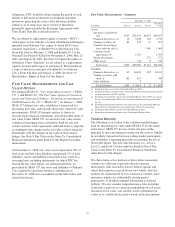

P

ERFORMANCE

R

ATIOS

Return on average capital 11% 25%

Noninterest income to total revenue 45 42

Efficiency 63 57

O

THER

I

NFORMATION

(b) (c)

Credit-related statistics:

Commercial nonperforming assets $540 $187

Consumer nonperforming assets 79 38

Total nonperforming assets (d) $619 $225

Commercial net charge-offs $239 $71

Consumer net charge-offs 129 60

Total net charge-offs $368 $131

Commercial net charge-off ratio 1.52% .52%

Consumer net charge-off ratio .56% .30%

Total net charge-off ratio .95% .39%

At December 31

Dollars in millions except as noted 2008 2007

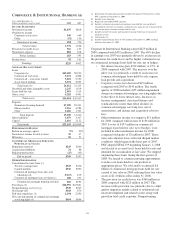

O

THER

I

NFORMATION CONTINUED

(b) (c)

Other statistics:

Full-time employees 11,481 11,022

Part-time employees 2,363 2,298

ATMs 4,041 3,900

Branches (e) 1,148 1,109

ASSETS UNDER ADMINISTRATION

(in billions) (f)

Assets under management

Personal $38 $49

Institutional 19 20

Total $57 $69

Asset Type

Equity $26 $40

Fixed income 19 17

Liquidity/other 12 12

Total $57 $69

Nondiscretionary assets under administration

Personal $23 $30

Institutional 64 82

Total $87 $112

Asset Type

Equity $34 $49

Fixed income 19 27

Liquidity/other 34 36

Total $87 $112

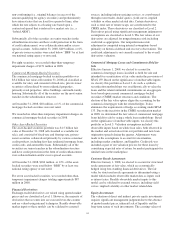

Home equity portfolio credit statistics:

% of first lien positions 38% 39%

Weighted average loan-to-value ratios (g) 73% 73%

Weighted average FICO scores (h) 727 727

Annualized net charge-off ratio .52% .20%

Loans 90 days past due .58% .37%

Checking-related statistics:

Retail Banking checking relationships 2,432,000 2,272,000

Consumer DDA households using online

banking 1,238,000 1,091,000

% of consumer DDA households using online

banking 57% 54%

Consumer DDA households using online bill

payment 882,000 667,000

% of consumer DDA households using online

bill payment 41% 33%

Small business loans and managed deposits:

Small business loans $13,483 $13,049

Managed deposits:

On-balance sheet

Noninterest-bearing demand (i) $8,319 $5,994

Interest-bearing demand 2,157 1,873

Money market 3,638 3,152

Certificates of deposit 880 1,068

Off-balance sheet (j)

Small business sweep checking 3,140 2,780

Total managed deposits $18,134 $14,867

Brokerage statistics:

Financial consultants (k) 414 364

Full service brokerage offices 23 24

Brokerage account assets (billions) $15 $19

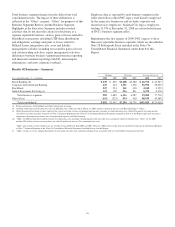

(a) Information for all periods presented excludes the impact of National City, which

PNC acquired on December 31, 2008, and Hilliard Lyons, which was sold on

March 31, 2008, and whose results have been reclassified to “Other.”

(b) Presented as of December 31 except for net charge-offs and net charge-off ratio.

(c) Amounts as of and for the year ended December 31, 2008 include the impact of

Yardville. Amounts subsequent to April 4, 2008 include the impact of Sterling.

47