The Hartford 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

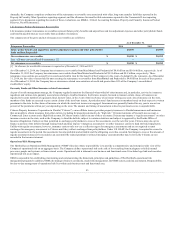

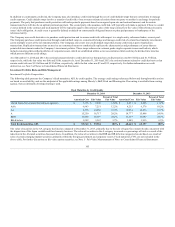

Interest Rate Sensitivity

Invested Assets Supporting Fixed Liabilities

Included in the following table is the before-tax change in the net economic value of investment contracts (e.g., fixed annuity contracts) issued by the

Company’s Talcott Resolution segment, as well as certain insurance product liabilities (e.g., disability contracts) issued by the Company’s Group Benefits

segment, for which the payment rates are fixed at contract issuance and the investment experience is substantially absorbed by the Company’s operations,

along with the corresponding invested assets. Also included in this analysis are the interest rate sensitive derivatives used by the Company to hedge its

exposure to interest rate risk in the investment portfolios supporting these contracts. This analysis does not include the assets and corresponding liabilities of

certain insurance products such as auto, property, term life insurance, and certain life contingent annuities. Certain financial instruments, such as limited

partnerships and other alternative investments, have been omitted from the analysis due to the fact that the investments generally lack sensitivity to interest

rate changes. Separate account assets and liabilities are excluded from the analysis because gains and losses in separate accounts accrue to policyholders. The

calculation of the estimated hypothetical change in net economic value below assumes a 100 basis point upward and downward parallel shift in the yield

curve.

Basis point shift -100 +100 -100 +100

Increase (decrease) in economic value, before tax $ (452) $ 304 $ (234) $ 128

[1] The table above excludes all assets and liabilities associated with the Company's former Japan variable and fixed annuity business.

The carrying value of fixed maturities, commercial mortgage loans and short-term investments related to the businesses included in the table above was $27.2

billion and $28.6 billion, as of December 31, 2014 and 2013, respectively. The hypothetical change in net economic value increased as compared to

December 31, 2013, primarily as a result of the impact of higher asset fair values driven by lower interest rates. The assets supporting the fixed liabilities are

monitored and managed within set duration guidelines, and are evaluated on a daily basis, as well as annually using scenario simulation techniques in

compliance with regulatory requirements.

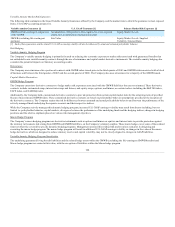

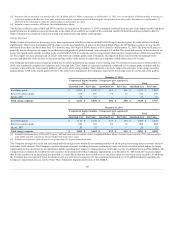

Invested Assets Not Supporting Fixed Liabilities

The following table provides an analysis showing the estimated before-tax change in the fair value of the Company’s investments and related derivatives,

excluding assets supporting fixed liabilities which are included in the table above, assuming 100 basis point upward and downward parallel shifts in the

yield curve as of December 31, 2014 and 2013. Certain financial instruments, such as limited partnerships and other alternative investments, have been

omitted from the analysis due to the fact that the investments are accounted for under the equity method and generally lack sensitivity to interest rate

changes.

Basis point shift -100 +100 -100 +100

Increase (decrease) in fair value, before tax $ 2,182 $ (2,083) $ 2,100 $ (2,005)

[1] The table above excludes all assets associated with the Company's former Japan variable and fixed annuity business.

The carrying value of fixed maturities, commercial mortgage loans and short-term investments related to the businesses included in the table above was $43.1

billion and $40.7 billion, as of December 31, 2014 and 2013, respectively. The selection of the 100 basis point parallel shift in the yield curve was made only

as an illustration of the potential hypothetical impact of such an event and should not be construed as a prediction of future market events. Actual results

could differ materially from those illustrated above due to the nature of the estimates and assumptions used in the above analysis. The Company’s sensitivity

analysis calculation assumes that the composition of invested assets and liabilities remain materially consistent throughout the year and that the current

relationship between short-term and long-term interest rates will remain constant over time. As a result, these calculations may not fully capture the impact of

portfolio re-allocations, significant product sales or non-parallel changes in interest rates.

Equity risk is defined as the risk of financial loss due to changes in the value of global equities or equity indices. The Company has exposure to equity risk

from assets under management, embedded derivatives within the Company’s variable annuities and assets that support the Company’s pension plans. Equity

Risk on the Company’s Variable Annuity products is mitigated through various hedging programs. (See the Variable Annuity Hedge Program Section)

97