The Hartford 2014 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

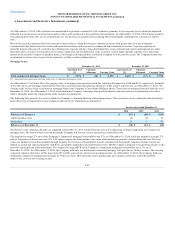

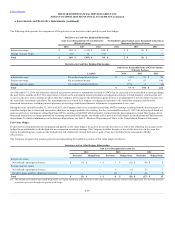

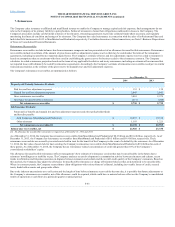

The following table presents the components of the gain or loss on derivatives that qualify as cash flow hedges:

Interest rate swaps $ 150 $ (315) $ 120 $ 2 $ (3) $ —

Foreign currency swaps (10) 12 (31) — — —

Interest rate swaps Net realized capital gain/(loss) $ (1) $ 91 $ 90

Interest rate swaps Net investment income 87 97 140

Foreign currency swaps Net realized capital gain/(loss) (13) 4 (6)

As of December 31, 2014, the before-tax deferred net gains on derivative instruments recorded in AOCI that are expected to be reclassified to earnings during

the next twelve months are $63. This expectation is based on the anticipated interest payments on hedged investments in fixed maturity securities that will

occur over the next twelve months, at which time the Company will recognize the deferred net gains (losses) as an adjustment to net investment income over

the term of the investment cash flows. The maximum term over which the Company is hedging its exposure to the variability of future cash flows for

forecasted transactions, excluding interest payments on existing variable-rate financial instruments, is approximately two years.

During the years ended December 31, 2014 and 2013, the Company had no net reclassifications from AOCI to earnings resulting from the discontinuance of

cash-flow hedges due to forecasted transactions that were no longer probable of occurring. For the year ended December 31, 2012 the before-tax deferred net

gains on derivative instruments reclassified from AOCI to earnings totaled $99 which primarily resulted from the discontinuance of cash flow hedges due to

forecasted transactions no longer probable of occurring associated with variable rate bonds sold as part of the Individual Life and Retirement Plans business

dispositions. For further information on the business dispositions, see Note 2 - Business Dispositions of Notes to the Consolidated Financial Statements.

For derivative instruments that are designated and qualify as fair value hedges, the gain or loss on the derivatives as well as the offsetting loss or gain on the

hedged items attributable to the hedged risk are recognized in current earnings. The Company includes the gain or loss on the derivative in the same line

item as the offsetting loss or gain on the hedged item. All components of each derivative’s gain or loss were included in the assessment of hedge

effectiveness.

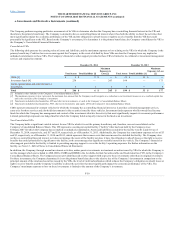

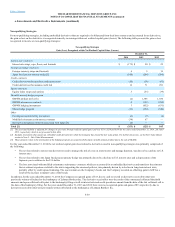

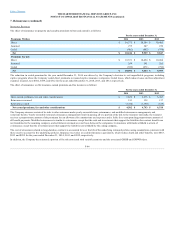

The Company recognized in income gains (losses) representing the ineffective portion of fair value hedges as follows:

Interest rate swaps

Net realized capital gains (losses) $ (3) $ 1 $ 7 $ (12) $ (4) $ 2

Foreign currency swaps

Net realized capital gains (losses) — — 1 (1) (7) 7

Benefits, losses and loss adjustment expenses — — (2) 2 (6) 6

[1] The amounts presented do not include the periodic net coupon settlements of the derivative or the coupon income (expense) related to the hedged item. The net of the amounts

presented represents the ineffective portion of the hedge.

F-58