The Hartford 2014 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

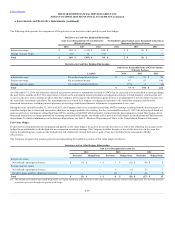

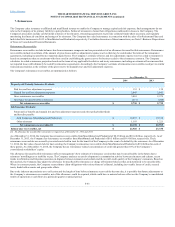

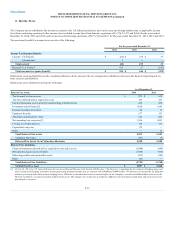

The carrying value of goodwill allocated to reporting units as of December 31, 2014 and 2013 is as follows:

Personal Lines $ 119 $ — $ 119

Mutual Funds 149 — 149

Corporate [1] 585 (355) 230

[1] Carrying value as of December 31, 2014 and 2013 includes $138 and $92 for the Group Benefits and Mutual Funds reporting units, respectively.

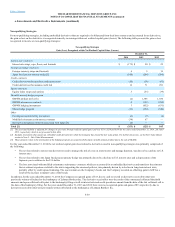

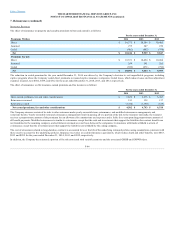

Year ended December 31, 2014

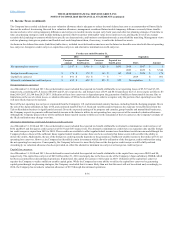

The annual goodwill assessment for the Group Benefits, Personal Lines, and Mutual Funds reporting units was completed as of October 31, 2014, which

resulted in no write-downs of goodwill for the year ended December 31, 2014. The reporting units passed the first step of their annual impairment test with a

significant margin with the exception of the Group Benefits reporting unit. Group Benefits passed the first step of its annual impairment test with less than a

10% margin. The fair value of the Group Benefits reporting unit is based on discounted cash flows using earnings projections on in force business and future

business growth. There could be a positive or negative impact on the results of step one in future periods if assumptions change about the level of capital,

future business growth, earnings projections or the weighted average cost of capital.

Year ended December 31, 2013

During the first quarter of 2013, the Company completed the sale of its Retirement Plans business to MassMutual. Accordingly, the carrying value of the

reporting unit's goodwill of $156 was reduced and included in reinsurance loss on disposition in the Company's Consolidated Statements of Operations.

The annual goodwill assessment for the Mutual Funds, Group Benefits, and Personal Lines reporting units was completed as of October 31, 2013, which

resulted in no write-downs of goodwill for the year ended December 31, 2013. All reporting units passed the first step of their annual impairment test with a

significant margin.

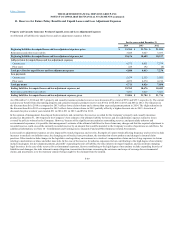

Year ended December 31, 2012

During the first quarter of 2012, the Company determined that a triggering event requiring an impairment assessment had occurred as a result of its decision

to pursue sales or other strategic alternatives for the Individual Life and Retirement Plans reporting units.

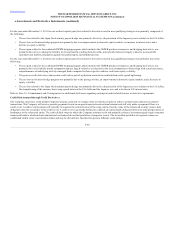

The Company completed interim impairment tests during each of the first three quarters of 2012 for the Retirement Plans reporting unit which resulted in no

impairment of goodwill. The annual goodwill assessment for Retirement Plans was completed as of October 31, 2012 and an additional impairment test was

completed as of December 31, 2012 as a result of the anticipated sale of this business unit. No write-down of goodwill resulted for the year ended December

31, 2012. Retirement Plans passed step one of the goodwill impairment tests with a margin of less than 10% between fair value and book value of the

reporting unit as of both dates. The fair value of the Retirement Plans reporting unit as of October 31, 2012 and December 31, 2012 was based on a negotiated

transaction price.

The Company completed interim impairment tests during each of the first three quarters of 2012 for the Individual Life reporting unit which resulted in no

impairment of goodwill in the first and second quarters of 2012. In the third quarter of 2012, the Individual Life reporting unit failed the goodwill impairment

test as the carrying amount of the Individual Life reporting unit's goodwill exceeded the implied goodwill value. Accordingly, an impairment loss of $342

was recognized, representing the carrying value of the reporting unit's goodwill. The goodwill impairment loss is included with reinsurance loss on

disposition in the Company's Consolidated Statements of Operations. The fair value of the Individual Life reporting unit as of September 30, 2012 was based

on a negotiated transaction price.

The annual goodwill assessment for the Mutual Funds and Personal Lines reporting units and the Group Benefits reporting unit within Corporate was

completed as of October 31, 2012, which resulted in no write-downs of goodwill for the year ended December 31, 2012. The reporting units passed the first

step of their annual impairment test with a significant margin with the exception of the Group Benefits reporting unit. Group Benefits passed the first step of

its annual impairment test with less than a 10% margin. The fair value of the Group Benefits reporting unit is based on discounted cash flows using earnings

projections on in force business and future business growth.

F-66