The Hartford 2014 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

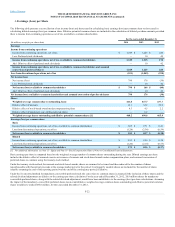

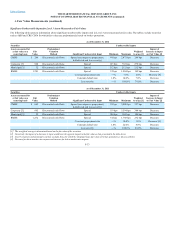

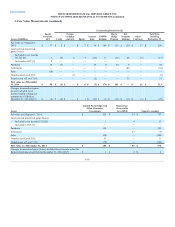

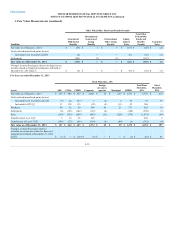

[1] Includes OTC and OTC-cleared derivative instruments in a net asset value position after consideration of the impact of collateral posting requirements which may be

imposed by agreements, clearinghouse rules, and applicable law. As of December 31, 2014 and 2013, $413 and $128, respectively, of cash collateral liability was netted

against the derivative asset value in the Consolidated Balance Sheets and is excluded from the table above. See footnote 4 below for derivative liabilities.

[2] Represents hedge funds where investment company accounting has been applied to a wholly-owned fund of funds measured at fair value.

[3] Approximately $2.5 billion and $2.4 billion of investment sales receivable, as of December 31, 2014 and 2013, respectively, are excluded from this disclosure requirement

because they are trade receivables in the ordinary course of business where the carrying amount approximates fair value.

[4] Includes OTC and OTC-cleared derivative instruments in a net negative market value position (derivative liability) after consideration of the impact of collateral posting

requirements which may be imposed by agreements, clearing house rules and applicable law. In the Level 3 roll-forward table included below in this Note 5, the derivative

assets and liabilities are referred to as “freestanding derivatives” and are presented on a net basis.

[5] Represents embedded derivatives associated with non-funding agreement-backed consumer equity linked notes.

Determination of Fair Values

The valuation methodologies used to determine the fair values of assets and liabilities under the “exit price” notion, reflect market participant objectives and

are based on the application of the fair value hierarchy that prioritizes relevant observable market inputs over unobservable inputs. The Company determines

the fair values of certain financial assets and liabilities based on quoted market prices where available, and where prices represent a reasonable estimate of fair

value. The Company also determines fair value based on future cash flows discounted at the appropriate current market rate. Fair values reflect adjustments

for counterparty credit quality, the Company’s default spreads, liquidity, and where appropriate, risk margins on unobservable parameters. The following is a

discussion of the methodologies used to determine fair values for the financial instruments listed in the above tables.

The fair value process is monitored by the Valuation Committee, which is a cross-functional group of senior management within the Company that meets at

least quarterly. The Valuation Committee is co-chaired by the Heads of Investment Operations and Accounting, and has representation from various

investment sector professionals, accounting, operations, legal, compliance and risk management. The purpose of the committee is to oversee the pricing

policy and procedures by ensuring objective and reliable valuation practices and pricing of financial instruments, as well as addressing valuation issues and

approving changes to valuation methodologies and pricing sources. There are also two working groups under the Valuation Committee, a Securities Fair

Value Working Group (“Securities Working Group”) and a Derivatives Fair Value Working Group ("Derivatives Working Group"), which include various

investment, operations, accounting and risk management professionals that meet monthly to review market data trends, pricing and trading statistics and

results, and any proposed pricing methodology changes described in more detail in the following paragraphs.

The Company also has an enterprise-wide Operational Risk Management function, led by the Chief Operational Risk Officer, which is responsible for

establishing, maintaining and communicating the framework, principles and guidelines of the Company's operational risk management program. This

includes model risk management which provides an independent review of the suitability, characteristics and reliability of model inputs, as well as an

analysis of significant changes to current models.

Fixed Maturities, AFS; Equity Securities, AFS; Equity Securities, FVO; Fixed Maturities, FVO, Equity Securities, Trading; and Short-term Investments

The fair value of AFS and FVO securities, equity securities, trading, and short-term investments in an active and orderly market (e.g. not distressed or forced

liquidation) are determined by management after considering the following primary sources of information: quoted prices for identical assets or liabilities,

third-party pricing services, independent broker quotations, or pricing matrices. Security pricing is applied using a “waterfall” approach whereby publicly

available prices are first sought from third-party pricing services, and the remaining unpriced securities are submitted to independent brokers for prices, or

priced using a pricing matrix. Typical inputs used by these pricing methods include, but are not limited to, reported trades, benchmark yields, issuer spreads,

bids, offers, and/or estimated cash flows, prepayment speeds, and default rates. Based on the typical trading volumes and the lack of quoted market prices for

fixed maturities, third-party pricing services will normally derive the security prices from recent reported trades for identical or similar securities making

adjustments through the reporting date based upon available market observable information as outlined above. If there are no recently reported trades, the

third-party pricing services and independent brokers may use matrix or model processes to develop a security price where future cash flow expectations are

developed based upon collateral performance and discounted at an estimated market rate. Included in the pricing of ABS and RMBS are estimates of the rate

of future prepayments of principal over the remaining life of the securities. Such estimates are derived based on the characteristics of the underlying structure

and prepayment speeds previously experienced at the interest rate levels projected for the underlying collateral. Actual prepayment experience may vary

from these estimates.

Prices from third-party pricing services are often unavailable for securities that are rarely traded or are traded only in privately negotiated transactions. As a

result, certain securities are priced via independent broker quotations which utilize inputs that may be difficult to corroborate with observable market based

data. Additionally, the majority of these independent broker quotations are non-binding.

F-29