The Hartford 2014 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In 2010, the Company issued 23 million depositary shares, each representing a 1/40th interest in the Company's 7.25% Series F mandatory convertible

preferred stock at a price of $25 per depositary share and received net proceeds of approximately $556. Cumulative dividends on each share of the Series F

mandatory convertible preferred stock were payable at a rate of 7.25% per annum on the initial liquidation preference of $1,000 per share. The Series F

mandatory convertible preferred stock was converted to 21.2 million shares of common stock on April 1, 2013.

In 2012, the Company repurchased 69,351,806 Series B and Series C warrants, at an exercise price of $25.23, for $300 representing all of the outstanding

warrants held by Allianz. Under the terms of the investment agreement, these warrants initially entitled Allianz to purchase 69,115,324 shares of the

Company’s common stock at an exercise price of $25.32 per share. The warrant repurchase was settled on April 17, 2012.

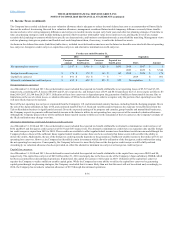

As of December 31, 2014 and 2013, respectively, the Company has 7.2 million and 32.4 million CPP warrants outstanding and exercisable. The CPP warrants

were issued in 2009 as part of a program established by the U.S. Department of the Treasury under the Emergency Economic Stabilization Act of 2008. The

CPP warrants expire in 2019.

CPP warrant exercises were 25.2 million and 18.1 million during the years ended December 31, 2014 and 2013, respectively. During the year ended

December 31, 2013, the Company also repurchased 1.6 million CPP warrants for $33 under the Company's authorized equity repurchase program.

The declaration of common stock dividends by the Company in excess of a threshold triggers a provision in the Company's warrant agreement with The Bank

of New York Mellon resulting in adjustments to the CPP warrant exercise price. Accordingly, the CPP warrant exercise price was $9.388, $9.504 and $9.599

as of December 31, 2014, 2013 and 2012, respectively. The exercise price will be settled by the Company's withholding the number of common shares

issuable upon exercise of the warrants equal to the value of the aggregate exercise price of the warrants so exercised determined by reference to the closing

price of the Company's common stock on the trading day on which the warrants are exercised and notice is delivered to the warrant agent.

In 2014, the Board of Directors approved increases aggregating $1.525 billion in the Company's authorized equity repurchase program, bringing the total

authorization for equity repurchases to $2.775 billion for the period January 1, 2014 through December 31, 2015, with $979 remaining as of December 31,

2014.

During the year ended December 31, 2014, the Company repurchased 49.5 million common shares for $1,796. During the period January 1, 2015 to February

24, 2015, the Company repurchased 4.1 million common shares for $165.

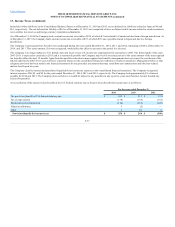

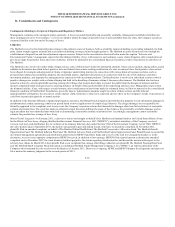

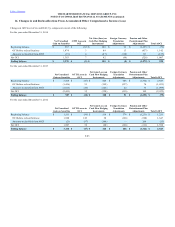

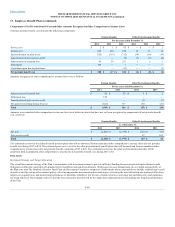

The domestic insurance subsidiaries of The Hartford prepare their statutory financial statements in conformity with statutory accounting practices prescribed

or permitted by the applicable state insurance department which vary materially from U.S. GAAP. Prescribed statutory accounting practices include

publications of the National Association of Insurance Commissioners (“NAIC”), as well as state laws, regulations and general administrative rules. The

differences between statutory financial statements and financial statements prepared in accordance with U.S. GAAP vary between domestic and foreign

jurisdictions. The principal differences are that statutory financial statements do not reflect deferred policy acquisition costs and limit deferred income taxes,

predominately use interest rate and mortality assumptions prescribed by the NAIC for life benefit reserves, generally carry bonds at amortized cost, and

present reinsurance assets and liabilities net of reinsurance.

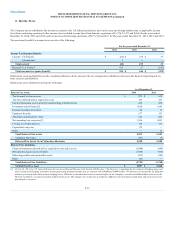

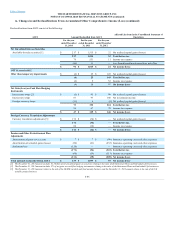

Statutory net income and statutory capital and surplus are as follows:

U.S. life insurance subsidiaries, includes domestic captive insurance subsidiaries $ 415 $ 2,144 $ 592

Property and casualty insurance subsidiaries 1,228 1,217 883

F-82