The Hartford 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

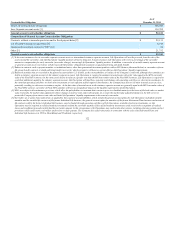

Cash used for investing activities in 2013 primarily relates to net proceeds of available-for-sale securities of $4.9 billion and proceeds from business sold of

$815 offset by net payments on derivatives of $2.2 billion. Cash used for investing activities in 2012 primarily relates to net payments on derivatives of $2.7

billion, purchases of mortgage loans of $968 and net payments for the purchases of partnerships of $695, partially offset by net proceeds of available-for-sale

securities of $1.7 billion and net receipts of fixed maturities, fair value option of $101.

Cash used for financing activities in 2013 primarily consists of net outflows on investment and universal life-type contracts of $2.1 billion, decrease in

securities loaned or sold under agreements to repurchase of $1.9 billion, repayment of long term debt of $ 1.3 billion and treasury stock acquired of $600.

Cash used for financing activities in 2012 primarily consists of net outflows on investment and universal life-type contracts of $1.4 billion, repurchase of

warrants of $300, as well as share repurchases and dividends paid on common and preferred stock. These were partially offset by net increases in securities

loaned or sold of $1.9 billion.

Equity Markets

For a discussion of the potential impact of the equity markets on capital and liquidity, see the Financial Risk on Statutory Capital and Liquidity Risk section

in this MD&A.

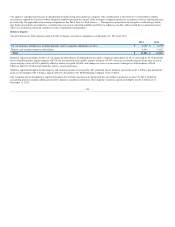

Ratings

Ratings are an important factor in establishing a competitive position in the insurance marketplace and impact the Company's ability to access financing and

its cost of borrowing. There can be no assurance that the Company’s ratings will continue for any given period of time, or that they will not be changed. In

the event the Company’s ratings are downgraded, the Company’s competitive position, ability to access financing, and its cost of borrowing, may be

adversely impacted.

On March 6, 2014, Moody’s Investors Service (“Moody’s”) affirmed the debt ratings of The Hartford Financial Services Group, Inc. and the insurance

financial strength ratings of its property and casualty subsidiaries and Hartford Life and Accident Insurance Company. The outlook on these entities was

changed to positive from stable. Moody’s downgraded the insurance financial strength rating of Hartford Life Insurance Company to Baa2 from A3. Moody’s

affirmed the insurance financial strength rating of Hartford Life and Annuity Insurance Company. Moody's outlook for Hartford Life Insurance Company and

Hartford Life and Annuity Insurance Company is stable.

On April 3, 2014, A.M. Best revised the outlook to positive from stable and affirmed the issuer credit ratings and debt ratings of The Hartford Financial

Services Group, Inc. and the financial strength ratings and issuer credit ratings of the property and casualty subsidiaries. A.M. Best upgraded the financial

strength rating of Hartford Life and Accident Insurance Company to A from A- and affirmed the ratings of Hartford Life Insurance Company and Hartford Life

and Annuity Insurance Company. A.M. Best's outlook for Hartford Life and Accident Insurance Company, Hartford Life Insurance Company and Hartford

Life and Annuity Insurance Company is stable.

On April 15, 2014 Standard & Poor’s (“S&P”) raised its long-term financial strength rating and counterparty credit ratings on Hartford Life and Accident

Insurance Company to A from A-. At the same time S&P raised the rating on Hartford Life Inc. to BBB from BBB-. The outlook for Hartford Life and Accident

Insurance Company and Hartford Life, Inc. is stable.

On August 29, 2014 Fitch Ratings affirmed and withdrew the ratings on the HFSG holding company, as well as the insurer financial strength rating of its

insurance subsidiaries for commercial reasons.

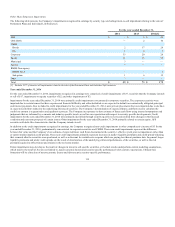

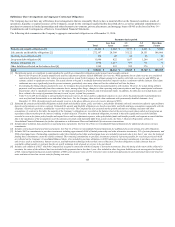

The following table summarizes The Hartford’s significant member companies’ financial ratings from the major independent rating organizations as of

February 24, 2015:

Insurance Financial Strength Ratings:

Hartford Fire Insurance Company A A A2

Hartford Life and Accident Insurance Company A A A3

Hartford Life Insurance Company A- BBB+ Baa2

Hartford Life and Annuity Insurance Company A- BBB+ Baa2

Other Ratings:

The Hartford Financial Services Group, Inc.:

Senior debt bbb+ BBB Baa3

Commercial paper AMB-2 A-2 P-3

These ratings are not a recommendation to buy or hold any of The Hartford’s securities and they may be revised or revoked at any time at the sole discretion

of the rating organization.

125