The Hartford 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

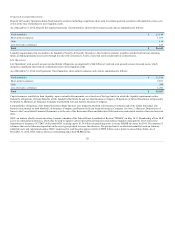

The following section discusses the overall financial strength of The Hartford and its insurance operations including their ability to generate cash flows from

each of their business segments, borrow funds at competitive rates and raise new capital to meet operating and growth needs over the next twelve months.

Liquidity Requirements and Sources of Capital

The liquidity requirements of the holding company of The Hartford Financial Services Group, Inc. (“HFSG Holding Company”) have been and will continue

to be met by HFSG Holding Company’s fixed maturities, short-term investments and cash, dividends from its subsidiaries, principally its insurance

operations, as well as the issuance of common stock, debt or other capital securities and borrowings from its credit facilities, as needed.

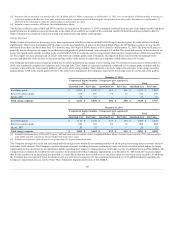

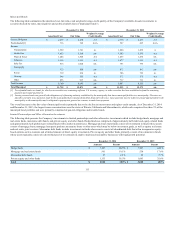

As of December 31, 2014, HFSG Holding Company held fixed maturities, short-term investments and cash of $2.1 billion. Expected liquidity requirements of

the HFSG Holding Company for the next twelve months include interest on debt of approximately $360 and common stockholder dividends, subject to

discretion of the Board of Directors, of approximately $300.

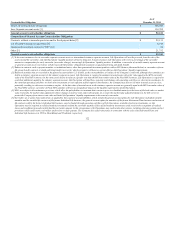

The Hartford has an intercompany liquidity agreement that allows for short-term advances of funds among the HFSG Holding Company and certain affiliates

of up to $2.0 billion for liquidity and other general corporate purposes. The Connecticut Insurance Department granted approval for certain affiliated

insurance companies that are parties to the agreement to treat receivables from a parent, including the HFSG Holding Company, as admitted assets for

statutory accounting purposes. As of December 31, 2014, there were no amounts outstanding from the HFSG holding company.

Equity

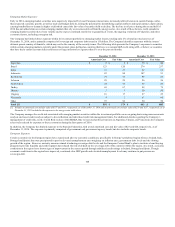

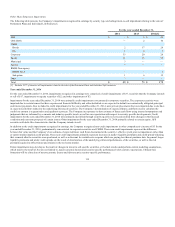

In 2014, the Board of Directors approved increases aggregating $1.525 billion in the Company's authorized equity repurchase program, bringing the total

authorization for equity repurchases to $2.775 billion for the period January 1, 2014 through December 31, 2015, with $979 remaining as of December 31,

2014.

In December 2014 the Company completed an ASR program, repurchasing a total of 13.9 million common shares under the ASR program for $525 million,

including the initial delivery of 11.2 million common shares in July 2014 and 2.7 million common shares delivered in December 2014.

During the year ended December 31, 2014, the Company repurchased 49.5 million common shares for $1,796. During the period January 1, 2015 to February

24, 2015, the Company repurchased 4.1 million common shares, for $165.

Debt

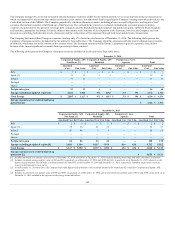

In 2014, the Board also authorized the Company to allocate up to $500, including any premium or associated costs, to reduce debt outstanding. Initially

expected to be completed prior to year end 2014, any repurchase of debt under the debt reduction allocation is now intended to occur in 2015 dependent on

market conditions. In addition, the Company intends to repay at maturity the 4% senior notes due March 2015 and the 7.3% senior notes due November

2015 totaling $456.

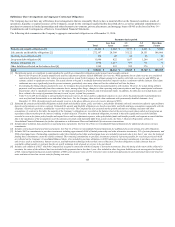

On April 18, 2013, the Company issued $300 aggregate principal amount of 4.3% Senior Notes (the "4.3% Notes") due April 15, 2043. On March 26, 2013,

the Company repurchased principal amounts of approximately $800, plus a payment for unpaid interest on senior notes due through the settlement date. The

Company recognized a loss on extinguishment in 2013 of approximately $213, before tax, representing the excess of the repurchase price over the principal

repaid and the write-off of the unamortized discount and debt issuance costs. For further information regarding debt, see Note 12 - Debt of Notes to

Consolidated Financial Statements.

Intercompany Liquidity Agreements

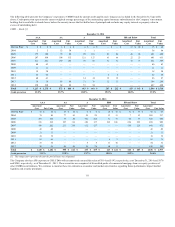

Until April 1, 2014, Hartford Life and Annuity Insurance Company ("HLAI"), a wholly-owned subsidiary of the Company, ceded certain variable annuity

contracts and their associated riders as well as certain payout annuities issued by HLAI or assumed by it to White River Life Reinsurance Company ("WRR"),

an affiliate captive reinsurer which was dissolved on April 30, 2014. Upon dissolution, WRR repaid an intercompany note payable to the Company in the

amount of $655 and returned $367 in capital to the Company, all of which was contributed as capital to HLAI to support the recaptured business. Effective

April 1, 2014, the Company recaptured all reinsured risks from WRR to HLAI. This transaction received required regulatory approvals.

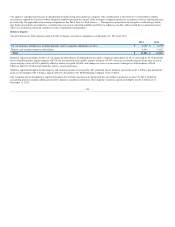

This arrangement provided the Company with a vehicle to provide more efficient financing of the risk associated with this business with internal funds. The

reinsurance arrangement between HLAI and WRR did not impact the Company's reserving methodology or the amount of required regulatory capital

associated with the reinsured business. The effects of this intercompany arrangement were eliminated in consolidation.

117