The Hartford 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

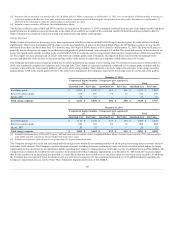

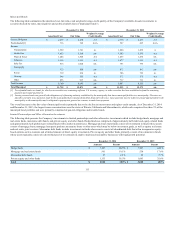

[3] Securities with an amortized cost and fair value of $1.0 billion and $1.1 billion, respectively, as of December 31, 2013, were reclassified in 2014 from utilities to energy as a

result of an update to the Barclays bond index which is the primary component used in determining the classification in the above table. The balances as of December 31,

2013 have been reclassified to reflect the categorization as of December 31, 2014.

[4] Included in equity securities, AFS on the Consolidated Balance Sheets.

The decline in the fair value of AFS and FVO securities as compared to December 31, 2013 is primarily attributable to the sale of the Japan variable and fixed

annuity buisness. In addition assets declined due to the effect of net outflows as a result of the continued runoff of Talcott Resolution, partially offset by

higher valuations as a result of a decrease in long term interest rates and tighter credit spreads.

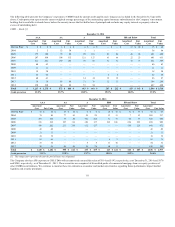

Energy Exposure

Market values of securities in the energy sector have experienced volatility in the second half of 2014 largely because prices for crude oil have declined

significantly. West Texas Intermediate (WTI) crude oil is the benchmark for oil prices in the United States. Prices for WTI futures contracts for one month

forward delivery have declined more than 51% from the June 2014 high of $108 a barrel, to $53 a barrel as of December 31, 2014. The drop in oil prices is

primarily due to an increase in supply, lower than expected growth in global demand, and a stronger U.S. dollar. The speed and severity of the decline in oil

prices has caused credit spreads to widen in the second half of 2014 for corporate and sovereign issuers that generate a large portion of their revenues from

oil. The impact was more pronounced on issuers with below investment grade credit. Ultimately, the impact on these issuers will be determined by the

severity and duration of the decline in oil prices and the ability of the issuers to adjust their cost structure or find other sources of revenue.

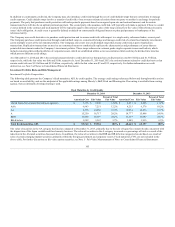

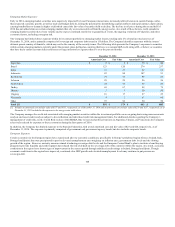

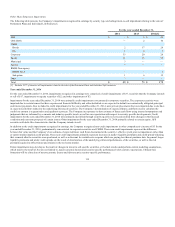

The Company has limited direct exposure within its investment portfolio to the energy sector, totaling only 5% of total invested assets as of December 31,

2014, and is primarily comprised of corporate and sovereign debt. The Company's exposure is primarily comprised of investment grade securities and the

exposure is diversified by issuer and in different sub sectors of the energy market. The Company selectively reduced its exposure to the energy sector by

approximately $300 in the fourth quarter of 2014. The table below summarizes the Company's exposure to the energy sector by sector and credit quality.

Investment grade $ 2,923 $ 3,162 $ 268 $ 266 $ 3,191 $ 3,428

Below investment grade 288 266 36 32 324 298

Equity, AFS 23 21 — — 23 21

Investment grade $ 3,114 $ 3,338 $ 355 $ 340 $ 3,469 $ 3,678

Below investment grade 320 324 84 78 404 402

Equity, AFS 20 22 — — 20 22

[1] Included in fixed maturities, AFS and FVO, equity, AFS and short-term investments on the Consolidated Balance Sheets. Excludes equity securities, FVO with cost and fair

value of $45 and $45, respectively, that are hedged with total return swaps.

[2] Includes sovereigns for which oil exports are greater than 4% of gross domestic product.

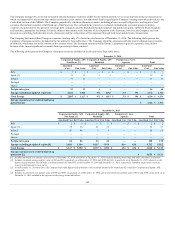

The Company manages the credit risk associated with the energy sector within the investment portfolio on an on-going basis using macroeconomic analysis

and issuer credit analysis. The Company considers alternate scenarios including oil prices remaining at low levels for an extended period and/or declining

significantly below current levels. For additional details regarding the Company’s management of credit risks, see the Credit Risk Section of this MD&A. The

Company has evaluated all available-for-sale securities for potential other-than-temporary impairments as of December 31, 2014 and 2013 and concluded

that for the securities in an unrealized loss position, it is more likely than not that we will recover our entire amortized cost basis in the securities. In addition,

the Company does not currently have the intent-to-sell, nor will we be required to sell, the securities discussed above. For additional details regarding the

Company’s impairment process, see the Other-Than-Temporary Impairments Section of this MD&A.

107