The Hartford 2014 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

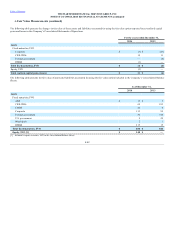

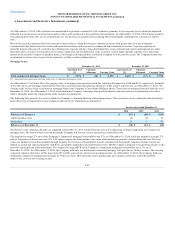

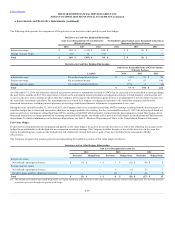

From time to time, the Company enters into repurchase agreements and dollar roll transactions to manage liquidity or to earn incremental spread income. A

repurchase agreement is a transaction in which one party (transferor) agrees to sell securities to another party (transferee) in return for cash (or securities), with

a simultaneous agreement to repurchase the same securities at a specified price at a later date. A dollar roll is a type of repurchase agreement where a mortgage

backed security is sold with an agreement to repurchase substantially the same security at a specified time in the future. These transactions generally have a

contractual maturity of ninety days or less and the carrying amounts of these instruments approximates fair value.

As part of repurchase agreements and dollar roll transactions, the Company transfers collateral of U.S. government and government agency securities and

receives cash. For the repurchase agreements, the Company obtains cash in an amount equal to at least 95% of the fair value of the securities transferred. The

agreements contain contractual provisions that require additional collateral to be transferred when necessary and provide the counterparty the right to sell or

re-pledge the securities transferred. The cash received from the repurchase program is typically invested in short-term investments or fixed maturities.

Repurchase agreements include master netting provisions that provide the counterparties the right to offset claims and apply securities held by them with

respect to their obligations in the event of a default. Although the Company has the contractual right to offset claims, fixed maturities do not meet the

specific conditions for net presentation under U.S. GAAP. The Company accounts for the repurchase agreements and dollar roll transactions as collateralized

borrowings. The securities transferred under repurchase agreements and dollar roll transactions are included in fixed maturities, AFS with the obligation to

repurchase those securities recorded in other liabilities on the Company's Consolidated Balance Sheets.

The Company had no outstanding repurchase agreements or dollar roll transactions as of December 31, 2014 or December 31, 2013.

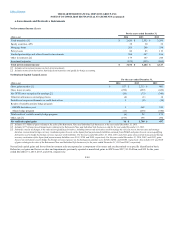

The Company is required by law to deposit securities with government agencies in certain states in which it conducts business. As of December 31, 2014 and

2013, the fair value of securities on deposit was approximately $2.5 billion and $1.9 billion, respectively.

As of December 31, 2013, the Company pledged as collateral $272 in Japan government bonds reported in fixed maturities, AFS, associated with short-term

debt of $238. The collateral and short-term debt were related to the Japan variable and fixed annuity business and were transferred to the Buyer as of June 30,

2014.

As of December 31, 2014 and 2013, the Company has pledged as collateral $34 and $34, respectively, of U.S. government securities and government agency

securities for letters of credit.

Refer to Derivative Collateral Arrangements section of this note for disclosure of collateral in support of derivative transactions.

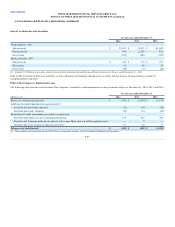

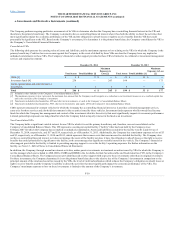

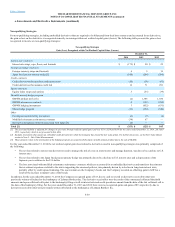

The majority of the Company's investments in limited partnerships and other alternative investments, including hedge funds, mortgage and real estate funds,

mezzanine debt funds, and private equity and other funds (collectively, “limited partnerships”), are accounted for under the equity method of accounting.

The Company’s maximum exposure to loss as of December 31, 2014 is limited to the total carrying value of $2.9 billion. In addition, the Company has

outstanding commitments totaling $604 to fund limited partnership and other alternative investments as of December 31, 2014. The Company’s investments

in limited partnerships are generally of a passive nature in that the Company does not take an active role in the management of the limited partnerships. In

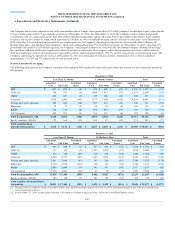

2014, aggregate investment income from limited partnerships and other alternative investments exceeded 10% of the Company’s pre-tax consolidated net

income. Accordingly, the Company is disclosing aggregated summarized financial data for the Company’s limited partnership investments. This aggregated

summarized financial data does not represent the Company’s proportionate share of limited partnership assets or earnings. Aggregate total assets of the

limited partnerships in which the Company invested totaled $85.8 billion and $85.6 billion as of December 31, 2014 and 2013, respectively. Aggregate total

liabilities of the limited partnerships in which the Company invested totaled $10.6 billion and $11.4 billion as of December 31, 2014 and 2013, respectively.

Aggregate net investment income of the limited partnerships in which the Company invested totaled $3.6 billion, $1.8 billion and $1.0 billion for the

periods ended December 31, 2014, 2013 and 2012, respectively. Aggregate net income of the limited partnerships in which the Company invested totaled

$9.6 billion, $8.4 billion and $7.2 billion for the periods ended December 31, 2014, 2013 and 2012, respectively. As of, and for the period ended,

December 31, 2014, the aggregated summarized financial data reflects the latest available financial information.

F-51