The Hartford 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

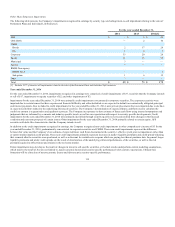

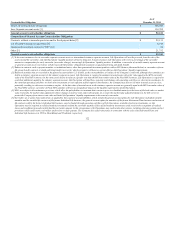

Capitalization

The capital structure of The Hartford as of December 31, 2014 and 2013 consisted of debt and stockholders’ equity, summarized as follows:

Short-term debt (includes current maturities of long-term debt) $ 456 $ 200 128 %

Short-term due on revolving credit facility — 238 (100)%

Long-term debt 5,653 6,106 (7)%

Stockholders’ equity excluding accumulated other comprehensive income (loss), net of tax (“AOCI”) 17,792 18,984 (6)%

AOCI, net of tax 928 (79) NM

Debt to stockholders’ equity 33% 35%

Debt to capitalization 25% 26%

[1] Total debt of the Company excludes $71 and $84 of consumer notes as of December 31, 2014 and December 31, 2013, respectively.

The Hartford’s total capitalization decreased $620 million, or 2%, from December 31, 2014 to December 31, 2013 primarily due to decreases in total debt.

Total stockholders' equity, remained flat from December 31, 2013 to December 31, 2014 due to share repurchases during the period, offset by an increase in

AOCI, primarily due to an increase in net unrealized capital gains from securities.

For additional information AOCI, net of tax, see Note 2 - Business Dispositions and Note 16 - Changes In and Reclassifications From Accumulated Other

Comprehensive Income of Notes to Consolidated Financial Statements, respectively.

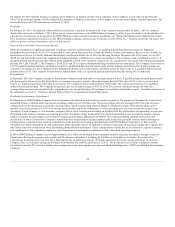

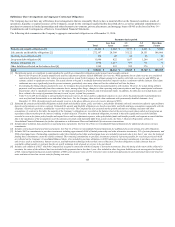

Cash Flow

Net cash provided by operating activities $ 1,886 $ 1,237 $ 2,681

Net provided by (used for) for investing activities $ 1,696 $ 3,745 $ (2,557)

Net cash used for financing activities $ (4,476) $ (5,820) $ (228)

Cash — end of year $ 399 $ 1,428 $ 2,421

Year ended December 31, 2014 compared to the year ended December 31, 2013

Cash provided by operating activities in 2014 reflect an increase in premiums collected and a decrease in loss and loss adjustment expenses paid, partially

offset by an increase in payments for payables and accruals. Operating cash flows for the years ended December 31, 2014, and 2013 have been adequate to

meet liquidity requirements. On June 30, 2014, the Company completed the sale of its Japan annuity business. The operations of this business are reported as

discontinued operations and are primarily in Net cash provided by operating activities. For further information regarding these transactions, see Note 2 -

Business Dispositions of Notes to Consolidated Financial Statements.

Cash used for investing activities in 2014 primarily relates to net proceeds from available-for-sale securities of $2.8 billion, and proceeds from the business

sold of $963, partially offset by net payments for short-term investments of $1.8 billion. Cash used for investing activities in 2013 primarily relates to net

proceeds from the sale of available-for-sale securities of $4.9 billion, and proceeds from the business sold of $815, partially offset by net payments on

derivatives of $2.2 billion.

Cash used for financing activities in 2014 primarily relates to $2.2 billion related to net activity for investment and universal life products, and acquisition of

treasury stock of $1.8 billion. Cash used for financing activities in 2013 primarily consists of net outflows on investment and universal life-type contracts of

$2.1 billion, decrease in securities loaned or sold under agreements to repurchase of $1.9 billion, repayment of long term debt of $ 1.3 billion and treasury

stock acquired of $600.

Year ended December 31, 2013 compared to the year ended December 31, 2012

Cash provided by operating activities decreased primarily due to realized capital losses of $1.5 billion in 2013, compared to an increase in income taxes

received of $486 in 2012.

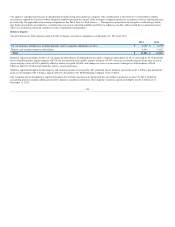

124