The Hartford 2014 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

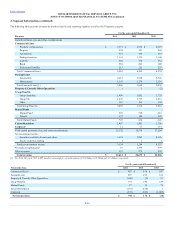

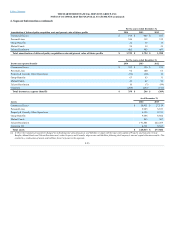

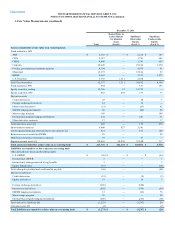

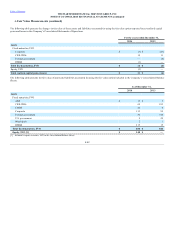

A description of additional inputs used in the Company’s Level 2 and Level 3 measurements is listed below:

Level 2 The fair values of most of the Company’s Level 2 investments are determined by management after considering prices received from third party

pricing services. These investments include most fixed maturities and preferred stocks, including those reported in separate account assets; as

well as, hedge funds where investment company accounting has been applied to a wholly-owned fund of funds measured at fair value, and

derivative instruments.

•ABS, CDOs, CMBS and RMBS — Primary inputs also include monthly payment information, collateral performance, which varies by

vintage year and includes delinquency rates, collateral valuation loss severity rates, collateral refinancing assumptions, credit default

swap indices and, for ABS and RMBS, estimated prepayment rates.

•Corporates, including investment grade private placements — Primary inputs also include observations of credit default swap curves

related to the issuer.

•Foreign government/government agencies - Primary inputs also include observations of credit default swap curves related to the issuer

and political events in emerging market economies.

•Municipals — Primary inputs also include Municipal Securities Rulemaking Board reported trades and material event notices, and

issuer financial statements.

•Short-term investments — Primary inputs also include material event notices and new issue money market rates.

•Equity securities, trading — Consist of investments in mutual funds. Primary inputs include net asset values obtained from third party

pricing services.

•Credit derivatives — Primary inputs include the swap yield curve and credit default swap curves.

•Foreign exchange derivatives — Primary inputs include the swap yield curve, currency spot and forward rates, and cross currency basis

curves.

•Interest rate derivatives — Primary input is the swap yield curve.

•Limited partnerships and other alternative investments — Primary inputs include a NAV for investment companies with no redemption

restrictions as reported on their U.S. GAAP financial statements, which are recorded on a one-month lag.

Level 3 Most of the Company's securities classified as Level 3 include less liquid securities such as lower quality ABS, CMBS, commercial real estate

("CRE") CDOs and RMBS primarily backed by sub-prime loans. Securities included in level 3 are primarily valued based on broker prices or

broker spreads, without adjustments. Primary inputs for non-broker priced investments, including structured securities, are consistent with the

typical inputs used in Level 2 measurements noted above, but are Level 3 due to their less liquid markets. Additionally, certain long-dated

securities are priced based on third party pricing services, including municipal securities, foreign government/government agencies, bank loans

and below investment grade private placement securities. Primary inputs for these long-dated securities are consistent with the typical inputs

used in Level 1 and Level 2 measurements noted above, but include benchmark interest rate or credit spread assumptions that are not observable

in the marketplace. Level 3 investments also include hedge funds where investment company accounting has been applied to a wholly-owned

fund of funds measured at fair value where the Company does not have the ability to redeem the investment in the near-term at the NAV. Also

included in Level 3 are certain derivative instruments that either have significant unobservable inputs or are valued based on broker quotations.

Significant inputs for these derivative contracts primarily include the typical inputs used in the Level 1 and Level 2 measurements noted above,

but also include equity and interest rate volatility and swap yield curves beyond observable limits.

F-32