The Hartford 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296

|

|

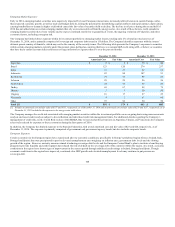

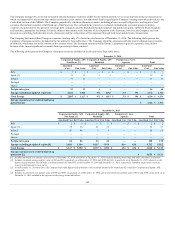

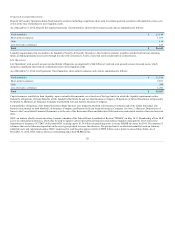

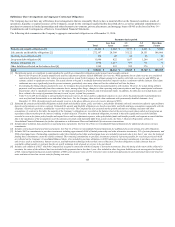

Municipal Bonds

The following table summarizes the amortized cost, fair value, and weighted average credit quality of the Company's available-for-sale investments in

securities backed by states, municipalities and political subdivisions (“municipal bonds”).

General Obligation $ 2,259

$ 2,480

AA

$ 2,358

$ 2,455

AA

Pre-Refunded [1] 716

748

AAA

567

605

AAA

Revenue

Transportation 1,599

1,781

A+

1,880

1,879

A

Health Care 1,412

1,560

AA-

1,305

1,335

AA

Water & Sewer 1,204

1,308

AA

1,455

1,476

AA-

Education 1,115

1,232

AA

1,077

1,105

AA

Sales Tax 916

1,020

AA-

793

795

AA-

Leasing [2]

772

858

AA-

877

897

AA-

Power 739

814

A+

706

722

A+

Housing 148

153

AA

177

171

AA

Other 855

917

AA-

737

733

A+

Total Revenue 8,760

9,643

AA-

9,007

9,113

AA-

[1] Pre-refunded bonds are bonds for which an irrevocable trust containing sufficient U.S. treasury, agency, or other securities has been established to fund the remaining

payment of principal and interest.

[2] Leasing revenue bonds are generally the obligations of a financing authority established by the municipality that leases municipal facilities to a municipality. The notes are

typically secured by lease payments made by the municipality that is leasing the facilities financed by the issue. Lease payments may be subject to annual appropriation by the

municipality or the municipality may be obligated to appropriate general tax revenues to make lease payments.

The overall increase in the fair value of municipal bonds is primarily due to the decline in interest rates and tighter credit spreads. As of December 31, 2014

and December 31, 2013, the largest issuer concentrations were the states of Illinois, California and Massachusetts, which each comprised less than 3% of the

municipal bond portfolio and were primarily comprised of general obligation and taxable bonds.

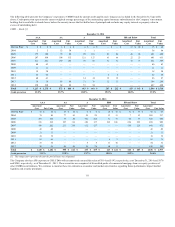

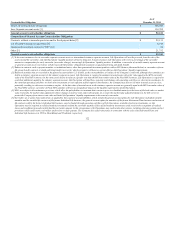

Limited Partnerships and Other Alternative Investments

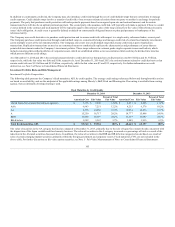

The following table presents the Company’s investments in limited partnerships and other alternative investments which include hedge funds, mortgage and

real estate funds, mezzanine debt funds, and private equity and other funds. Hedge funds are comprised of approximately half credit and equity related funds

and approximately half global macro related funds with a market neutral focus. Mortgage and real estate funds consist of investments in funds whose assets

consist of mortgage loans, mortgage loan participations, mezzanine loans or other notes which may be below investment grade, as well as equity real estate

and real estate joint ventures. Mezzanine debt funds include investments in funds whose assets consist of subordinated debt that often incorporates equity-

based options such as warrants and a limited amount of direct equity investments. Private equity and other funds primarily consist of investments in funds

whose assets typically consist of a diversified pool of investments in small to mid-sized non-public businesses with high growth potential.

Hedge funds $ 1,187 40.3% $ 1,341 44.1%

Mortgage and real estate funds 561 19.1% 534 17.6%

Mezzanine debt funds 61 2.1% 82 2.7%

Private equity and other funds 1,133 38.5% 1,083 35.6%

113