The Hartford 2014 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296

|

|

Table of Contents

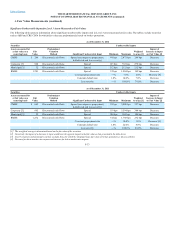

The Company utilizes derivative instruments to manage the risk associated with certain assets and liabilities. However, the derivative instrument may not be

classified with the same fair value hierarchy level as the associated assets and liabilities. Therefore the realized and unrealized gains and losses on derivatives

reported in the Level 3 rollforward may not reflect the offsetting impact of the realized and unrealized gains and losses of the associated assets and liabilities.

Limited partnerships and other alternative investments

A portion of limited partnerships and other alternative investments include hedge funds where investment company accounting has been applied to a wholly-

owned fund of funds measured at fair value. These funds are fair valued using the net asset value per share or equivalent (“NAV”), as a practical expedient,

calculated on a monthly basis and is the amount at which a unit or shareholder may redeem their investment, if redemption is allowed. Certain impediments

to redemption include, but are not limited to the following: 1) redemption notice periods vary and may be as long as 90 days, 2) redemption may be restricted

(e.g. only be allowed on a quarter-end), 3) a holding period referred to as a lock-up may be imposed whereby an investor must hold their investment for a

specified period of time before they can make a notice for redemption, 4) gating provisions may limit all redemptions in a given period to a percentage of the

entities' equity interests, or may only allow an investor to redeem a portion of their investment at one time and 5) early redemption penalties may be imposed

that are expressed as a percentage of the amount redeemed. The Company regularly assesses impediments to redemption and current market conditions that

will restrict the redemption at the end of the notice period. Any funds that are subject to significant liquidity restrictions are reported in Level 3; all others

have been classified as Level 2.

Valuation Techniques and Inputs for Investments

Generally, the Company determines the estimated fair value of its AFS and FVO securities, equity securities, trading, and short-term investments using the

market approach. The income approach is used for securities priced using a pricing matrix, as well as for derivative instruments. Certain limited partnerships

and other alternative investments are measured at fair value using a NAV as a practical expedient. For Level 1 investments, which are comprised of on-the-run

U.S. Treasuries, exchange-traded equity securities, short-term investments, and exchange traded futures and option contracts, valuations are based on

observable inputs that reflect quoted prices for identical assets in active markets that the Company has the ability to access at the measurement date.

For most of the Company’s debt securities, the following inputs are typically used in the Company’s pricing methods: reported trades, benchmark yields, bids

and/or estimated cash flows. For securities except U.S. Treasuries, inputs also include issuer spreads, which may consider credit default swaps. Derivative

instruments are valued using mid-market inputs that are predominantly observable in the market.

F-31