The Hartford 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

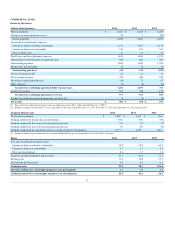

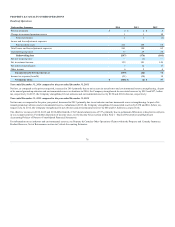

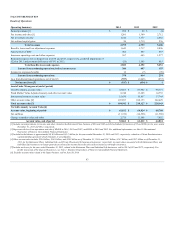

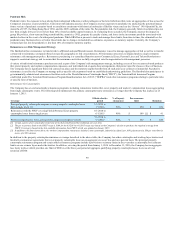

Year ended December 31, 2014 compared to the year ended December 31, 2013

Net income slightly decreased in 2014, as compared to the prior year period, primarily due to lower premiums and other considerations, net investment

income and net realized capital gains, offset by lower benefits, losses and loss adjustment expenses and insurance operating costs and other expenses.

Premiums and other considerations decreased in 2014, as compared to the prior year period, due primarily to management actions related to the Association -

Financial Institutions block of business. Insurance operating costs and other expenses decreased in 2014, compared to the prior year period, due primarily to

lower profit sharing expense related to the Association - Financial Institutions block of business.

Fully insured ongoing sales, excluding buyouts declined 17% in 2014, as compared to prior year period. Excluding Association - Financial Institutions

block of business, fully insured ongoing sales, excluding buyouts decreased 12% in 2014 primarily due to lower large case sales.

The total loss ratio increased by 0.6 points in 2014, as compared to the prior year period. Excluding the Association - Financial Institutions block of business,

the loss ratio improved 1.9 points in 2014 due to improvements in both the life and disability loss ratios. The life loss ratio improvement reflects favorable

mortality experience, improved pricing, and the impact of changes in reserve assumptions. The disability loss ratio improvement reflects improved accident

year incidence and pricing partially offset by higher new claim severity and less favorable development on prior accident year recoveries.

The expense ratio improved 1.7 points in 2014, compared to the prior year period, primarily due to lower profit sharing expense related to the Association -

Financial Institutions block of business in relation to lower premium and other considerations.

The after-tax core earnings margin, excluding buyouts, improved 0.9 points in 2014, compared to the prior year period. The improvement was primarily due

to the improved loss ratio excluding the Association - Financial Institutions block of business.

Investment income and net realized capital gains decreased in 2014, as compared to the prior year period. For discussion of consolidated investment results,

see MD&A - Investment Results, Investment Income (Loss) and Net Realized Capital Gains (Losses).

The effective tax rate, in both periods, differs from the U.S. Federal statutory rate primarily due to permanent differences related to investments in tax exempt

securities. For further discussion of income taxes, see Note 13 - Income Taxes of Notes to Consolidated Financial Statements.

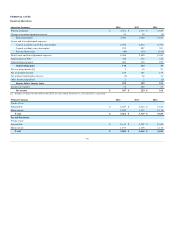

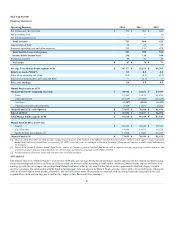

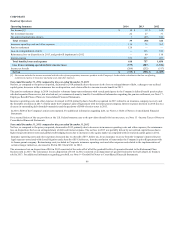

Year ended December 31, 2013 compared to the year ended December 31, 2012

Net income, as compared to the prior year period, increased in 2013 driven primarily by an improvement in the loss ratio and lower insurance operating costs

and other expenses, partially offset by a decrease in premiums and other considerations.

The decrease in premiums was driven by continued pricing discipline, our decision not to renew our largest account effective January 1, 2013 due to pricing

and other considerations and management actions to reduce the association business. Insurance operating costs and other expenses decreased in 2013 as

compared to the prior year due to lower commission payments as a result of overall lower premiums.

The improvement in the loss ratio in 2013 was primarily attributable to the long-term disability product driven by favorable claim recoveries from claims

incurred in 2013 and prior years, lower incidence trends and improved renewal pricing. Additionally, the 2012 loss ratio reflected unfavorable long-term

disability severity. The increase in after-tax core earnings margin, excluding buyouts, was primarily due to an improved loss ratio.

The effective tax rate, in both periods, differs from the U.S. Federal statutory rate primarily due to permanent differences related to investments in tax exempt

securities. For further discussion of income taxes, see Note 13 - Income Taxes of Notes to Consolidated Financial Statements.

80