The Hartford 2014 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

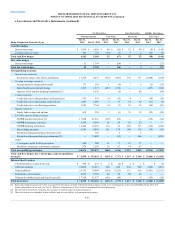

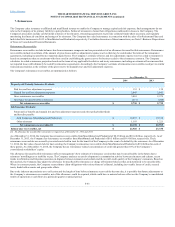

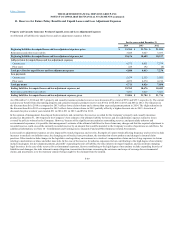

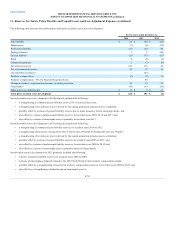

The following tables present the notional amount, fair value, weighted average years to maturity, underlying referenced credit obligation type and average

credit ratings, and offsetting notional amounts and fair value for credit derivatives in which the Company is assuming credit risk as of December 31, 2014 and

2013.

Single name credit default swaps

Investment grade risk exposure $ 320 $ 5 2 years

Corporate Credit/

Foreign Gov. BBB+ $ 247 $ (5)

Below investment grade risk exposure 29 — 2 years Corporate Credit BB 29 (1)

Basket credit default swaps [4]

Investment grade risk exposure 2,546 33 3 years Corporate Credit BBB 1,973 (25)

Below investment grade risk exposure 38 (1) 12 years Corporate Credit D — —

Investment grade risk exposure 722 (12) 6 years CMBS Credit AA+ 269 3

Below investment grade risk exposure 154 (22) 2 years CMBS Credit CCC+ 154 23

Embedded credit derivatives

Investment grade risk exposure 350 342 2 years Corporate Credit A — —

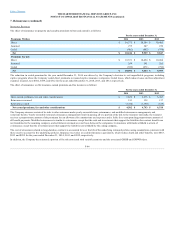

Single name credit default swaps

Investment grade risk exposure $ 1,259 $ 8 1 year

Corporate Credit/

Foreign Gov. A $ 1,066 $ (9)

Below investment grade risk exposure 24 — 1 year Corporate Credit CCC 24 (1)

Basket credit default swaps [4]

Investment grade risk exposure 3,447 50 3 years Corporate Credit BBB 2,270 (35)

Below investment grade risk exposure 166 15 5 years Corporate Credit BB- — —

Investment grade risk exposure 327 (7) 3 years CMBS Credit A 327 7

Below investment grade risk exposure 195 (31) 3 years CMBS Credit B- 195 31

Embedded credit derivatives

Investment grade risk exposure 350 339 3 years Corporate Credit BBB+ — —

[1] The average credit ratings are based on availability and the midpoint of the applicable ratings among Moody’s, S&P, Fitch and Morningstar. If no rating is available from a

rating agency, then an internally developed rating is used.

[2] Notional amount is equal to the maximum potential future loss amount. These derivatives are governed by agreements, clearing house rules and applicable law which include

collateral posting requirements. There is no additional specific collateral related to these contracts or recourse provisions included in the contracts to offset losses.

[3] The Company has entered into offsetting credit default swaps to terminate certain existing credit default swaps, thereby offsetting the future changes in value of, or losses paid

related to, the original swap.

[4] Includes $3.5 billion and $4.1 billion as of December 31, 2014 and 2013, respectively, of standard market indices of diversified portfolios of corporate and CMBS issuers

referenced through credit default swaps. These swaps are subsequently valued based upon the observable standard market index.

[5] Excludes investments that contain an embedded credit derivative for which the Company has elected the fair value option. For further discussion, see the Fair Value Option

section in Note 5 - Fair Value Measurements.

F-61