The Hartford 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

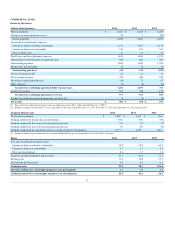

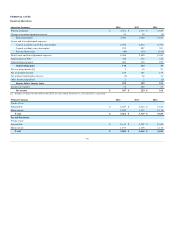

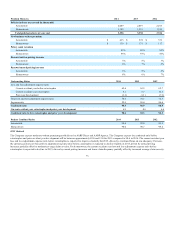

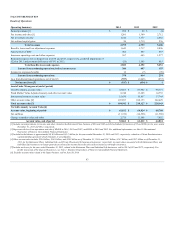

Investment Results

Investment income decreased in 2014, as compared to the prior year period. For discussion of consolidated investment results, see MD&A - Investment

Results, Net Investment Income (Loss) and Net Realized Capital Gains (Losses).

Income Taxes

The effective tax rate, in both periods, differs from the U.S. Federal statutory rate primarily due to permanent differences related to investments in tax exempt

securities. For further discussion of income taxes, see Note 13 - Income Taxes of Notes to Consolidated Financial Statements.

Year ended December 31, 2013 compared to the year ended December 31, 2012

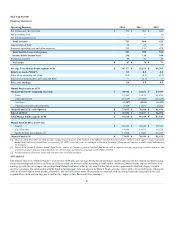

Overview

Net income, as compared to the prior year period, increased in 2013 primarily due to improvements in underwriting results, driven by lower current accident

year losses and loss adjustment expenses before catastrophes and lower current accident year catastrophe losses.

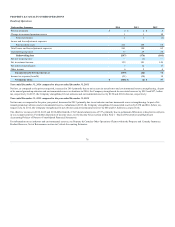

Revenues - Earned and Written Premium

Earned premiums decreased in 2013, reflecting the impact of lower written premiums primarily in middle market and specialty lines, partially offset by

written premium growth in small commercial.

Written premium increases in small commercial, primarily in workers’ compensation business, were driven by favorable audit premium as well as favorable

renewal premium due to higher earned pricing, partially offset by lower policy count retention. Written premium decreases in middle market were driven

primarily by lower renewal premium in workers' compensation business partially offset by new business premium growth in property, general liability and

auto and favorable overall inforce policy retention. Written premium decreases in specialty lines were primarily the result of underwriting actions to

reposition the captives business and exit unprofitable programs partially offset by new business growth in national accounts. The Company ceased writing all

transportation programs effective January 1, 2014.

Losses and Loss Adjustment Expenses

Losses and loss adjustment expenses reflect favorable current accident year losses before catastrophes in all three businesses and a significant decline in

current accident year catastrophes partially offset by unfavorable prior accident years development.

• Favorable current accident year losses and loss adjustment expenses before catastrophes were primarily driven by lower loss and loss adjustment

expenses in workers’ compensation due to favorable severity and frequency. The current accident year loss and loss adjustment expense ratio before

catastrophes decreased accordingly by 4.0 points to 62.8 in 2013 from 66.8 in 2012.

• Current accident year catastrophe losses of $105, before tax, in 2013, compared to $325, before tax, in 2012. Losses in 2013 were primarily due to

multiple thunderstorm, hail and tornado events across various U.S. geographic regions. Losses in 2012 were primarily driven by $207 related to

Storm Sandy and multiple thunderstorm, hail and tornado events across various U.S. geographic regions. For additional information, see MD&A -

Critical Accounting Estimates, Property and Casualty Insurance Product Reserves, Net of Reinsurance.

• Prior accident years reserve strengthening of $83, before tax, in 2013, compared to $72, before tax, in 2012. Development in 2013 was primarily due

to strengthening related to commercial auto liability and the closing of the New York Section 25A Fund for Reopened Cases partially offset by a

release of general liability reserves. Development in 2012 was primarily due to strengthening related to commercial auto liability claims,

professional liability directors and officers claims and workers compensation partially offset by a release of general liability and catastrophe

reserves. For additional information, see MD&A - Critical Accounting Estimates, Reserve Roll-forwards and Development.

Underwriting Ratios

The combined ratio, before catastrophes and prior year development, improved 3.2 points to 95.1 in 2013 from 98.3 in 2012. The improvement primarily

reflects a decrease in the current accident year before catastrophes loss and loss adjustment expense ratio.

Investment Results

Investment income increased in 2013, as compared to the prior year period. For discussion of consolidated investment results, see MD&A - Investment

Results, Net Investment Income (Loss) and Net Realized Capital Gains (Losses).

Income Taxes

The effective tax rate, in both periods, differs from the U.S. Federal statutory rate primarily due to permanent differences related to investments in tax exempt

securities. For further discussion of income taxes, see Note 13 - Income Taxes of Notes to Consolidated Financial Statements.

73