The Hartford 2014 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

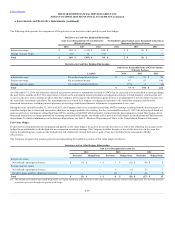

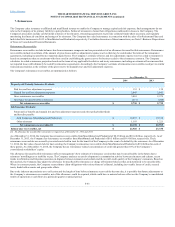

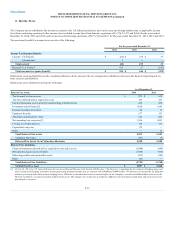

The following table provides details concerning GMDB/GMWB exposure as of December 31, 2014:

MAV only $ 17,435 $ 2,590 $ 396 70

With 5% rollup [2] 1,451 209 59 70

With Earnings Protection Benefit Rider (“EPB”) [3] 4,342 579 83 68

With 5% rollup & EPB 547 115 25 71

Total MAV 23,775 3,493 563

Asset Protection Benefit (“APB”) [4] 15,183 228 151 68

Lifetime Income Benefit (“LIB”) – Death Benefit [5] 624 7 7 68

Reset [6] (5-7 years) 3,036 22 22 69

Return of Premium (“ROP”) [7]/Other 10,243 57 50 68

Less: General Account Value with GMDB/GMWB 4,009

Separate Account Liabilities without GMDB $ 85,850

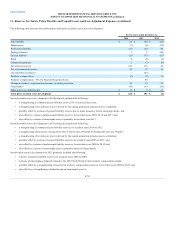

[1] MAV GMDB is the greatest of current AV, net premiums paid and the highest AV on any anniversary before age 80 years (adjusted for withdrawals).

[2] Rollup GMDB is the greatest of the MAV, current AV, net premium paid and premiums (adjusted for withdrawals) accumulated at generally 5% simple interest up to the

earlier of age 80 years or 100% of adjusted premiums.

[3] EPB GMDB is the greatest of the MAV, current AV, or contract value plus a percentage of the contract’s growth. The contract’s growth is AV less premiums net of

withdrawals, subject to a cap of 200% of premiums net of withdrawals.

[4] APB GMDB is the greater of current AV or MAV, not to exceed current AV plus 25% times the greater of net premiums and MAV (each adjusted for premiums in the past 12

months).

[5] LIB GMDB is the greatest of current AV, net premiums paid, or for certain contracts a benefit amount that ratchets over time, generally based on market performance.

[6] Reset GMDB is the greatest of current AV, net premiums paid and the most recent five to seven year anniversary AV before age 80 years (adjusted for withdrawals).

[7] ROP GMDB is the greater of current AV or net premiums paid.

[8] AV includes the contract holder’s investment in the separate account and the general account.

[9] NAR is defined as the guaranteed benefit in excess of the current AV. RNAR represents NAR reduced for reinsurance. NAR and RNAR are highly sensitive to equity markets

movements and increase when equity markets decline.

[10] Some variable annuity contracts with GMDB also have a life-contingent GMWB that may provide for benefits in excess of the return of the GRB. Such contracts included in

this amount have $8.5 billion of total account value and weighted average attained age of 70 years. There is no NAR or retained NAR related to these contracts.

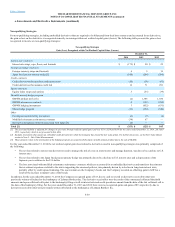

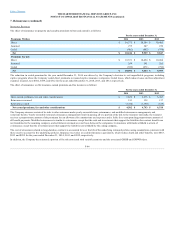

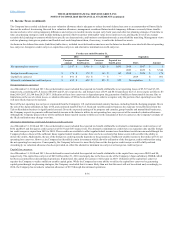

In the U.S., account balances of contracts with guarantees were invested in variable separate accounts as follows:

Equity securities (including mutual funds) $ 44,786 $ 52,858

Cash and cash equivalents 4,066 4,605

As of December 31, 2014 and December 31, 2013, approximately 17% of the equity securities above were funds invested in fixed income securities and

approximately 83% were funds invested in equity securities.

For further information on guaranteed living benefits that are accounted for at fair value, such as GMWB, see Note 5 - Fair Value Measurements of Notes to

Consolidated Financial Statements.

F-68