The Hartford 2014 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

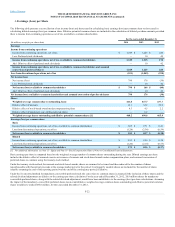

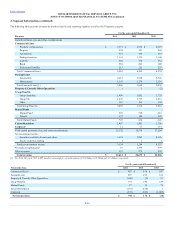

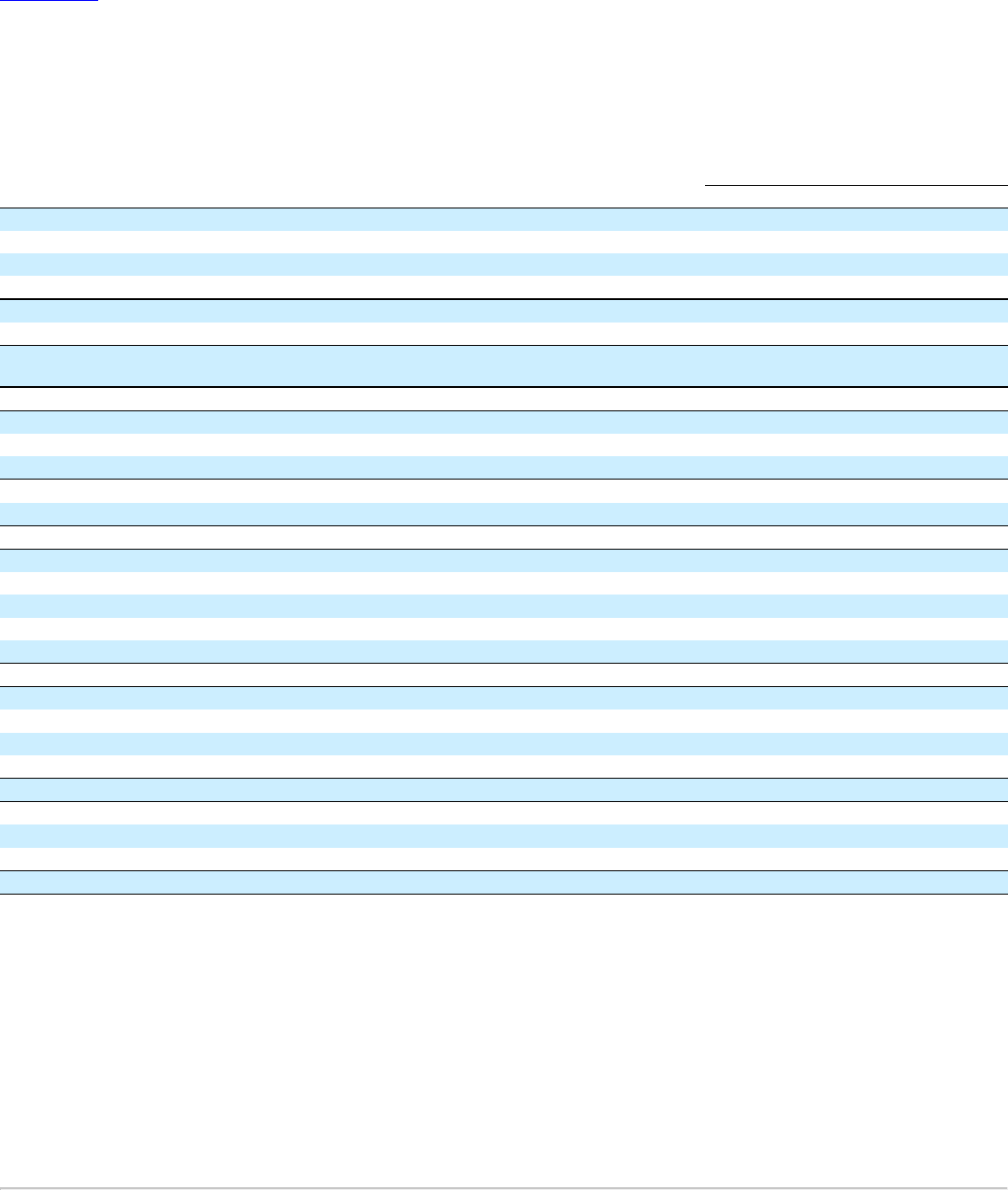

The following table presents a reconciliation of net income (loss) and shares used in calculating basic earnings (loss) per common share to those used in

calculating diluted earnings (loss) per common share. Dilutive potential common shares are included in the calculation of diluted per share amounts provided

there is income from continuing operations, net of tax, available to common shareholders.

(In millions, except for per share data)

Earnings

Income from continuing operations, net of tax $ 1,349 $ 1,225 $ 220

Less: Preferred stock dividends — 10 42

Add: Dilutive effect of preferred stock dividends — 10 42

Net income (loss) 798 176 (38)

Less: Preferred stock dividends — 10 42

Add: Dilutive effect of preferred stock dividends — 10 42

Shares

Dilutive effect of warrants 12.1 32.2 26.0

Dilutive effect of stock-based awards under compensation plans 6.3 4.5 2.2

Dilutive effect of mandatory convertible preferred shares — 6.2 —

Earnings (loss) per common share

Income from continuing operations, net of tax, available to common shareholders $ 3.05 $ 2.71 $ 0.41

Loss from discontinued operations, net of tax (1.24) (2.34) (0.59)

Income from continuing operations, net of tax, available to common shareholders $ 2.93 $ 2.50 $ 0.38

Loss from discontinued operations, net of tax (1.20) (2.14) (0.55)

[1] For additional information, see Note 15 - Equity and Note 18 - Stock Compensation Plans of Notes to Consolidated Financial Statements.

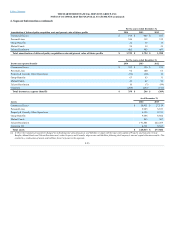

Basic earnings per share is computed based on the weighted average number of common shares outstanding during the year. Diluted earnings per share

includes the dilutive effect of assumed exercise or issuance of warrants and stock-based awards under compensation plans, and assumed conversion of

preferred shares to common using the treasury stock method.

Under the treasury stock method, for warrants and stock-based awards, shares are assumed to be issued and then reduced for the number of shares

repurchaseable with theoretical proceeds at the average market price for the period. Contingently issuable shares are included for the number of shares

issuable assuming the end of the reporting period was the end of the contingency period, if dilutive.

Under the if-converted method for mandatory convertible preferred stock the conversion to common shares is assumed if the inclusion of these shares and the

related dividend adjustment are dilutive to the earnings per share calculation. For the year ended December 31, 2012, 20.9 million shares for mandatory

convertible preferred shares, along with the related dividend adjustment, would have been antidilutive to the earnings (loss) per share calculations. Assuming

the impact of the mandatory convertible preferred shares was not antidilutive, weighted average common shares outstanding and dilutive potential common

shares would have totaled 486.8 million, for the year ended December 31, 2012.

F-22