The Hartford 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Emerging Market Exposure

Early in 2014, emerging market securities were negatively impacted by lower European interest rates, increased political tension in eastern Europe, softer-

than-expected economic growth, as well as trade and budget deficits, raising the potential for destabilizing capital outflows and rapid currency depreciation,

causing bondholders to demand a higher yield which caused the fair value of securities held to decline. The decline in oil prices during the second half of

2014 has put added strain on certain emerging markets that rely on revenues derived from the energy sector. As a result of these factors, credit spreads for

emerging market securities have been volatile and we expect continued sensitivity to geopolitical events, the ongoing evolution of Fed policy and other

economic factors, including contagion risk.

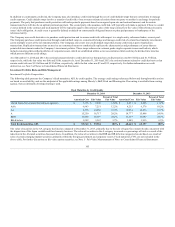

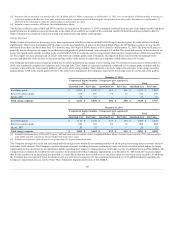

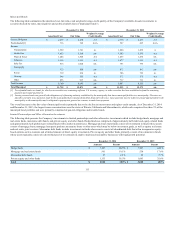

The Company has limited direct exposure within its investment portfolio to emerging market issuers, totaling only 2% of total invested assets as of

December 31, 2014, and is primarily comprised of sovereign and corporate debt issued in US dollars. The Company identifies exposures with the issuers’

ultimate parent country of domicile, which may not be the country of the security issuer. The following table presents the Company’s exposure to securities

within certain emerging markets currently under the greatest stress, defined as countries that have a sovereign S&P credit rating of B- or below; or countries

that have had a current account deficit and has an average inflation level greater than 5% over the past six months.

Argentina $ 2 $ 2 $ 38 $ 40

Brazil 123 120 274 257

India 37 37 62 62

Indonesia 82 80 107 93

Kazakhstan 79 73 88 83

Lebanon 29 29 26 26

South Africa 54 53 65 60

Turkey 65 67 88 79

Ukraine 3 3 50 50

Uruguay 16 17 27 25

Venezuela 4 2 67 60

Other 97 96 50 50

[1] Includes an amortized cost and fair value of $137 and $131, respectively, as of December 31, 2014 and an amortized cost and fair value of $254 and $237, respectively, as of

December 31, 2013 included in the exposure to the energy sector table above.

The Company manages the credit risk associated with emerging market securities within the investment portfolio on an on-going basis using macroeconomic

analysis and issuer credit analysis subject to diversification and individual credit risk management limits. For additional details regarding the Company’s

management of credit risk, see the Credit Risk section of this MD&A. Due to increased political tensions in Argentina, Ukraine, and Venezuela, the Company

selectively reduced its exposure to these economies during the first quarter of 2014.

In addition, the Company has limited exposure to the Russian Federation, with a total amortized cost and fair value of $23 and $20, respectively, as of

December 31, 2014. The exposure is primarily comprised of government and government agency bonds, but also includes corporate bonds.

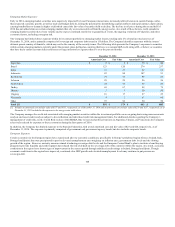

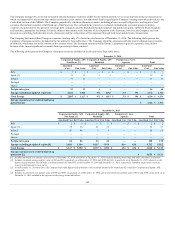

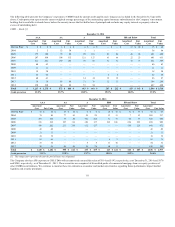

European Exposure

Certain economies in the European region have experienced adverse economic conditions, specifically in Europe’s peripheral region (Greece, Ireland, Italy,

Portugal and Spain), that were precipitated in part by elevated unemployment rates weighing on inflation rates, government debt levels and the slowing

growth of the region. However, austerity measures aimed at reducing sovereign debt levels and the European Central Bank’s plan to institute a bond buying

program to provide liquidity and credit support, has reduced the risk of default on the sovereign debt of the countries within the region. As a result, economic

conditions in the region have shown signs of improvement in the current period through stabilized credit ratings in Ireland, Portugal and Spain. Though

economic conditions in the region have improved, continued slow GDP growth and elevated unemployment levels may continue to put pressure on

sovereign debt.

108