The Hartford 2014 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

On June 30, 2014, the Company completed the sale of all of the issued and outstanding equity of HLIKK to ORIX Life Insurance Corporation ("Buyer"), a

subsidiary of ORIX Corporation, a Japanese company for cash proceeds of $963. HLIKK sold variable and fixed annuity policies in Japan from 2001 to 2009

and had been in runoff since 2009. The sale transaction resulted in an after-tax loss on disposition of $659 in the year ended December 31, 2014. The

operations of the Company's Japan business meet the criteria for reporting as discontinued operations. For further information regarding discontinued

operations, see Note 19 - Discontinued Operations of Notes to Consolidated Financial Statements. The Company's Japan business is included in the Talcott

Resolution reporting segment.

Concurrently with the sale, HLIKK recaptured certain risks that had been reinsured to the Company’s U.S. subsidiaries, Hartford Life and Annuity Insurance

Company ("HLAI") and Hartford Life Insurance Company ("HLIC") by terminating intercompany agreements. Upon closing, the Buyer became responsible

for all liabilities for the recaptured business. The Company has, however, continued to provide reinsurance for Japan fixed payout annuities of $763 as of

December 31, 2014.

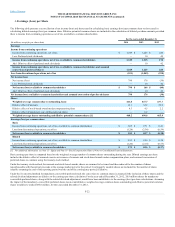

The following table summarizes the major classes of assets and liabilities transferred by the Company in connection with the sale of HLIKK.

Cash and investments $ 18,733

Reinsurance recoverables $ 46

Property and equipment, net $ 18

Other assets $ 988

Reserve for future policy benefits and unpaid loss and loss adjustment expenses $ 320

Other policyholder funds and benefits payable $ 2,265

Other policyholder funds and benefits payable - international variable annuities $ 16,465

Short-term debt $ 247

Other liabilities $ 102

On December 12, 2013, the Company completed the sale of all of the issued and outstanding equity of HLIL in a cash transaction to Columbia Insurance

Company, a Berkshire Hathaway company, for approximately $285. At closing, HLIL’s sole asset was its subsidiary, Hartford Life Limited, a Dublin-based

company that sold variable annuities in the U.K. from 2005 to 2009. The sale transaction resulted in an after-tax loss of $102 upon disposition in the year

ended December 31, 2013. The operations of the Company's U.K. variable annuity business meet the criteria for reporting as discontinued operations. For

further information regarding discontinued operations, see Note 19 - Discontinued Operations of Notes to Consolidated Financial Statements. The Company's

U.K. variable annuities business is included in the Talcott Resolution reporting segment.

On January 1, 2013, the Company completed the sale of its Retirement Plans business to MassMutual for a ceding commission of $355. The business sold

included products and services provided to corporations pursuant to Section 401(k) of the Internal Revenue Code of 1986, as amended (the “Code”), and

products and services provided to municipalities and not-for-profit organizations under Sections 457 and 403(b) of the Code, collectively referred to as

government plans. The sale was structured as a reinsurance transaction and resulted in an after-tax loss of $24 for the year ended December 31, 2013. The

after-tax loss is primarily driven by the reduction in goodwill that is non-deductible for income tax purposes. The Company recognized a reinsurance loss on

disposition of $634 offset by $634 in net realized capital gains for the year ended December 31, 2013.

Upon closing, the Company reinsured $9.2 billion of policyholder liabilities and $26.3 billion of separate account liabilities under an indemnity reinsurance

arrangement. The reinsurance transaction does not extinguish the Company's primary liability on the insurance policies issued under the Retirement Plans

business. The Company also transferred invested assets with a carrying value of $9.3 billion, net of the ceding commission, to MassMutual and recognized

other non-cash decreases in assets totaling $200 relating to deferred acquisition costs, deferred income taxes, goodwill, property and equipment and other

assets associated with the disposition. The company continued to sell retirement plans during the transition period which ended on June 30, 2014.

MassMutual has assumed all expenses and risks for these sales through the reinsurance agreement.

F-20