The Hartford 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296

|

|

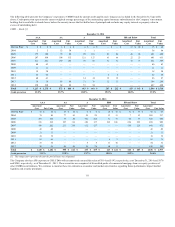

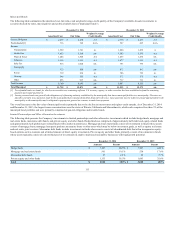

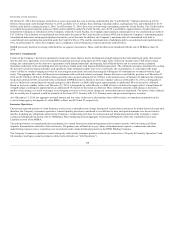

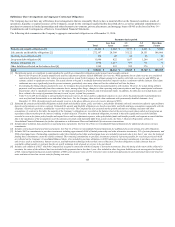

Other-Than-Temporary Impairments

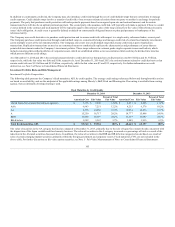

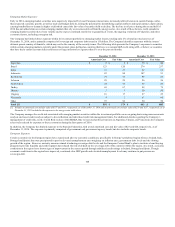

The following table presents the Company’s impairments recognized in earnings by security type excluding intent-to-sell impairment relating to the sales of

Retirement Plans and Individual Life businesses.

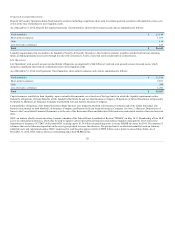

ABS $ — $ 9 $ 29

CRE CDOs — 2 10

CMBS

Bonds 2 17 24

IOs 1 4 3

Corporate 35 20 28

Equity 11 15 65

Municipal 3 — —

Agency 3 — —

RMBS Non-agency

RMBS Alt-A — — 1

Sub-prime 1 6 12

Other 3 — —

Total

[1] Excludes $177 of intent-to-sell impairments related to the sales of the Retirement Plans and Individual Life businesses.

Year ended December 31, 2014

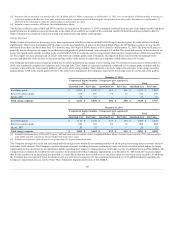

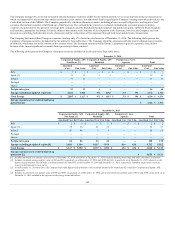

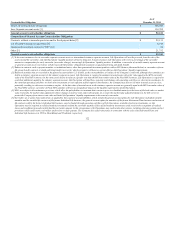

For the year ended December 31, 2014, impairments recognized in earnings were comprised of credit impairments of $37, securities that the Company intends

to sell of $17, impairments on equity securities of $2, and other impairments of $3.

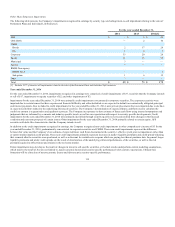

Impairments for the year ended December 31, 2014 were primarily credit impairments concentrated in corporate securities. The corporate securities were

impaired due to certain issuers that have experienced financial difficulty and either defaulted or are expected to default on contractually obligated principal

and interest payments. Also included in credit impairments for the year ended December 31, 2014, were private placements that were impaired due to declines

in expected cash flows related to the underlying referenced securities. The Company’s determination of expected future cash flows used to calculate the

credit loss amount is a quantitative and qualitative process. The Company incorporates its best estimate of future cash flows using internal assumptions and

judgments that are informed by economic and industry specific trends, as well as our expectation with respect to security specific developments. Credit

impairments for the year ended December 31, 2014 were primarily identified through security specific reviews and resulted from changes in the financial

condition and near term prospects of certain issuers. Other impairments for the year ended December 31, 2014 primarily related to certain equity, AFS

securities with debt-like characteristics that the Company intends to sell.

In addition to the credit impairments recognized in earnings, the Company recognized non-credit impairments in other comprehensive income of $5 for the

year ended December 31, 2014, predominantly concentrated in corporate securities and CMBS. These non-credit impairments represent the difference

between fair value and the Company’s best estimate of expected future cash flows discounted at the security’s effective yield prior to impairment, rather than

at current market implied credit spreads. These non-credit impairments primarily represent increases in market liquidity premiums and credit spread widening

that occurred after the securities were purchased, as well as a discount for variable-rate coupons which are paying less than at purchase date. In general, larger

liquidity premiums and wider credit spreads are the result of deterioration of the underlying collateral performance of the securities, as well as the risk

premium required to reflect future uncertainty in the real estate market.

Future impairments may develop as the result of changes in intent to sell specific securities or if actual results underperform current modeling assumptions,

which may be the result of, but are not limited to, macroeconomic factors and security-specific performance below current expectations. Ultimate loss

formation will be a function of macroeconomic factors and idiosyncratic security-specific performance.

115