The Hartford 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

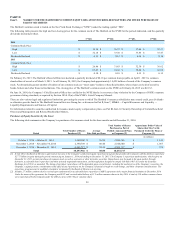

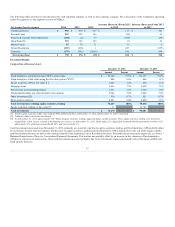

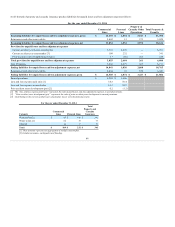

Net Realized Capital Gains (Losses)

(Before tax)

Gross gains on sales [1]

$ 527

$ 2,313

$ 801

Gross losses on sales

(250)

(659)

(420)

Net OTTI losses recognized in earnings [2]

(59)

(73)

(349)

Valuation allowances on mortgage loans

(4)

(1)

14

Periodic net coupon settlements on credit derivatives

1

(8)

(18)

Results of variable annuity hedge program

GMWB derivatives, net

5

262

519

Macro hedge program

(11)

(234)

(340)

Total results of variable annuity hedge program

(6)

28

179

Other, net [3]

(193)

198

290

[1] Includes $1.5 billion of gains relating to the sales of the Retirement Plans and Individual Life businesses in the year ended December 31, 2013.

[2] Includes $177 of intent-to-sell impairments for the year ended December 31, 2012, relating to the sales of the Retirement Plans and Individual Life businesses in 2013.

[3] Primarily consists of changes in value of non-qualifying derivatives, including interest rate derivatives used to manage duration, and the Japan fixed payout annuity hedge.

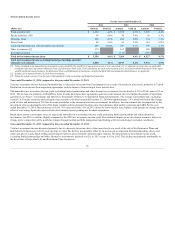

Details on the Company’s net realized capital gains and losses are as follows:

Gross gains and losses on sales

• Gross gains on sales for the year ended December 31, 2014 were primarily due to gains on the sale of corporate securities, CMBS, RMBS, and municipal

securities. Gross losses on sales for the year ended December 31, 2014 were primarily the result of losses on the sale of corporate and foreign government

and government agency securities, which included sales resulting from a reduction in our exposure to the emerging market and energy sector securities

as well as other portfolio management activities. The sales were primarily a result of duration, liquidity and credit management, as well as tactical

changes to the portfolio as a result of changing market conditions.

• Gross gains on sales for the year ended December 31, 2013 were predominately from the sale of the Retirement Plans and Individual Life businesses

resulting in a gain of $1.5 billion. The remaining gains on sales were primarily due to the sales of corporate securities and tax-exempt municipals. Gross

losses on sales were primarily the result of the sales of U.S. Treasuries and mortgage backed securities, predominantly due to duration, liquidity and

credit management as well as progress towards sector allocation objectives.

• Gross gains and losses on sales for the year ended December 31, 2012 were predominately from investment grade corporate securities, municipal bonds,

mortgage backed securities and U.S. Treasuries. These sales were the result of tactical portfolio management as well as to maintain duration targets.

Net OTTI losses

•See Other-Than-Temporary Impairments within the Investment Portfolio Risks and Risk Management section of the MD&A.

Valuation allowances on mortgage loans

•See Valuation Allowances on Mortgage Loans within the Investment Portfolio Risks and Risk Management section of the MD&A.

Variable annuity hedge program

• For the year ended December 31, 2014, the gain related to the combined GMWB derivatives, net, which include the GMWB product, reinsurance, and

hedging derivatives, was primarily driven by gains of $25 on liability/model assumption updates and gains of $15 due to increased volatility, partially

offset by a loss of $26 resulting from policyholder behavior primarily related to increased surrenders. The loss on the macro hedge program for the year

ended December 31, 2014 was primarily due to a loss of $25 driven by an improvement in the domestic equity markets, partially offset by a gain of $17

related to a decrease in interest rates.

39