The Hartford 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The preparation of financial statements, in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at

the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ, and in the past

have differed, from those estimates.

The Company has identified the following estimates as critical in that they involve a higher degree of judgment and are subject to a significant degree of

variability:

• property and casualty insurance product reserves, net of reinsurance;

• estimated gross profits used in the valuation and amortization of assets and liabilities associated with variable annuity and other universal life-type

contracts;

• evaluation of other-than-temporary impairments on available-for-sale securities and valuation allowances on mortgage loans;

• living benefits required to be fair valued (in other policyholder funds and benefits payable);

• goodwill impairment;

• valuation of investments and derivative instruments;

• valuation allowance on deferred tax assets; and

• contingencies relating to corporate litigation and regulatory matters.

Certain of these estimates are particularly sensitive to market conditions, and deterioration and/or volatility in the worldwide debt or equity markets could

have a material impact on the Consolidated Financial Statements. In developing these estimates management makes subjective and complex judgments that

are inherently uncertain and subject to material change as facts and circumstances develop. Although variability is inherent in these estimates, management

believes the amounts provided are appropriate based upon the facts available upon compilation of the financial statements.

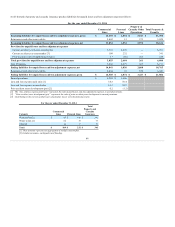

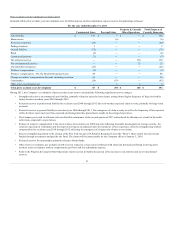

Property and Casualty Insurance Product Reserves, Net of Reinsurance

The Hartford establishes reserves on its property and casualty insurance products to provide for the estimated costs of paying claims under insurance policies

written by the Company. These reserves include estimates for both claims that have been reported and those that have not yet been reported, and include

estimates of all expenses associated with processing and settling these claims. Incurred but not reported (“IBNR”) reserves represent the difference between

the estimated ultimate cost of all claims and the actual reported loss and loss adjustment expenses (“reported losses”). Reported losses represent cumulative

loss and loss adjustment expenses paid plus case reserves for outstanding reported claims. Company actuaries evaluate the total reserves (IBNR and case

reserves) on an accident year basis. An accident year is the calendar year in which a loss is incurred, or, in the case of claims-made policies, the calendar year

in which a loss is reported.

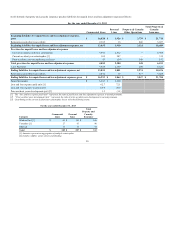

Reserve estimates can change over time because of unexpected changes in the external environment. Potential external factors include (1) changes in the

inflation rate for goods and services related to covered damages such as medical care, hospital care, auto parts, wages and home repair; (2) changes in the

general economic environment that could cause unanticipated changes in the claim frequency per unit insured; (3) changes in the litigation environment as

evidenced by changes in claimant attorney representation in the claims negotiation and settlement process; (4) changes in the judicial environment regarding

the interpretation of policy provisions relating to the determination of coverage and/or the amount of damages awarded for certain types of damages; (5)

changes in the social environment regarding the general attitude of juries in the determination of liability and damages; (6) changes in the legislative

environment regarding the definition of damages; and (7) new types of injuries caused by new types of injurious exposure: past examples include lead paint,

construction defects and tainted Chinese-made drywall.

Reserve estimates can also change over time because of changes in internal Company operations. Potential internal factors include (1) periodic changes in

claims handling procedures; (2) growth in new lines of business where exposure and loss development patterns are not well established; (3) changes in the

quality of risk selection in the underwriting process; (4) changes in the geographic mix of business; (5) changes in the mix of business by industry; (6)

changes in policy language; or (7) changes in the mix of business by policy limit or deductible.

In the case of assumed reinsurance, all of the above risks apply. In addition, changes in ceding company case reserving and reporting patterns can create

additional factors that need to be considered in estimating the reserves. Due to the inherent complexity of the assumptions used, final claim settlements may

vary significantly from the present estimates, particularly when those settlements may not occur until well into the future.

41