The Hartford 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

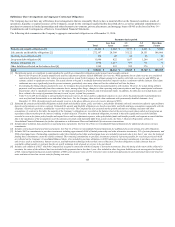

In any particular year, statutory surplus amounts and RBC ratios may increase or decrease depending upon a variety of factors. The amount of change in the

statutory surplus or RBC ratios can vary based on individual factors and may be compounded in extreme scenarios or if multiple factors occur at the same

time. At times the impact of changes in certain market factors or a combination of multiple factors on RBC ratios can be counterintuitive. For further

discussion on these factors and the potential impacts to the life insurance subsidiaries, see the Financial Risk on Statutory Capital section within Enterprise

Risk Management.

Statutory capital at the property and casualty subsidiaries has historically been maintained at or above the capital level required to meet “AA level” ratings

from rating agencies. Statutory capital generated by the property and casualty subsidiaries in excess of the capital level required to meet “AA level” ratings is

available for use by the enterprise or for corporate purposes. The amount of statutory capital can increase or decrease depending on a number of factors

affecting property and casualty results including, among other factors, the level of catastrophe claims incurred, the amount of reserve development, the effect

of changes in interest rates on investment income and the discounting of loss reserves, and the effect of realized gains and losses on investments.

In addition, the Company can access the $500 Glen Meadow trust contingent capital facility and maintains the ability to access $1.0 billion of capacity

under its revolving credit facility.

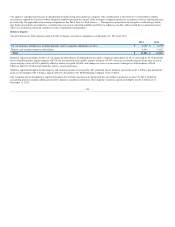

Contingencies

Legal Proceedings — For a discussion regarding contingencies related to The Hartford’s legal proceedings, please see the information contained under

“Litigation” and “Asbestos and Environmental Claims,” in Note 14 - Commitments and Contingencies of Notes to Consolidated Financial Statements, which

is incorporated herein by reference.

For a discussion of terrorism reinsurance legislation and how it affects The Hartford, see MD&A - Enterprise Risk Management, Insurance Risk Management,

Terrorism Risk.

Tax proposals and regulatory initiatives which have been or are being considered by Congress and/or the United States Treasury Department could have a

material effect on the insurance business. These proposals and initiatives include, or could include, new taxes or assessments on large financial institutions,

changes pertaining to the income tax treatment of insurance companies and life insurance products and annuities, repeal or reform of the estate tax and

comprehensive federal tax reform, and changes to the regulatory structure for financial institutions. The nature and timing of any Congressional or regulatory

action with respect to any such efforts is unclear.

Legislative Developments

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”)

The Dodd-Frank Act was enacted on July 21, 2010, mandating changes to the regulation of the financial services industry. Implementation of the Dodd-Frank

Act is ongoing and may affect our operations and governance in ways that could adversely affect our financial condition and results of operations. The Dodd-

Frank Act requires central clearing of, and imposes new margin requirements on, certain derivatives transactions, which increases the costs of our hedging

program. Other provisions in the Dodd-Frank Act that may impact us include: the new “Federal Insurance Office” within Treasury; the possible adverse

impact on the pricing and liquidity of the securities in which we invest resulting from the proprietary trading and market making limitation of the Volcker

Rule; the possible adverse impact on the market for insurance-linked securities, including catastrophe bonds, resulting from the limitations of banking entity

involvement in and ownership of certain asset-backed securities transactions; and enhancements to corporate governance, especially regarding risk

management.

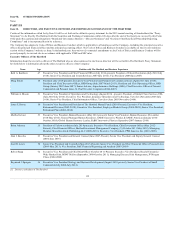

The Dodd-Frank Act vests the Financial Stability Oversight Council (“FSOC”) with the power to designate “systemically important” institutions, which will

be subject to special regulatory supervision and other provisions intended to prevent, or mitigate the impact of, future disruptions in the U.S. financial

system. Based on its most current financial data, The Hartford is below the quantitative thresholds used by the FSOC to determine which nonbank companies

merit consideration. However, the FSOC has indicted it will review on a quarterly basis whether nonbank financial institutions meet the metrics for further

review. If we were to be designated as a systemically important institution, we could be subject to heightened regulation under the Federal Reserve, which

could impact requirements regarding our required level of capital, liquidity and leverage as well as our business and investment conduct. In addition, we

could be subject to assessments to pay for the orderly liquidation of other systemically important financial institutions that have become insolvent.

128