The Hartford 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Revolving Credit Facilities

On October 31, 2014, the Company entered into a senior unsecured five-year revolving credit facility (the “Credit Facility”) that provides for up to $1.0

billion of unsecured credit through October 31, 2019, available in U.S. dollars, Euro, Sterling, Canadian dollars, and Japanese Yen, and terminated its $1.75

billion credit facility expiring January 6, 2016. As of December 31, 2014, there were no borrowings outstanding under the Credit Facility. The Credit Facility

is available for general corporate purposes. Of the total availability under the Credit Facility, up to $250 is available to support letters of credit issued on

behalf of the Company or subsidiaries of the Company. Under the Credit Facility, the Company must maintain a minimum level of consolidated net worth of

$13.5 billion. The definition of consolidated net worth under the terms of the Credit Facility excludes AOCI and includes the Company’s outstanding junior

subordinated debentures and perpetual preferred securities, net of discount. In addition, the Company’s maximum ratio of consolidated total debt to

consolidated total capitalization permitted under the Credit Facility is 35%, and the maximum ratio of subsidiary debt to consolidated total capitalization is

10%. As of December 31, 2014, the Company was in compliance with all financial covenants under the Credit Facility.

HLIKK previously had four revolving credit facilities in support of operations. These credit facilities were transfered with the sale of HLIKK on June 30,

2014.

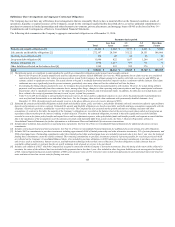

Certain of the Company’s derivative agreements contain provisions that are tied to the financial strength ratings of the individual legal entity that entered

into the derivative agreement as set by nationally recognized statistical rating agencies. If the legal entity’s financial strength were to fall below certain

ratings, the counterparties to the derivative agreements could demand immediate and ongoing full collateralization and in certain instances demand

immediate settlement of all outstanding derivative positions traded under each impacted bilateral agreement. The settlement amount is determined by netting

the derivative positions transacted under each agreement. If the termination rights were to be exercised by the counterparties, it could impact the legal

entity’s ability to conduct hedging activities by increasing the associated costs and decreasing the willingness of counterparties to transact with the legal

entity. The aggregate fair value of all derivative instruments with credit-risk-related contingent features that are in a net liability position as of December 31,

2014 was $1.0 billion. Of this $1.0 billion the legal entities have posted collateral of $1.3 billion in the normal course of business. In addition, the Company

has posted collateral of $41 associated with a customized GMWB derivative. Based on derivative market values as of December 31, 2014, a downgrade of

one level below the current financial strength ratings by either Moody’s or S&P could require approximately an additional $4 to be posted as collateral.

Based on derivative market values as of December 31, 2014, a downgrade by either Moody’s or S&P of two levels below the legal entities’ current financial

strength ratings could require approximately an additional $18 of assets to be posted as collateral. These collateral amounts could change as derivative

market values change, as a result of changes in our hedging activities or to the extent changes in contractual terms are negotiated. The nature of the collateral

that we would post, if required, would be primarily in the form of U.S. Treasury bills, U.S. Treasury notes and government agency securities.

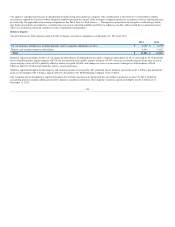

As of December 31, 2014, the aggregate notional amount and fair value of derivative relationships that could be subject to immediate termination in the

event of rating agency downgrades to either BBB+ or Baa1 was $388 and $3, respectively.

Current and expected patterns of claim frequency and severity or surrenders may change from period to period but continue to be within historical norms and,

therefore, the Company’s insurance operations’ current liquidity position is considered to be sufficient to meet anticipated demands over the next twelve

months, including any obligations related to the Company’s restructuring activities. For a discussion and tabular presentation of the Company’s current

contractual obligations by period, refer to Off-Balance Sheet Arrangements and Aggregate Contractual Obligations within the Capital Resources and

Liquidity section of the MD&A.

The principal sources of operating funds are premiums, fees earned from assets under management and investment income, while investing cash flows

originate from maturities and sales of invested assets. The primary uses of funds are to pay claims, claim adjustment expenses, commissions and other

underwriting expenses, taxes, to purchase new investments and to make dividend payments to the HFSG Holding Company.

The Company’s insurance operations consist of property and casualty insurance products (collectively referred to as “Property & Casualty Operations”) and

life insurance and legacy annuity products (collectively referred to as “Life Operations”).

120