The Hartford 2014 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The Company's stock-based compensation plans are described below. Shares issued in satisfaction of stock-based compensation may be made available from

authorized but unissued shares, shares held by the Company in treasury or from shares purchased in the open market. In 2014, 2013 and 2012, the Company

issued shares from treasury in satisfaction of stock-based compensation.

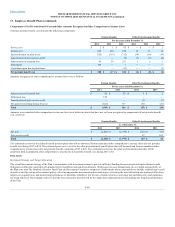

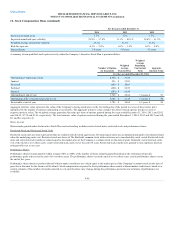

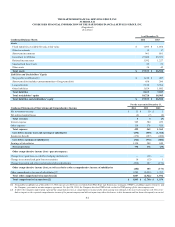

The Company recognized stock-based compensation expense as follows:

Stock-based compensation plans expense $ 98 $ 69 $ 95

Income tax benefit (34) (24) (33)

In 2014, the Company modified an executive’s awards to receive retirement treatment. The incremental compensation cost resulting from the modifications

totaled $16 of which $11 was recognized at the modification date. The remainder is recognized over the remaining service period.

The Company did not capitalize any cost of stock-based compensation. As of December 31, 2014, the total compensation cost related to non-vested awards

not yet recognized was $86, which is expected to be recognized over a weighted average period of 1.9 years.

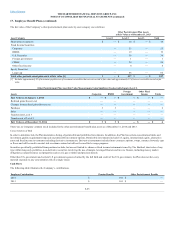

On May 21, 2014, at the Company’s Annual Meeting of Shareholders, the shareholders approved The Hartford 2014 Incentive Stock Plan (the “Incentive

Stock Plan”) which supersedes and replaces earlier incentive stock plans and as a result is currently the only plan pursuant to which future stock-based awards

may be granted (other than the Subsidiary Stock Plan and the Employee Stock Purchase Plan described below). The terms of the Incentive Stock Plan are

substantially similar to the terms of the earlier incentive stock plans, with changes primarily to ensure alignment with market practices and simplify

administration. These changes did not result in incremental compensation cost for outstanding awards. The Incentive Stock Plan provides for awards to be

granted in the form of non-qualified or incentive stock options qualifying under Section 422 of the Internal Revenue Code, stock appreciation rights,

performance shares, restricted stock or restricted stock units, or any other form of stock-based award. The maximum number of shares, subject to adjustments

set forth in the Incentive Stock Plan, that may be issued to Company employees and third party service providers during the 10-year duration of the Incentive

Stock Plan is 12,000,000 shares. If any award under an earlier incentive stock plan (other than the plan approved in 2000) is forfeited, terminated,

surrendered, exchanged, expires unexercised, or is settled in cash in lieu of stock (including to effect tax withholding) or for the net issuance of a lesser

number of shares than the number subject to the award, the shares of stock subject to such award (or the relevant portion thereof) shall be available for awards

under the Incentive Stock Plan and such shares shall be added to the maximum limit. As of December 31, 2014, there were 12,603,158 shares available for

future issuance.

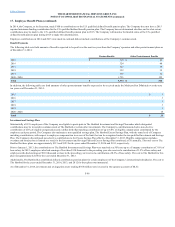

The fair values of awards granted under the Incentive Stock Plan are measured as of the grant date and expensed ratably over the awards’ vesting periods,

generally 3 years. For stock option awards to retirement-eligible employees the Company recognizes the expense immediately or over a period shorter than

the stated vesting period because the employees receive accelerated vesting upon retirement and therefore the vesting period is considered non-substantive.

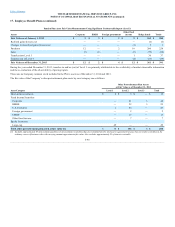

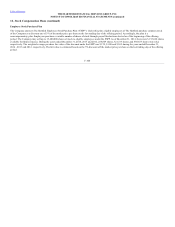

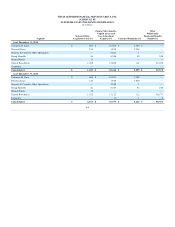

Stock Option Awards

Under the Incentive Stock Plan, options granted have an exercise price at least equal to the market price of the Company’s common stock on the date of

grant, and an option’s maximum term is not to exceed 10 years. Options generally become exercisable over a three year period commencing one year from the

date of grant. Certain other options become exercisable at the later of three years from the date of grant or upon specified market appreciation of the

Company's common shares.

The Company uses a hybrid lattice/Monte-Carlo based option valuation model (the “valuation model”) that incorporates the possibility of early exercise of

options into the valuation. The valuation model also incorporates the Company’s historical termination and exercise experience to determine the option

value.

The valuation model incorporates ranges of assumptions for inputs, and therefore, those ranges are disclosed below. The term structure of volatility is

generally constructed utilizing implied volatilities from exchange-traded options, CPP warrants related to the Company’s stock, historical volatility of the

Company’s stock and other factors. The Company uses historical data to estimate option exercise and employee termination within the valuation model, and

accommodates variations in employee preference and risk-tolerance by segregating the grantee pool into a series of behavioral cohorts and conducting a fair

valuation for each cohort individually. The expected term of options granted is derived from the output of the option valuation model and represents, in a

mathematical sense, the period of time that options are expected to be outstanding. The risk-free rate for periods within the contractual life of the option is

based on the U.S. Constant Maturity Treasury yield curve in effect at the time of grant.

F-97