The Hartford 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

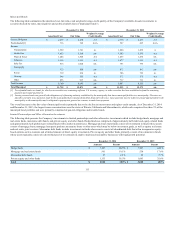

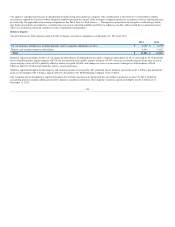

On January 29, 2015 Hartford Insurance Company of the Midwest, an indirect wholly-owned subsidiary of the Company, issued a Revolving Note (the

"Note") in the principal amount of $58 to Hartford Fire Insurance Company, a subsidiary of the Company, under the intercompany liquidity agreement. The

Note bears interest at 0.20% and matures on March 31, 2015.

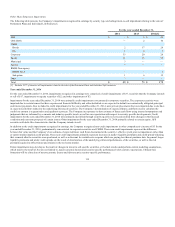

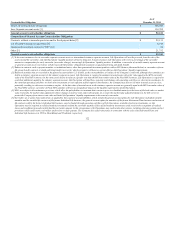

Dividends

On February 26, 2015, The Hartford’s Board of Directors declared a quarterly dividend of $0.18 per common share payable on April 1, 2015 to common

shareholders of record as of March 9, 2015. There are no current restrictions on the HFSG Holding Company's ability to pay dividends to its shareholders. For

a discussion of restrictions on dividends to the HFSG Holding Company from its insurance subsidiaries, see "Dividends from Insurance Subsidiaries" below.

For a discussion of potential restrictions on the HFSG Holding Company's ability to pay dividends, see Part I, Item 1A, — Risk Factors for the risk factor "Our

ability to declare and pay dividends is subject to limitations" .

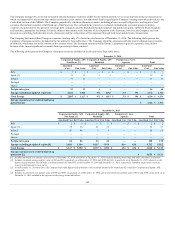

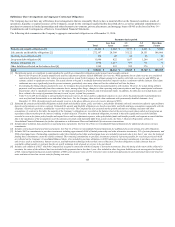

Pension Plans and Other Postretirement Benefits

While the Company has significant discretion in making voluntary contributions to the U. S. qualified defined benefit pension plan, the Employee

Retirement Income Security Act of 1974, as amended by the Pension Protection Act of 2006, the Worker, Retiree, and Employer Recovery Act of 2008, the

Preservation of Access to Care for Medicare Beneficiaries and Pension Relief Act of 2010, the Moving Ahead for Progress in the 21st Century Act of 2012

(MAP-21) and Internal Revenue Code regulations mandate minimum contributions in certain circumstances. The Company made contributions to the U. S.

qualified defined benefit pension plan of $100, $100 and $200 in 2014, 2013 and 2012, respectively. No contributions were made to the other postretirement

plans in 2014, 2013 and 2012. The Company’s 2014, 2013 and 2012 required minimum funding contributions were immaterial. The Company does not have

a 2015 required minimum funding contribution for the U.S. qualified defined benefit pension plan and the funding requirements for all pension plans are

expected to be immaterial. The Company has not determined whether, and to what extent, contributions may be made to the U. S. qualified defined benefit

pension plan in 2015. The Company will monitor the funded status of the U.S. qualified defined benefit pension plan during 2015 to make this

determination.

In September 2014, the Company extended a limited time voluntary lump sum offer to vested participants in the U.S. qualified defined benefit pension plan

who had separated from service, but who had not yet commenced annuity benefits. These participants had until November 2014 to elect to receive their

benefit in a lump-sum payment, rather than as an annuity. The Company made benefit payments in December 2014 using assets from the U.S. qualified

defined benefit pension plan. The Company recognized a pre-tax settlement charge of $128 in 2014. The pension settlement charge was offset by a

corresponding increase in accumulated other comprehensive income and therefore did not impact consolidated stockholders’ equity. For further discussion of

the settlement, see Note 17 - Employee Benefit Plans of Notes to Consolidated Financial Statements.

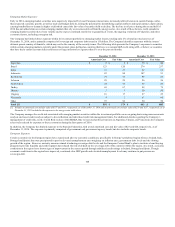

Dividends from Insurance Subsidiaries

Dividends to the HFSG Holding Company from its insurance subsidiaries are restricted by insurance regulation. The payment of dividends by Connecticut-

domiciled insurers is limited under the insurance holding company laws of Connecticut. These laws require notice to and approval by the state insurance

commissioner for the declaration or payment of any dividend, which, together with other dividends or distributions made within the preceding twelve

months, exceeds the greater of (i) 10% of the insurer’s policyholder surplus as of December 31 of the preceding year or (ii) net income (or net gain from

operations, if such company is a life insurance company) for the twelve-month period ending on the thirty-first day of December last preceding, in each case

determined under statutory insurance accounting principles. In addition, if any dividend of a Connecticut-domiciled insurer exceeds the insurer’s earned

surplus, it requires the prior approval of the State of Connecticut Insurance Department ("CTDOI"). The insurance holding company laws of the other

jurisdictions in which The Hartford’s insurance subsidiaries are incorporated (or deemed commercially domiciled) generally contain similar (although in

certain instances somewhat more restrictive) limitations on the payment of dividends. Dividends paid to HFSG Holding Company by its life insurance

subsidiaries are further dependent on cash requirements of HLI and other factors. In addition to statutory limitations on paying dividends, the Company also

takes other items into consideration when determining dividends from subsidiaries. These considerations include, but are not limited to, expected earnings

and capitalization of the subsidiary, regulatory capital requirements and liquidity requirements of the individual operating company.

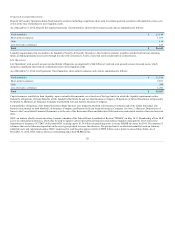

In 2014, HFSG Holding Company received approximately $2.5 billion in dividends from its property-casualty insurance subsidiaries through a series of

transactions affecting the property and casualty and life insurance subsidiaries, including $1.4 billion of extraordinary dividends. As a result of the

extraordinary dividend received in July 2014, Hartford Fire has no remaining ordinary dividend capacity for the twelve months following. As such, the

Company does not anticipate taking any dividends from Hartford Fire until the third quarter of 2015. The dividends received from its property-casualty

subsidiaries included $97 related to funding interest payments on an intercompany note between Hartford Holdings, Inc. (“HHI”) and Hartford Fire Insurance

Company.

118