The Hartford 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Reinstatement premiums

Reinstatement premium represents additional ceded premium paid for the reinstatement of the amount of reinsurance coverage that was reduced as a result of

a reinsurance loss payment.

Renewal earned price increase (decrease)

Written premiums are earned over the policy term, which is six months for certain personal lines auto business and twelve months for substantially all of the

remainder of the Company’s property and casualty business. Because the Company earns premiums over the six to twelve month term of the policies, renewal

earned price increases (decreases) lag renewal written price increases (decreases) by six to twelve months.

Renewal written price increase (decrease)

Renewal written price increase (decrease) represents the combined effect of rate changes, amount of insurance and individual risk pricing decisions per unit of

exposure since the prior year. The rate component represents the change in rate filings during the period and the amount of insurance represents the change in

the value of the rating base, such as model year/vehicle symbol for auto, building replacement costs for property and wage inflation for workers’

compensation. A number of factors affect renewal written price increases (decreases) including expected loss costs as projected by the Company’s pricing

actuaries, rate filings approved by state regulators, risk selection decisions made by the Company’s underwriters and marketplace competition. Renewal

written price changes reflect the property and casualty insurance market cycle. Prices tend to increase for a particular line of business when insurance carriers

have incurred significant losses in that line of business in the recent past or the industry as a whole commits less of its capital to writing exposures in that line

of business. Prices tend to decrease when recent loss experience has been favorable or when competition among insurance carriers increases. Renewal written

price statistics are subject to change from period to period, based on a number of factors, including changes in actuarial estimates and the effect of subsequent

cancellations and non-renewals on rate achieved, and modifications made to better reflect ultimate pricing achieved.

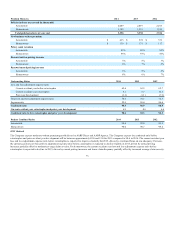

Return on Assets (“ROA”), core earnings

ROA, core earnings, is a non-GAAP financial measure that the Company uses to evaluate, and believes is an important measure of, certain of the segment’s

operating performance. ROA is the most directly comparable U.S. GAAP measure. The Company believes that ROA, core earnings, provides investors with a

valuable measure of the performance of certain of the Company’s on-going businesses because it reveals trends in our businesses that may be obscured by the

effect of realized gains (losses). ROA, core earnings, should not be considered as a substitute for ROA and does not reflect the overall profitability of our

businesses. Therefore, the Company believes it is important for investors to evaluate both ROA, core earnings, and ROA when reviewing the Company’s

performance. ROA is calculated by dividing core earnings by a two-point average AUM. A reconciliation of ROA to ROA, core earnings for the years ended

December 31, 2014, 2013 and 2012 is set forth in the ROA section within MD&A - Mutual Funds.

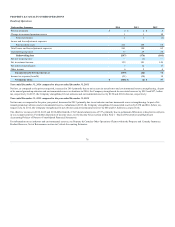

Underwriting gain (loss)

The Company's management evaluates profitability of the P&C businesses primarily on the basis of underwriting gain (loss). Underwriting gain (loss) is a

before-tax measure that represents earned premiums less incurred losses, loss adjustment expenses and underwriting expenses. Underwriting gain (loss) is

influenced significantly by earned premium growth and the adequacy of the Company's pricing. Underwriting profitability over time is also greatly

influenced by the Company's pricing and underwriting discipline, which seeks to manage exposure to loss through favorable risk selection and

diversification, its management of claims, its use of reinsurance and its ability to manage its expense ratio, which it accomplishes through economies of scale

and its management of acquisition costs and other underwriting expenses. Net income (loss) is the most directly comparable GAAP measure. The Company

believes that underwriting gain (loss) provides investors with a valuable measure of before-tax profitability derived from underwriting activities, which are

managed separately from the Company's investing activities. A reconciliation of underwriting gain (loss) to net income (loss) for Commercial Lines, Personal

Lines and Property & Casualty Other Operations is set forth in their respective discussions herein.

69