The Hartford 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 Outlook

The Company expects economic conditions to continue to improve slowly driving a modest increase in exposures, while pricing is anticipated to moderate.

As such, the Company expects low-to-mid single-digit written premiums growth in 2015 driven by small commercial and middle market where the Company

continues to develop comprehensive product solutions, deeper relationships with distribution partners, differentiating customer experiences and enhanced

ease of doing business processes and technologies. In specialty lines, the Company expects modest written premium growth in professional liability. The

Company expects the combined ratio before catastrophes and prior accident year development will be between approximately 89.5 and 91.5 for 2015,

compared to 91.5 in 2014, due to stable to slightly improving margins as earned pricing increases are expected to be slightly ahead of long-term loss costs

trends.

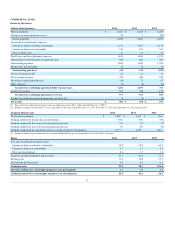

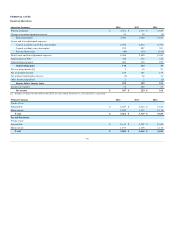

Year ended December 31, 2014 compared to the year ended December 31, 2013

Overview

Net income, as compared to the prior year period, increased in 2014 primarily due to an improvement in underwriting results, driven by lower current

accident year losses and loss adjustment expenses before catastrophes and lower prior accident years development, partially offset by a shift to net realized

capital losses in the current year from net realized capital gains in the prior year period. Underwriting expenses, compared to the prior year period, reflect a

reduction of $49, before tax, in the Company's estimated liability for NY State Workers' Compensation Board assessments.

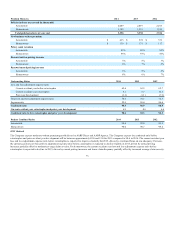

Revenues - Earned and Written Premiums

Earned premiums increased in 2014, reflecting the impact of higher written premiums primarily in small commercial and to a lesser extent in middle market,

partially offset by written premium declines in specialty lines.

Written premium increased in all small commercial lines of business, driven by favorable renewal premium due to higher policy count retention and higher

written pricing, as well as an increase in new business and higher audit premium on workers' compensation policies. Written premium increases in middle

market were driven primarily by higher renewal written premium in property, general liability and auto, partially offset by the impact of underwriting actions

that reduced written premium in the programs business. Written premium decreases in specialty lines were primarily the result of underwriting actions to

improve profitability of the captives business, partially offset by growth in national accounts and bond.

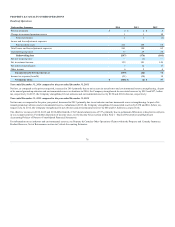

Losses and Loss Adjustment Expenses

Losses and loss adjustment expenses reflect favorable current accident year losses before catastrophes in all lines of business and lower unfavorable prior

accident years development.

• The reduction in the current accident year loss and loss adjustment expense ratio before catastrophes in 2014 was primarily driven by a lower loss

and loss adjustment expense ratio in workers' compensation due to earned pricing increases and favorable frequency and severity trends.

Accordingly, the current accident year loss and loss adjustment expense ratio before catastrophes decreased by 3.4 points to 59.4 in 2014 from 62.8

in 2013.

• Current accident year catastrophe losses of $109, before tax, in 2014, compared to $105, before tax, in 2013. Losses in 2014 were primarily due to

multiple winter storm and wind and hail events across various U.S. geographic regions. Losses in 2013 were primarily due to multiple wind and hail

and tornado events across various U.S. geographic regions. For additional information, see MD&A - Critical Accounting Estimates, Property and

Casualty Insurance Product Reserves, Net of Reinsurance.

• Prior accident years reserve strengthening of $13, before tax, in 2014, compared to $83, before tax, in 2013. Development in 2014 was primarily due

to discount accretion on workers' compensation and strengthening related to commercial auto liability, partially offset by a release of professional

and general liability reserves. Development in 2013 was primarily due to strengthening related to commercial auto liability and the closing of the

New York Section 25A Fund for Reopened Cases, partially offset by a release of professional and general liability reserves. For additional

information, see MD&A - Critical Accounting Estimates, Reserve Roll-forwards and Development.

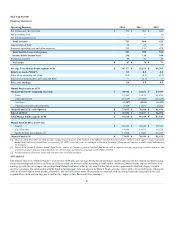

Underwriting Ratios

The combined ratio, before catastrophes and prior year development, improved 3.6 points to 91.5 in 2014 from 95.1 in 2013. The improvement primarily

reflects a decrease in the current accident year loss and loss adjustment expense ratio before catastrophes, as well as a decrease in the expense ratio (including

a 0.8 point favorable impact on the expense ratio related to a reduction in NY State Workers' Compensation Board assessments).

72