The Hartford 2014 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2014 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

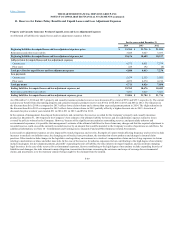

The Company cedes insurance to affiliated and unaffiliated insurers to enable the Company to manage capital and risk exposure. Such arrangements do not

relieve the Company of its primary liability to policyholders. Failure of reinsurers to honor their obligations could result in losses to the Company. The

Company's procedures include careful initial selection of its reinsurers, structuring agreements to provide collateral funds where necessary, and regularly

monitoring the financial condition and ratings of its reinsurers. The Company has ceded reinsurance in connection with the sales of its Retirement Plans and

Individual Life businesses in 2013 to MassMutual and Prudential, respectively. For further discussion of these transactions, see Note 2 -Business Dispositions

of Notes to Consolidated Financial Statements.

Reinsurance Recoverables

Reinsurance recoverables include balances due from reinsurance companies and are presented net of an allowance for uncollectible reinsurance. Reinsurance

recoverables include an estimate of the amount of gross losses and loss adjustment expense reserves that may be ceded under the terms of the reinsurance

agreements, including incurred but not reported unpaid losses. The Company’s estimate of losses and loss adjustment expense reserves ceded to reinsurers is

based on assumptions that are consistent with those used in establishing the gross reserves for business ceded to the reinsurance contracts. The Company

calculates its ceded reinsurance projection based on the terms of any applicable facultative and treaty reinsurance, including an estimate of how incurred but

not reported losses will ultimately be ceded by reinsurance agreements. Accordingly, the Company’s estimate of reinsurance recoverables is subject to similar

risks and uncertainties as the estimate of the gross reserve for unpaid losses and loss adjustment expenses.

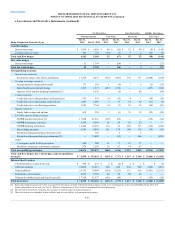

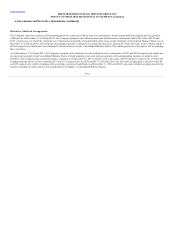

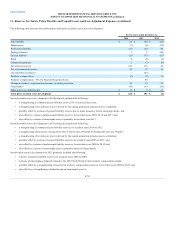

The Company's reinsurance recoverables are summarized as follows:

Paid loss and loss adjustment expenses $ 133 $ 138

Unpaid loss and loss adjustment expenses 2,868 2,841

Gross reinsurance recoverables 3,001 2,979

Allowance for uncollectible reinsurance (271) (244)

Future policy benefits and unpaid loss and loss adjustment expenses and other policyholder funds

and benefits payable

Sold businesses (MassMutual and Prudential) $ 18,997 $ 19,374

Other reinsurers 1,193 1,221

[1] No allowance for uncollectible reinsurance is required as of December 31, 2014 and 2013.

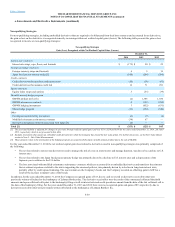

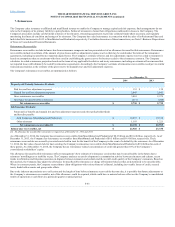

As of December 31, 2014, the Company has reinsurance recoverables from MassMutual and Prudential of $8.6 billion and $10.4 billion, respectively. As of

December 31, 2013, the Company has reinsurance recoverables from MassMutual and Prudential of $9.5 billion and $9.9 billion, respectively. These

reinsurance recoverables are secured by invested assets held in trust for the benefit of the Company in the event of a default by the reinsurers. As of December

31, 2014, the fair value of assets held in trust securing the Company's reinsurance recoverables from MassMutual and Prudential is $9.0 billion for each of

these parties. As of December 31, 2014, the Company has no reinsurance-related concentrations of credit risk greater than 10% of the Company’s

consolidated stockholders’ equity.

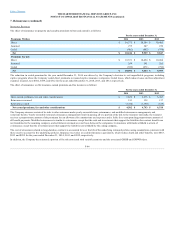

The allowance for uncollectible reinsurance reflects management’s best estimate of reinsurance cessions that may be uncollectible in the future due to

reinsurers’ unwillingness or inability to pay. The Company analyzes recent developments in commutation activity between reinsurers and cedants, recent

trends in arbitration and litigation outcomes in disputes between reinsurers and cedants and the overall credit quality of the Company’s reinsurers. Based on

this analysis, the Company may adjust the allowance for uncollectible reinsurance or charge off reinsurer balances that are determined to be uncollectible.

Where its contracts permit, the Company secures future claim obligations with various forms of collateral, including irrevocable letters of credit, secured

trusts, funds held accounts and group-wide offsets.

Due to the inherent uncertainties as to collection and the length of time before reinsurance recoverables become due, it is possible that future adjustments to

the Company’s reinsurance recoverables, net of the allowance, could be required, which could have a material adverse effect on the Company’s consolidated

results of operations or cash flows in a particular quarter or annual period.

F-63