Telus 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.94 . TELUS 2010 annual report

the use of licensed and/or unlicensed spectrum to deliver higher-speed

data services. In addition satellite operators such as Barrett Xplore have

announced that they are augmenting their existing HSIA capabilities

with the launch of high-throughput satellites, targeting households in

rural and remote locations claiming to offer speeds of up to 10 Mbps.

Risk mitigation in wireless markets: The Company improved its

competitive position with the launch of its HSPA+ wireless network in

November 2009. The network offers manufacturer-rated data down-

load speeds of up to 21 Mbps and covers approximately 97% of

Canada’s population, including network sharing agreements with Bell

Canada and SaskTel. In 2010 and 2011, the Company is deploying

HSPA+ dual-cell technology, which is expected to increase manufacturer-

rated maximum data download speeds to up to 42 Mbps when

commercialized.

HSPA+ technology enables TELUS to provide an expanded selection

of mobile devices and capability to roam in more than 200 countries.

Prior to November 2009, Rogers Communications Inc., as the only

global system for mobile communication (GSM) and HSPA competitor

in Canada, enjoyed advantages in handset selection, earlier availability

of certain devices, lower handset costs and access to international

in-roaming revenue.

The Company introduced a variety of initiatives in 2010 to bring

greater transparency and simplicity to customers, such as data notifica-

tions, the new Clear and Simple Device Upgrade program, and a more

transparent cancellation policy for those who have activated or renewed

their contract after November 20, 2010. (See Section 2.2 Strategic

imperatives – Providing integrated solutions that differentiate TELUS from

its competitors.) In addition, to compete more effectively in serving a

variety of customer segments, TELUS also offers a basic service brand

called Koodo Mobile first launched in March 2008.

TELUS intends to continue the marketing and distribution of innovative

and differentiated wireless services; investing in its extensive network;

evolving technologies when deemed prudent; and acquiring spectrum,

as appropriate, to facilitate service development and profitable expansion

of the Company’s subscriber base.

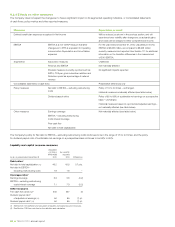

10.2 Technology

Technology is a key enabler for TELUS and its customers, however,

technology evolution brings risks, uncertainties and opportunities.

TELUS is vigorous in maintaining its short-term and long-term technology

strategy to optimize the Company’s selection and timely use of tech-

nology, while minimizing the associated costs, risks and uncertainties.

The following identifies the main technology risks and uncertainties

and how TELUS is proactively addressing them.

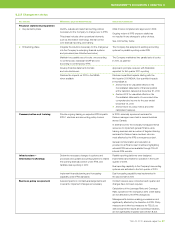

Evolving wired broadband access technology standards may

outpace projected access infrastructure investment lifetimes

The technology standards for broadband access over copper loops

to customer premises are evolving rapidly, enabling higher broadband

access speeds. The evolution is fuelled by user appetite for faster con-

nectivity, the threat of increasing competitor capabilities and offerings,

and the desire of service providers like TELUS to offer new services,

such as IP TV, that require greater bandwidth. In general, the evolution

to higher broadband access speeds is achieved by deploying fibre

further out from the central office, thus shortening the copper loop

portion of the access network and using faster modem technologies

on the shortened copper loop. However, new access technologies

are evolving faster than the traditional investment cycle for access infra-

structure. The introduction of these new technologies and the pace

enabled the Company’s June 2010 launch of the Optik brand, featuring

a suite of advanced TV and high-speed Internet services (see Section 2.2

Strategic imperatives), and drove an 85% expansion in TELUS’ TV

subscriber base in 2010.

Increasing vertical integration by competitors into broadcast

content ownership

While TELUS is not currently seeking to be a broadcast content owner,

several competitors have acquired broadcast content assets. This

includes Shaw Communications’ 2010 acquisition of Canwest Global

and BCE’s pending acquisition of the programming services of

CTVglobemedia, while Rogers Communications and Quebecor already

own content assets. There is a risk that vertical integration could result

in content being withheld from TELUS, or being made available at

inflated prices.

Risk mitigation: TELUS’ strategy is to aggregate, integrate and

make accessible content and applications for customers’ enjoyment.

The Company does not believe it is necessary to own content to

make it accessible to customers on an economically attractive basis

and it is not clear that any positive synergies of ownership for carriers

outweigh negative synergies of limiting audiences through exclusive

arrangements and impacts on other supplier relationships. This inherent

conflict may limit preferential self-dealing by vertically integrated competi-

tors, however, TELUS believes that regulatory safeguards are necessary.

The CRTC has initiated a proceeding to discuss issues related to vertical

integration. (See Section 10.3 Regulatory – Broadcasting distribution

undertakings and Risk mitigation for regulatory matters.)

Wireless markets

Wireless competitive intensity is expected to increase

The AWS spectrum auction in 2008 resulted in eight new potential

competitors acquiring spectrum in separate and overlapping regions,

collectively covering most markets in Canada. By the end of 2010,

four new entrants had launched services using portions of their AWS

spectrum coverage and are expected to expand their roll-outs in

2011. Shaw Communications has announced that it expects to launch

services in early 2012 (see key assumption discussion in Section 1.4).

New entrants, with the exception of Quebecor (Videotron) in the province

of Quebec, are not expected to build networks in remote and rural

areas for some time, choosing instead to focus on urban markets and

provide extended coverage for their urban-based subscribers through

roaming agreements. To win market share, strategies of entrants

have included price discounting relative to incumbents, unlimited rate

plans or zone-based pricing, and increased competition at points of

distribution. Existing competitors have also become more aggressive,

re-launching or introducing new brands.

TELUS anticipates continued pressure on average revenue per

subscriber unit (ARPU), cost of acquisition (COA) and cost of retention

(COR) as competitors increase subsidies for handsets (particularly for

generally more expensive smartphones), lower prices for airtime and

wireless data, and offer other incentives to attract new customers.

TELUS believes it has positioned itself well to respond to the arrival of

new entrants and increased competitive intensity from incumbents,

but there can be no assurance that the Company’s preparations and

responses will be as successful as planned.

Competition from adjunct wireless technologies may increase

While adjunct wireless technologies, like fixed WiMAX and Wi-Fi (wireless

fidelity), are continuing to develop, their associated economic viability

remains unproven. Regardless, increased competition is expected through