Telus 2010 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 145

Other defined benefit pension plans: In addition to the foregoing

plans, the Company has non-registered, non-contributory supplementary

defined benefit pension plans which have the effect of maintaining the

earned pension benefit once the allowable maximums in the registered

plans are attained. As is common with non-registered plans of this

nature, these plans are funded only as benefits are paid.

The Company has three contributory, non-indexed pension plans

arising from a pre-merger acquisition which comprise less than 1%

of the Company’s total accrued benefit obligation; these plans ceased

accepting new participants in September 1989.

Other defined benefit plans: Other defined benefit plans, which

are all non-contributory, are comprised of a disability income plan,

a healthcare plan for retired employees and a life insurance plan.

The healthcare plan for retired employees and the life insurance plan

ceased accepting new participants effective January 1, 1997. In con-

nection with the collective agreement signed in 2005, an external

supplier commenced providing a new long-term disability plan effective

January 1, 2006. The existing disability income plan will continue

to provide payments to previously approved claimants and qualified

eligible employees.

Telecommunication Workers Pension Plan: Certain employees

in British Columbia are covered by a negotiated-cost, target-benefit

union pension plan. Contributions are determined in accordance

with provisions of negotiated labour contracts and are generally based

on employee gross earnings.

British Columbia Public Service Pension Plan: Certain employees

in British Columbia are covered by a public service pension plan.

Contributions are determined in accordance with provisions of labour

contracts negotiated by the Province of British Columbia and are

generally based on employee gross earnings.

Defined contribution pension plan: Effective January 1, 2007, the

Company offered one defined contribution pension plan, which is

contributory, and is the only Company-sponsored pension plan avail-

able to non-unionized and certain unionized employees joining the

Company after that date. Generally, employees can annually choose to

contribute to the plan at a rate of between 3% and 6% of their pension-

able earnings. The Company will match 100% of the contributions

of the employees up to 5% of their pensionable earnings and will match

80% of employee contributions greater than that. Membership in the

defined contribution pension plan is voluntary until an employee’s

third year service anniversary. In the event that annual contributions

exceed allowable maximums, excess amounts are contributed

to a non-registered supplementary defined contribution pension plan.

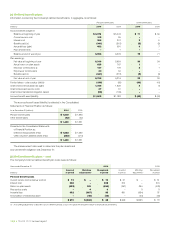

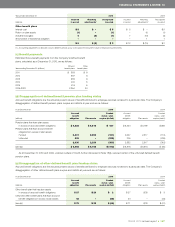

The Company has a number of defined benefit and defined contri-

bution plans providing pension, other retirement and post-employment

benefits to most of its employees. Other benefit plans include a

TELUS Québec Inc. retiree healthcare plan. The benefit plan(s) in which

an employee is a participant reflects the general development of

the Company.

Pension Plan for Management and Professional Employees of

TELUS Corporation: This defined benefit pension plan, which ceased

accepting new participants on January 1, 2006, and which comprises

approximately one-quarter of the Company’s total accrued benefit

obligation, provides a non-contributory base level of pension benefits.

Additionally, on a contributory basis, employees can annually choose

increased and/or enhanced levels of pension benefits over the base level

of pension benefits. At an enhanced level of pension benefits, the defined

benefit pension plan has indexation of 100% of a specified cost-of-living

index, to an annual maximum of 2%. Pensionable remuneration is deter-

mined by the annualized average of the best sixty consecutive months.

TELUS Corporation Pension Plan: Management and professional

employees in Alberta who joined the Company prior to January 1, 2001,

and certain unionized employees are covered by this contributory defined

benefit pension plan, which comprises slightly more than one-half of

the Company’s total accrued benefit obligation. The plan contains a

supplemental benefit account which may provide indexation up to 70%

of the annual change of a specified cost-of-living index and pensionable

remuneration is determined by the average of the best five years in

the last ten years preceding retirement.

TELUS Québec Defined Benefit Pension Plan: Any employee not

governed by a collective agreement in Quebec who joined the Company

prior to April 1, 2006, any non-supervisory employee governed by a

collective agreement prior to September 6, 2006, and certain other

unionized employees are covered by this contributory defined benefit

pension plan, which comprises approximately one-tenth of the

Company’s total accrued benefit obligation. The plan has no indexation

and pensionable remuneration is determined by the average of the

best four years.

TELUS Edmonton Pension Plan: This contributory defined benefit

pension plan ceased accepting new participants on January 1, 1998.

Indexation is 60% of the annual change of a specified cost-of-living index

and pensionable remuneration is determined by the annualized average

of the best sixty consecutive months.

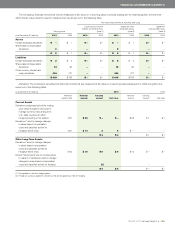

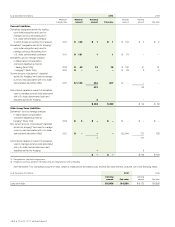

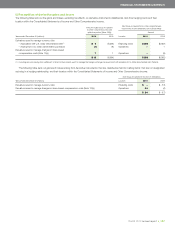

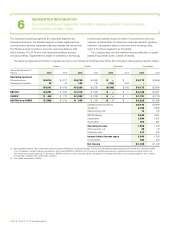

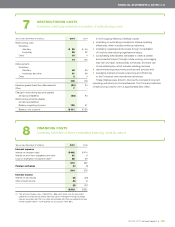

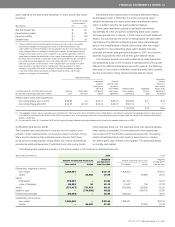

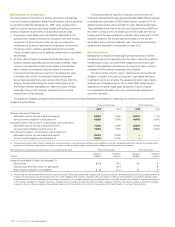

FINANCIAL STATEMENTS & NOTES: 13

13 EMPLOYEE FUTURE BENEFITS

Summary schedules and review of employee future benefits and related disclosures