Telus 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 45

MANAGEMENT’S DISCUSSION & ANALYSIS: 1

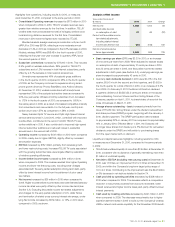

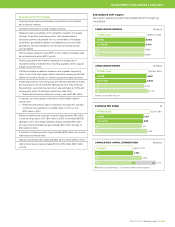

Consolidated 2011 targets

See Caution regarding forward-looking statements at the beginning

of the MD&A.

10

09

08

07

06

CONSOLIDAT ED REVENUE ($ millions)

11 IFRS target 9,925 to 10,225

9,606

9,653

9,792

9,779

10 IFRS

10 C-GAAP

09

08

06

10

09

08

07

06

CONSOLIDAT ED EBITDA ($ millions)

11 IFRS target 3,675 to 3,875

3,491

3,779

3,650

3,643

10 IFRS

10 C-GAAP

09

08

06

EBITDA is a non-GAAP measure.

10

09

08

07

06

EARNINGS PER SHARE ($)

11 IFRS target 3.50 to 3.90

3.14

3.52

3.27

3.23

10 IFRS

10 C-GAAP

09

08

06

10

09

08

07

CONSOLIDAT ED CAPITA L EXPENDITURES ($ millions)

11 target approx. 1,700

2,741

8821,859

1,721

2,10 3

10

09

08

General capital expendituresPayment for AWS spectrum licences

Assumptions for 2011 targets

Ongoing intense wireline and wireless competition in both business

and consumer markets

Continued downward re-pricing of legacy services

Wireless industry penetration of the Canadian population to increase

between 4.5 and five percentage points, with wireless industry

subscriber growth to accelerate due to a combination of increased

competition, accelerated adoption of smartphones and use of data

applications, and the emergence of new types of wireless devices

such as tablets

TELUS wireless domestic voice ARPU erosion offset by increased data

and international roaming ARPU growth

Wireless acquisition and retention expenses to increase due to

increased loading of smartphones, including upgrades, and to support

a larger subscriber base

Continued wireline broadband expansion and upgrades supporting

Optik TV and Optik High Speed Internet subscriber revenue growth that

offsets the continued erosion in network access line-related revenues

A preliminary pension accounting discount rate was estimated at 5.35%

and subsequently set at 5.25% (60 basis points lower than 2010) and

the preliminary expected long-term return was estimated at 7.25% and

subsequently set at 7% (25 basis points lower than 2010)

.Defined benefit pension plans net recovery was set at $34 million

A voluntary one-time pension contribution of $200 million made in

January 2011

.Defined benefit pension plans contributions including the voluntary

contribution are estimated to be $298 million in 2011, up from

$137 million in 2010

Efficiency initiatives are expected to result in approximately $50 million

in restructuring costs in 2011 ($74 million in 2010). Incremental EBITDA

savings for 2011 were initially estimated at approximately $75 million

and are currently estimated at approximately $50 million (savings of

$134 million in 2010)

A reduction in financing costs of approximately $135 million due to lower

debt levels and interest rates

Statutory income tax rate of approximately 26.5 to 27.5% (29% in 2010)

Cash income taxes of approximately $130 to $180 million ($311 million

in 2010)