Telus 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 . TELUS 2010 annual report

4.2 Operational resources

Operational resources Operational risks and risk management

People

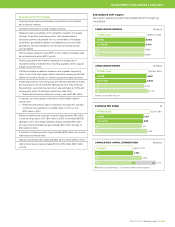

At the end of 2010, the Company employed approximately 34,800 TELUS

team members (33,900 FTE) across a wide range of operational functions

domestically and certain functions internationally.

Offshore operations support business process outsourcing services for

external customers. The Company also uses offshore services for certain

internal operations to improve efficiency and to allow onshore operations

to focus on value-added services.

Employee compensation programs support a high-performance culture and

contain market-driven and performance-based components.

The Company expects that it has adequate employee resources to cover

ongoing retirements, and ready access to labour in Canada and, for call

centres and specific support functions, various locations internationally.

TELUS uses a small number of external contractors or consultants.

The Company has extensive training programs in place.

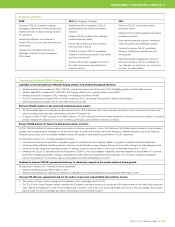

Employee compensation, retention and labour relations risks

discussion – See Section 10.4 Human resources. See also

Section 10.5 Process risks – foreign operations.

.Approximately 12,400 team members are covered by a collective

agreement. The collective agreement with the Telecommunications

Workers Union, representing approximately 11,000 members,

expired on November 19, 2010

.TELUS International employs approximately 8,400 team members

.Retention and hiring issues are expected to remain due to an

increase in the number of competitors

.TELUS will continue to focus on other non-monetary factors that

have a clear alignment with engagement including: performance

management, career opportunities, training and development,

and recognition

.Starting in 2010, the Company altered weightings of its performance-

based measures to place greater emphasis on corporate-wide

and

individual performance.

General safety risks – See Section 10.8 Health, safety and environment.

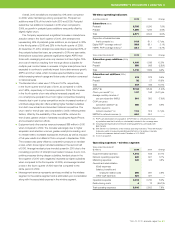

Brand and distribution

The Company has a well established and recognizable national brand that

is supported by extensive advertising across all media.

TELUS successfully launched Optik TV and Optik High Speed Internet

brands in mid-2010.

Niche market brand CAYATM (come as you are) and stores introduced in late

2010 for lesbian, gay, bisexual and transgender customers among others.

Koodo Mobile® basic wireless brand and postpaid service introduced in

March 2008.

TELUS launched HSPA+ wireless services on November 5, 2009, with

a wide variety of new smartphones, including the iPhone, BlackBerrys

and many others.

Services are summarized in Section 4.1 above.

Sales distribution:

.Wireless services supported through a broad network of TELUS-owned

and branded stores (including Black’s Photo stores), an extensive

distribution network of exclusive dealers and large third-party electronics

retailers (e.g. Future Shop / Best Buy, London Drugs) and online

self-serve applications

.Business services across wireless and wireline supported through

both TELUS sales representatives and independent dealers

.Wireline residential services supported through mass-marketing

campaigns, client care telephone agents and online self-serve

applications.

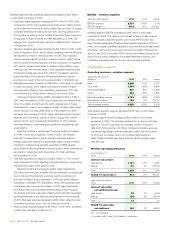

Competition – See Section 4.1 above and Section 10.1.

Industry and economy – See Section 9: General outlook and

Section 10.11 Economic growth and fluctuations.

Regulation – See Section 10.3. Regulatory context:

.None of the Wireless segment revenues are currently subject

to CRTC price regulation

.Less than one-quarter of the Company’s revenues are from

Wireline segment regulated services and subject to CRTC

price regulation

.Deregulation of wireline local phone services for residential

markets covering approximately three-quarters of its residential

land business lines in incumbent areas of B.C., Alberta and

Eastern Quebec

.Non-incumbent local exchange carrier (non-ILEC) services,

long distance, Internet, international telecommunications, inter-

exchange private line and certain data services, as well as the

sale of customer premises equipment, continue to be forborne

from regulation

.Vertical integration of competitors

.Foreign ownership restrictions generally apply to wireless

telecommunications companies, as well as to facilities-based

wireline telecommunications companies and to broadcasting

distribution undertakings

.The design of future wireless spectrum auctions, such as for

the 700 MHz and 2.5/2.6 GHz ranges, may be unfavourable to

incumbents, making the cost of acquiring or availability of future

spectrum uncertain.