Telus 2010 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 147

FINANCIAL STATEMENTS & NOTES: 13

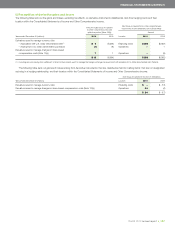

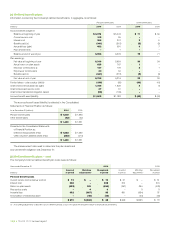

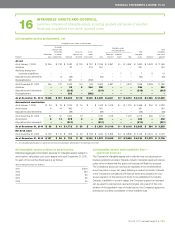

(d) Disaggregation of defined benefit pension plan funding status

Accrued benefit obligations are the actuarial present values of benefits attributed to employee services rendered to a particular date. The Company’s

disaggregation of defined benefit pension plans surplus and deficits at year-end are as follows:

As at December 31 2010 2009

Accrued Funded Accrued Funded

benefit status – plan benefit status – plan

(millions) obligation Plan assets surplus (deficit) obligation Plan assets surplus (deficit)

Pension plans that have plan assets

in excess of accrued benefit obligations $ß4,328 $ß4,515 $ 187 $ß3,544 $ß3,799 $ß255

Pension plans that have accrued benefit

obligations in excess of plan assets

Funded 2,401 2,250 (151) 2,627 2,517 (110)

Unfunded 229 – (229) 205 – (205)

2,630 2,250 (380) 2,832 2,517 (315)

(see (a)) $ß6,958 $ß6,765 $ß(193) $ß6,376 $ß6,316 $ (60)

As at December 31, 2010 and 2009, undrawn Letters of Credit, further discussed in Note 18(d), secured certain of the unfunded defined benefit

pension plans.

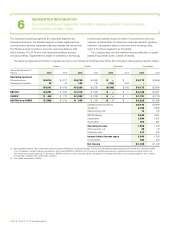

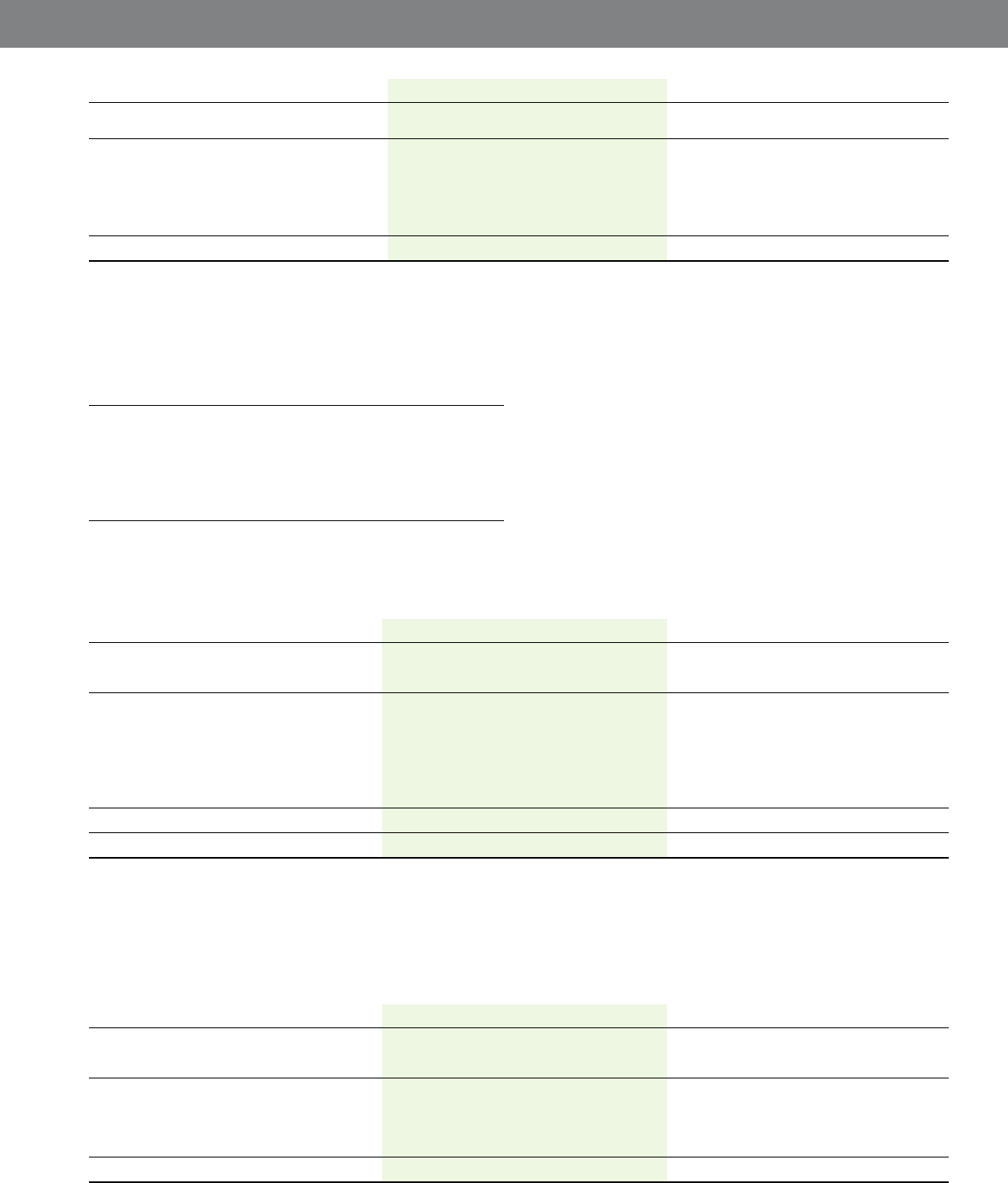

(e) Disaggregation of other defined benefit plan funding status

Accrued benefit obligations are the actuarial present values of benefits attributed to employee services rendered to a particular date. The Company’s

disaggregation of other defined benefit plans surplus and deficits at year-end are as follows:

As at December 31 2010 2009

Accrued Funded Accrued Funded

benefit status – plan benefit status – plan

(millions) obligation Plan assets surplus (deficit) obligation Plan assets surplus (deficit)

Other benefit plan that has plan assets

in excess of accrued benefit obligations $ß27 $ß29 $ 2 $ß27 $ß30 $ 3

Unfunded other benefit plans that have accrued

benefit obligations in excess of plan assets 48 – (48) 44 – (44)

(see (a)) $ß75 $ß29 $ß(46) $ß71 $ß30 $ß(41)

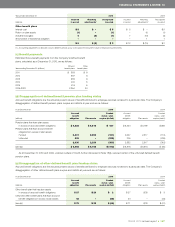

(c) Benefit payments

Estimated future benefit payments from the Company’s defined benefit

plans, calculated as at December 31, 2010, are as follows:

Pension Other

Years ending December 31 (millions) benefit plans benefit plans

2 011 $ 353 $ß 6

2012 367 6

2013 383 6

2014 400 5

2015 416 5

2016–2020 2,254 24

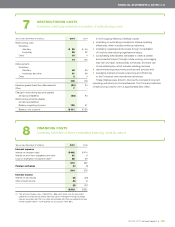

Years ended December 31 2010 2009

Incurred Matching Recognized Incurred Matching Recognized

(millions) in period adjustments(1) in period in period adjustments(1) in period

Other benefit plans

Interest cost $ 5 $ – $ 5 $ß 5 $ – $ß5

Return on plan assets (1) – (1) – (1) (1)

Actuarial loss (gain) 4 (5) (1) 7 (10) (3)

Amortization of transitional obligation – – – – 1 1

$ 8 $ß(5) $ 3 $ß12 $ß(10) $ß2

(1) Accounting adjustments to allocate costs to different periods so as to recognize the long-term nature of employee future benefits.