Telus 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 . TELUS 2010 annual report

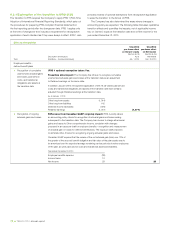

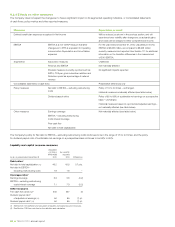

Effects of transition

Topic

Unaudited Unaudited

pro forma effect pro forma effect

on Owners’ equity on Net income

(Section 8.2.2) (Section 8.2.3)

Description and impacts As at Year ended

($ millions – increase (decrease)) Jan. 1, 2010 Dec. 31, 2010

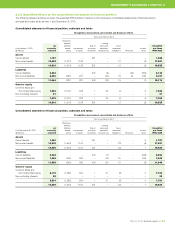

Leasing (sales and leaseback

transactions)

Difference from Canadian GAAP: The Company sold and leased-back certain

non-strategic buildings, primarily in 2000 and 2001. IFRS requires that, where the

original sale was at fair value, the gain be recognized in income immediately. Canadian

GAAP required that gains arising on sales and leaseback transactions be deferred

and amortized over the term of the resulting lease.

Transition date impact: A portion of gains deferred under Canadian GAAP will

be recognized at the transition date as an increase in opening Retained earnings.

As at January 1, 2010

Accounts payable (6)

Other long-term liabilities (31)

Deferred income tax liability 7

Retained earnings 30 30

Ongoing impact: Amortization of deferred gains under IFRS will be reduced

for the portion of gains recognized at the transition date under IFRS.

Year ended December 31, 2010

Goods and services purchased 12

Income taxes (3)

Net income (9) (9)

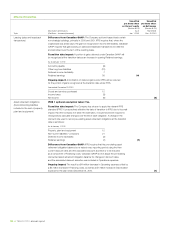

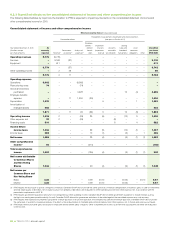

Asset retirement obligations

(Decommisioning liabilities

included in the cost of property,

plant and equipment)

IFRS 1 optional exemption taken: Yes.

Transition date impact: The Company has chosen to apply the relevant IFRS

standard (IFRIC 1) prospectively effective the date of transition to IFRS due to its small

impact. Had the Company not taken the exemption, it would have been required to

retrospectively calculate changes over the life of each obligation. A change in the

discount rate used to record pre-existing asset retirement obligations at the transition

date is as follows:

As at January 1, 2010

Property, plant and equipment 12

Non-current liabilities – provisions 21

Deferred income tax liability (2)

Retained earnings (7) (7)

Difference from Canadian GAAP: IFRS requires that the pre-existing asset

retirement obligation balance be re-valued every reporting period using the then

current discount rates and the associated discount accretion is to be included

as a component of Financing costs. Canadian GAAP did not adjust the pre-existing

discounted asset retirement obligation balance for changes in discount rates,

and the associated discount accretion was included in Operations expenses.

Ongoing impact: The result is a $4 million decrease in Operating expenses offset by

a $4 million increase in Financing costs, as well as a $1 million increase in Depreciation

expense for the year ended December 31, 2010. (1)