Telus 2010 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136 . TELUS 2010 annual report

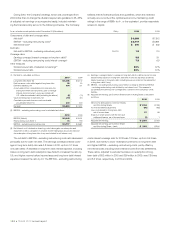

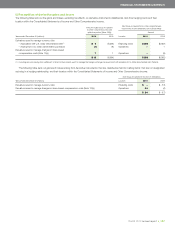

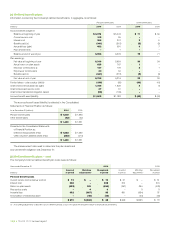

As at December 31 (millions) 2010 2009

Maximum Notional Carrying Notional Carrying

maturity date amount amount Fair value amount amount Fair value

Current Liabilities

Derivatives designated as held for trading

upon initial recognition and used to

manage currency risks arising from

U.S. dollar denominated purchases

to which hedge accounting is not applied 2 011 $ 140 $ß 1 $ß 1 $ 102 $ß 2 $ß 2

Derivatives(1) designated as held for hedging(2)

upon initial recognition and used to

manage currency risks arising from

U.S. dollar denominated purchases 2 011 $ 121 1 1 $ 79 – –

Derivatives used to manage changes

in share-based compensation

costs and classified as held for

– Trading (Note 12(b)) 2012 $ 60 13 13 $ 130 51 51

– Hedging(1)(2) (Note 12(c)) 2010 $ – – – $ 26 9 9

Current amount of derivatives(1) classified

as held for hedging(2) and used to manage

currency risks associated with U.S. dollar

denominated debt (Note 18(b)) 2 011 $ß1,133 404 407 $ – – –

419 62

Add: Interest payable in respect of derivatives

used to manage currency risks associated

with U.S. dollar denominated debt and

classified as held for hedging 3 –

$ß422 $ß422 $ß 62 $ß 62

Other Long-Term Liabilities

Derivatives(1) used to manage changes

in share-based compensation

costs and classified as held for

hedging(2) (Note 12(c)) 2012 $ß 4 $ß – $ß – $ – $ß – $ß –

Non-current amount of derivatives(1) classified

as held for hedging(2) and used to manage

currency risks associated with U.S. dollar

denominated debt (Note 18(b)) 2 011 $ – – – $ß2,064 721 726

– 721

Add: Interest payable in respect of derivatives

used to manage currency risks associated

with U.S. dollar denominated debt and

classified as held for hedging – 5

$ß – $ß – $ß726 $ß726

(1) Designated as cash flow hedging items.

(2) Hedge accounting is applied to derivatives that are designated as held for hedging.

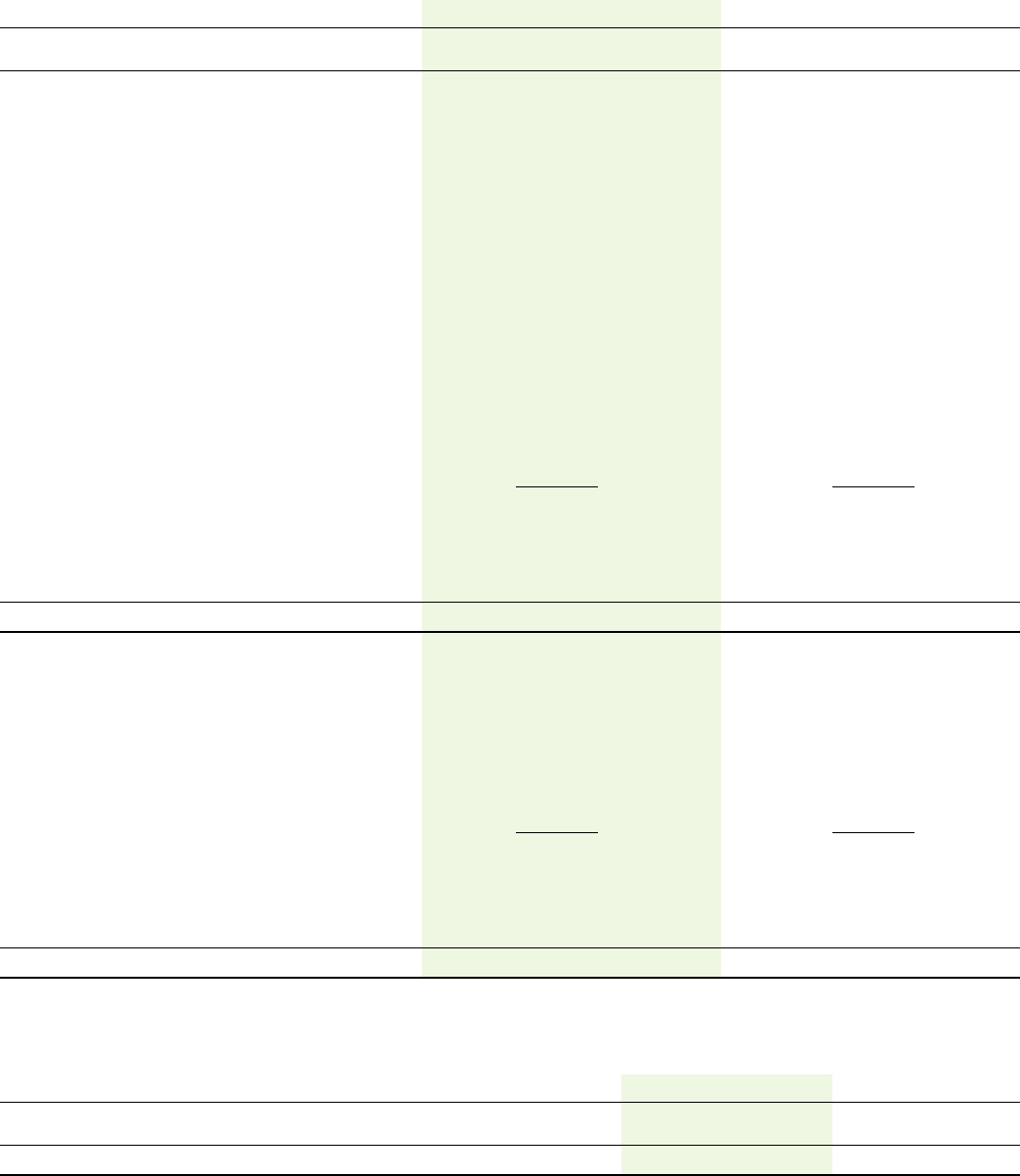

Non-derivative: The Company’s long-term debt, which is measured at amortized cost, and the fair value thereof, is as set out in the following table.

As at December 31 (millions) 2010 2009

Carrying Carrying

amount Fair value amount Fair value

Long-term debt $ß6,056 $ß6,590 $ß6,172 $ß6,656