Telus 2010 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

142 . TELUS 2010 annual report

price. During the year ended December 31, 2010, in respect of dividends

reinvested, the Company issued Non-Voting Shares from Treasury at a

discount of 3%. In respect of Common Share and Non-Voting Share divi-

dends declared during the year ended December 31, 2010, $183 million

(2009 – $36 million) was to be reinvested in Non-Voting Shares.

Optional cash payments: Shares purchased through optional cash

payments are subject to a minimum investment of $100 per transaction

and a maximum investment of $20,000 per calendar year.

(b) Dividend Reinvestment and Share Purchase Plan

The Company has a Dividend Reinvestment and Share Purchase Plan

under which eligible holders of Common Shares and Non-Voting Shares

may acquire Non-Voting Shares through the reinvestment of dividends

and making additional optional cash payments to the trustee. Under

this Plan, the Company has the option of offering shares from Treasury

or having the trustee acquire shares in the stock market.

Reinvestment of dividends: The Company, at its discretion, may

offer the Non-Voting Shares at up to a 5% discount from the market

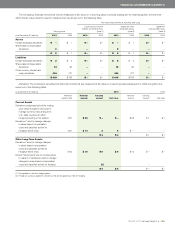

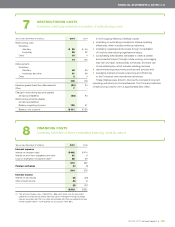

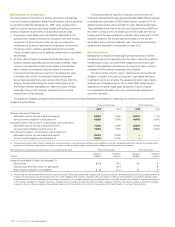

(a) Details of share-based compensation expense

Reflected in the Consolidated Statements of Income and Other Comprehensive Income as Operations expense and in the Consolidated Statements

of Cash Flows are the following share-based compensation amounts:

Years ended December 31 2010 2009

Associated Statement of Associated Statement of

Operations operating cash flows Operations operating cash flows

(millions) expense cash outflows adjustment expense cash outflows adjustment

Share option awards(1) $ß 1 $ß(24) $ß(23) $ß11 $ß(26) $ß(15)

Restricted stock units(2) 29 (36) (7) 29 (37) (8)

Employee share purchase plan 27 (27) – 29 (29) –

$ß57 $ß(87) $ß(30) $ß69 $ß(92) $ß(23)

(1) The expense (recovery) arising from share options with the net-cash settlement feature, net of cash-settled equity swap agreement effects (see Note 5(i)), was $(10) (2009 – $(2)).

(2) The expense arising from restricted stock units was net of cash-settled equity swap agreement effects (see Note 5(i)).

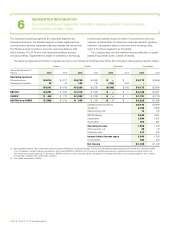

12 SHARE-BASED COMPENSATION

Summary schedules and review of compensation arising from share option awards,

restricted stock units and employee share purchase plan

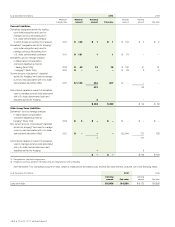

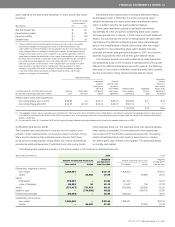

Share option awards accounted for as equity instruments:

The weighted average fair value of share option awards granted, and

the weighted average assumptions used in the fair value estimation

at the time of grant, using the Black-Scholes model (a closed-form option

pricing model), are as follows:

Years ended December 31 2010 2009

Share option award fair value (per share option) $ß 4.30 $ß 3.64

Risk free interest rate 2.5% 2.3%

Expected lives(1) (years) 4.5 4.5

Expected volatility 26.3% 26.0%

Dividend yield 5.8% 6.2%

(1) The maximum contractual term of the share option awards granted in 2010 and 2009

was seven years.

The risk free interest rate used in determining the fair value of the

share option awards is based on a Government of Canada yield curve

that is current at the time of grant. The expected lives of the share option

awards are based on historical share option award exercise data of the

Company. Similarly, expected volatility considers the historical volatility

of the Company’s Non-Voting Shares. The dividend yield is the annual-

ized dividend current at the date of grant divided by the share option

award exercise price. Dividends are not paid on unexercised share option

awards and are not subject to vesting.

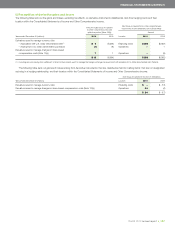

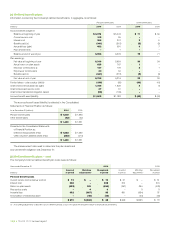

Had the weighted average assumptions for grants of share option

awards that are reflected in the expense disclosures above been varied

by 10% and 20% changes, the compensation cost arising from share

For the year ended December 31, 2010, the associated operating

cash outflows in respect of share option awards include cash outflows

arising from the cash-settled equity swap agreements of $18 million

(2009 – $19 million). Similarly, for the year ended December 31, 2010,

the associated operating cash outflows in respect of restricted stock

units include cash outflows arising from the cash-settled equity swap

agreements of $4 million (2009 – $15 million). For the year ended

December 31, 2010, the income tax benefit arising from share-based

compensation was $6 million (2009 – $18 million); as disclosed in

Note 9, not all share-based compensation amounts are deductible

for income tax purposes.

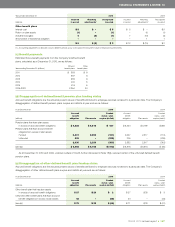

(b) Share option awards

General: The Company applies the fair value based method of

accounting for share-based compensation awards granted to employees.

The Company uses share option awards as a form of retention and

incentive compensation. Share option awards typically vest over a three-

year period (the requisite service period), but may vest over periods

of up to five years. The vesting method of share option awards, which is

determined on or before the date of grant, may be either cliff or graded;

all share option awards granted subsequent to 2004 have been cliff-

vesting awards.