Telus 2010 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2010 annual report . 161

FINANCIAL STATEMENTS & NOTES: 20

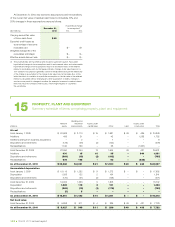

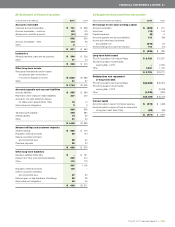

(a) Leases

The Company occupies leased premises in various centres and has land, buildings and equipment under operating leases. At December 31, 2010,

the future minimum lease payments under capital leases and operating leases are as follows:

Operating lease payments

Operating

Land and buildings Vehicles lease receipts

Capital lease Occupancy and other from sub-let land

Years ending December 31 (millions) payments Rent costs Gross equipment To t a l and buildings

2 011 $ß8 $ß169 $ß96 $ß265 $ß20 $ß285 $ß 7

2012 – 153 88 241 12 253 12

2013 – 142 87 229 6 235 12

2014 – 129 83 212 2 214 12

2015 – 118 81 199 1 200 12

Total future minimum lease payments 8

Less imputed interest 1

Capital lease liability $ß7

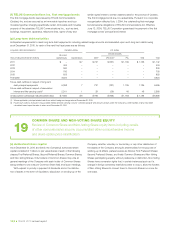

20 COMMITMENTS AND CONTINGENT LIABILITIES

Summary review of contingent liabilities, lease obligations, guarantees,

claims and lawsuits

transaction, historically the Company has not made significant payments

under these indemnities.

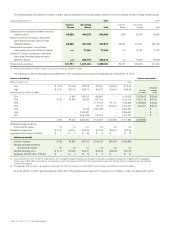

In connection with its 2001 disposition of TELUS’ directory business,

the Company agreed to bear a proportionate share of the new owner’s

increased directory publication costs if the increased costs were to arise

from a change in the applicable CRTC regulatory requirements. The

Company’s proportionate share is 40% through May 2011 and then 15%

in the final five years, ending May 2016. As well, should the CRTC take

any action which would result in the owner being prevented from carrying

on the directory business as specified in the agreement, TELUS would

indemnify the owner in respect of any losses that the owner incurred.

As at December 31, 2010, the Company has no liability recorded in

respect of indemnification obligations.

(d) Claims and lawsuits

General: A number of claims and lawsuits (including class actions)

seeking damages and other relief are pending against the Company.

As well, the Company has received or is aware of certain potential

claims (including intellectual property infringement claims) against the

Company and, in some cases, numerous other wireless carriers and

telecommunications service providers. In some instances, the matters

are at a preliminary stage and the potential for liability and magnitude

of potential loss currently cannot be readily determined. It is impossible

at this time for the Company to predict with any certainty the outcome

of any such claims, potential claims and lawsuits. However, subject

to the foregoing limitations, management is of the opinion, based upon

legal assessment and information presently available, that it is unlikely

that any liability, to the extent not provided for through insurance or

otherwise, would be material in relation to the Company’s consolidated

financial position, excepting the items enumerated following.

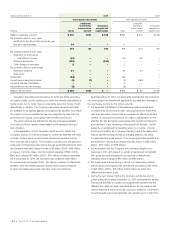

Certified class actions: A class action was brought in August 2004,

under the Class Actions Act (Saskatchewan), against a number of

past and present wireless service providers including the Company.

That claim (the Frey matter) alleges that each of the carriers is in breach

of contract and has violated competition, trade practices and consumer

Total future minimum operating lease payments at December 31, 2010,

were $2,333 million. Of this amount, $2,291 million was in respect of land

and buildings; approximately 57% of this amount was in respect of the

Company’s five largest leases, all of which were for office premises over

various terms, with expiry dates which range from 2016 to 2026.

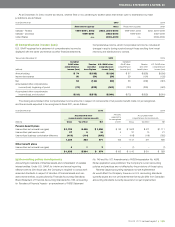

(b) Concentration of labour

In 2010, TELUS commenced collective bargaining with the Telecommu-

nications Workers Union to renew the collective agreement which expired

November 19, 2010. As at December 31, 2010, approximately 31%

(2009 – 32%) of the Company’s workforce is covered by the expired

contract with the Telecommunications Workers Union.

(c) Guarantees

Guarantees: Canadian generally accepted accounting principles

require the disclosure of certain types of guarantees and their maximum,

undiscounted amounts. The maximum potential payments represent

a worst-case scenario and do not necessarily reflect results expected

by the Company. Guarantees requiring disclosure are those obligations

that require payments contingent on specified types of future events.

In the normal course of its operations, the Company enters into obligations

that GAAP may consider to be guarantees. As defined by Canadian

GAAP, guarantees subject to these disclosure guidelines do not include

guarantees that relate to the future performance of the Company. As at

December 31, 2010, the Company’s maximum undiscounted guarantee

amounts, without regard for the likelihood of having to make such

payment, were not material.

Indemnification obligations: In the normal course of operations,

the Company may provide indemnification in conjunction with certain

transactions. These indemnification obligations range in duration

and vary in terms. Where appropriate, an indemnification obligation is

recorded as a liability. In many cases, there is no maximum limit on

these indemnification obligations and the overall maximum amount

of such indemnification obligations cannot be reasonably estimated.

Other than obligations recorded as liabilities at the time of the