Telus 2010 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2010 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146 . TELUS 2010 annual report

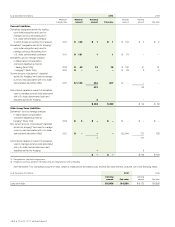

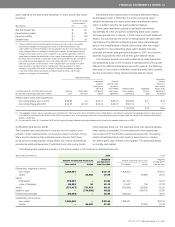

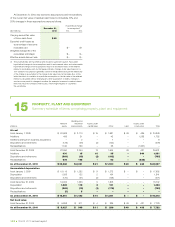

(a) Defined benefit plans

Information concerning the Company’s defined benefit plans, in aggregate, is as follows:

Pension benefit plans Other benefit plans

(millions) 2010 2009 2010 2009

Accrued benefit obligation:

Balance at beginning of year $ß6,376 $ß5,243 $ 71 $ 64

Current service cost 103 85 – –

Interest cost 368 374 5 5

Benefits paid (c) (341) (318) (5) (5)

Actuarial loss (gain) 452 991 4 7

Plan amendments – 1 – –

Balance at end of year (d)-(e) 6,958 6,376 75 71

Plan assets (g):

Fair value at beginning of year 6,316 5,654 30 34

Actual return on plan assets 623 767 1 –

Employer contributions (j) 137 179 3 1

Employees’ contributions 30 34 – –

Benefits paid (c) (341) (318) (5) (5)

Fair value at end of year 6,765 6,316 29 30

Funded status – plan surplus (deficit) (193) (60) (46) (41)

Unamortized net actuarial loss (gain) 1,726 1,528 4 (1)

Unamortized past service costs 27 31 – –

Unamortized transitional obligation (asset) (58) (106) – –

Accrued benefit asset (liability) $ß1,502 $ß1,393 $ß(42) $ß(42)

The accrued benefit asset (liability) is reflected in the Consolidated

Statements of Financial Position as follows:

As at December 31 (millions) 2010 2009

Pension benefit plans $ß1,502 $ß1,393

Other benefit plans (42) (42)

$ß1,460 $ß1,351

Presented in the Consolidated Statements

of Financial Position as:

Deferred charges (Note 21(b)) $ß1,683 $ß1,565

Other long-term liabilities (Note 21(b)) (223) (214)

$ß1,460 $ß1,351

The measurement date used to determine the plan assets and

accrued benefit obligation was December 31.

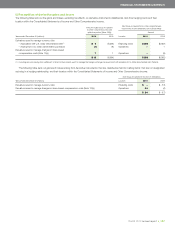

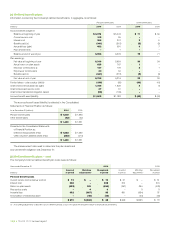

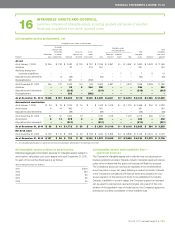

(b) Defined benefit plans – cost

The Company’s total net defined benefit plan costs were as follows:

Years ended December 31 2010 2009

Incurred Matching Recognized Incurred Matching Recognized

(millions) in period adjustments(1) in period in period adjustments(1) in period

Pension benefit plans

Current service cost (employer portion) $ß 73 $ – $ß 73 $ß 51 $ – $ß 51

Interest cost 368 – 368 374 – 374

Return on plan assets (623) 169 (454) (767) 364 (403)

Past service costs – 4 4 – 3 3

Actuarial loss 452 (367) 85 991 (954) 37

Amortization of transitional asset – (48) (48) – (44) (44)

$ß270 $ß(242) $ß 28 $ß649 $ß(631) $ß 18

(1) Accounting adjustments to allocate costs to different periods so as to recognize the long-term nature of employee future benefits.